Best Airline Loyalty Programs: Which Frequent Flyer Programs Offer the Most Value?

You know those irritating trust fund travel influencers splattered all over the home pages of Instagram and TikTok? They fly all over the world, flaunting a seemingly boundless travel budget. It must be nice to have the money to go anywhere at a moment’s notice.

Here’s the secret that very few people realize: You don’t need to be independently wealthy to travel all the time. Whether you want to take a glitzy first-class vacation to Southeast Asia or simply jump a couple of states to spend Thanksgiving with your family, the key is airline loyalty programs.

The best part is that you don’t need to fly to earn the rewards you need for (nearly) free travel. You can easily earn them with the best airline credit cards. But which airline loyalty programs should you focus on? We’ve crafted a list of top options based on award value, ease of earning miles, redemption flexibility, elite perks and credit card partnerships.

400+ Credit Cards

Analyzed independently across 50+ data points in 30+ product categories

Reviewed

By a team of credit card experts with an average of 9+ years of experience

Trusted by

More than one million monthly readers seeking unbiased credit card guidance

CardCritics™ editorial team is dedicated to providing unbiased credit card reviews, advice and comprehensive comparisons. Our team of credit card experts uses rigorous data-driven methodologies to evaluate every card feature, fee structure and rewards program. In most instances, our experts are longtime members or holders of the very programs and cards they review, so they have firsthand experience maximizing them. We maintain complete editorial independence — our ratings and recommendations are never influenced by advertiser relationships or affiliate partnerships. You can learn more about our editorial standards, transparent review process and how we make money to understand how we help you make informed financial decisions.

How We Ranked the Best Airline Loyalty Programs

Key Factors We Considered

- Award pricing and redemption value

- Ease of earning miles (flying vs. credit cards)

- Airline partners and global alliances

- Elite status value and accessibility

- Transfer partners and co-branded credit cards

Why Credit Cards Matter More Than Flying

Unless you travel often for business or spend a stunning amount of money on paid airfare, flying likely isn’t the way you’ll earn most of your airline miles.

The easiest way to earn scads of travel rewards is through credit cards. From generous welcome bonuses to funneling your everyday purchases through valuable bonus categories, it’s not difficult to generate many hundreds of thousands of rewards each year. I typically earn at least half a million points or miles each year from just welcome bonuses alone.

To boot, credit card points can be worth even more than the rewards you’d get from flying. That’s because many credit card rewards currencies can be converted into a wide range of airline frequent flyer miles.

For example, when you earn miles from a paid flight, you’ll receive the rewards currency of one airline. But when you earn American Express Membership Rewards® points (a transferable rewards currency), you’ve got the option to convert those points to airline programs such as:

- Air Canada Aeroplan

- The British Airways Club

- Delta SkyMiles

- JetBlue TrueBlue

- Singapore Airlines KrisFlyer

- Virgin Atlantic Flying Club

In other words, you aren’t handcuffed to one specific airline rewards currency. You can transfer points to whichever airline program best serves each trip.

Best Airline Loyalty Programs Overall

First things first: There is no one-size-fits-all “best” airline loyalty program. They each have particular virtues that make them uniquely valuable, depending on your travel needs. For example:

- Do you want to book short domestic hops?

- Which airlines best serve your home airport?

- Are you looking for specific elite status perks?

- Are you searching for an airline that specializes in fancy international travel?

Varying goals and circumstances like this make a big difference in which loyalty program is the “best.” You’ll often find that collecting rewards with multiple airlines is the smart move.

It’s worth noting that the airlines you prefer can heavily shape your rewards credit card strategy — but you may also find that lucrative credit card offers can shape the airlines you choose to fly.

We’ve considered the most common travel styles to help you find the best airline frequent flyer programs for your situation. Below are the top airline loyalty programs ranked.

Alaska Airlines Atmos Rewards — Best for Cheap Partner Flights

The combined Alaska Airlines/Hawaiian Airlines Atmos Rewards program is a huge favorite among travel rewards enthusiasts. Arguably, its best feature is the incredibly reasonable price you’ll pay for booking partner award flights. It’s almost always lower than what you’d pay when booking with the partner airline’s own miles.

For example, you can book a short-haul American Airlines flight for just 4,500 miles (American Airlines typically charges 6,000+ for the same ticket). Or you book a fancy business-class flight on Aer Lingus between the U.S. and Ireland for 45,000 miles (Aer Lingus charges 50,000 miles and over $100 more in taxes and fees).

Alaska Airlines is also excellent for those who value stopovers. It’s uncommon for airlines to allow free stopovers, but Alaska Airlines does (as long as you’re traveling between regions, such as the U.S. and Europe). You’ll get one free stopover per one-way booking — or two stopovers per round-trip. Just note that you can’t book a domestic stopover.

Best Credit Cards for Alaska Miles

These Bank of America credit cards earn Alaska Airlines miles directly:

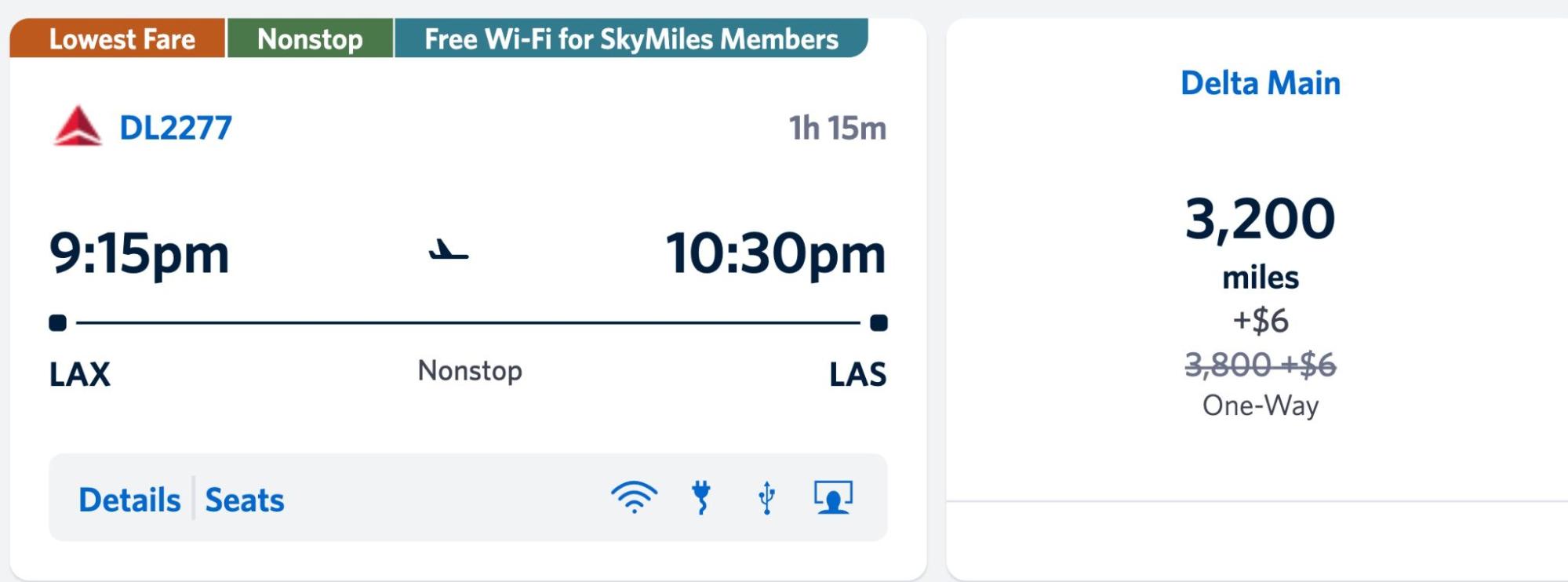

Delta SkyMiles — Best for Flash Sales

Delta is a notoriously bad option for flying internationally thanks to its often staggering award prices. Its awards are generally best used for domestic flights.

However, Delta routinely drops confusingly low award prices for random routes — both domestic and international. Delta often doesn’t promote the deals, either.

Plus, if you’ve got an annual fee-incurring Delta credit card, you’ll get 15% off Delta-operated flights. Depending on your route, this can bring your final price down to under 4,000 miles.

Best Credit Cards for Delta Miles

Our advertising partner American Express issues credit cards that earn Delta miles directly, as well as cards that earn Amex Membership Rewards points you can transfer to Delta SkyMiles at a 1:1 ratio:

- Delta SkyMiles® Gold American Express Card

- Delta SkyMiles® Platinum American Express Card

- Delta SkyMiles® Reserve American Express Card

- American Express® Gold Card

- American Express Platinum Card®

United Airlines MileagePlus — Best for Low Fees

United miles can be redeemed for the vast majority of its aforementioned powerhouse airline partners. No matter what cranny of the planet you’re trying to visit, you’re most likely to reach it with United miles.

United Airlines MileagePlus is exceptional at keeping taxes and fees low. It doesn’t pass along fuel surcharges, meaning you won’t ever pay hundreds of dollars in cash along with an award flight. This is refreshing, as many competitors may occasionally ding you for over $1,000 in addition to the miles cost.

United’s award prices aren’t the lowest — but if your primary concern is to keep the cash portion low, United is your best bet.

Best Credit Cards for United Airlines Miles

You’ll want to focus on Chase credit cards that earn United miles directly, or cards that earn transferable Chase Ultimate Rewards® points, which you can transfer to United and other partners at a 1:1 ratio:

- United℠ Explorer Card

- United Quest℠ Card

- Chase Sapphire Preferred® Card

- United Club℠ Card

- Chase Sapphire Reserve®

American Airlines AAdvantage — Best for Easy-to-Earn Elite Status

American Airlines AAdvantage stands out thanks to its reasonable award prices. It even offers off-peak award prices on select dates from January to March and November to December.

The AAdvantage program also makes earning elite status easy by allowing you to earn top-tier status through spending on co-branded American Airlines credit cards alone. Depending on the status level you’re chasing, you must earn between 40,000 and 200,000 “Loyalty Points” (the currency American Airlines uses to quantify your loyalty). You’ll earn 1 Loyalty Point for every dollar you spend.

Plus, the Citi® / AAdvantage® Executive World Elite Mastercard® offers up to 20,000 bonus Loyalty Points in addition to its 1 Loyalty Point per dollar earning rate. You’ll earn 10,000 bonus points after earning 50,000 Loyalty Points and another 10,000 bonus points after reaching 90,000 Loyalty Points during a status qualification year.

Best Credit Cards for American Airlines Miles

Consider these Citi credit cards (an advertising partner) that either earn AA miles directly or that earn transferable Citi ThankYou® points you can transfer to American Airlines and other partners:

- Citi® / AAdvantage® Platinum Select® World Elite Mastercard®

- Citi® / AAdvantage® Globe™ Mastercard®

- Citi AA Executive card

- Citi Strata Premier® Card

- Citi Strata Elite℠ Card

Southwest Rapid Rewards — Best for BOGO Flights

Known for its reasonable domestic fares, Southwest’s tentacles also touch international locations south of the border, including Mexico, the Caribbean and Costa Rica.

Southwest Rapid Rewards has one of the best deals in all of travel: The Southwest Companion Pass. When you earn 135,000 qualifying Southwest points in a calendar year, you’ll receive a pass that allows you to take a travel buddy with you for just the cost of taxes and fees — every single time you fly Southwest. The pass is good for the remainder of the current calendar year in which you earn it as well as the following calendar year.

Earning the Southwest Companion Pass is surprisingly easy. You can learn more in our Southwest Rapid Rewards guide.

Best Credit Cards for Southwest Points

Again, you’ll want to look to Chase for its co-branded Southwest credit cards and cards that earn transferable Ultimate Rewards points:

- Southwest Rapid Rewards® Plus Credit Card

- Southwest Rapid Rewards® Premier Credit Card

- Southwest Rapid Rewards® Priority Credit Card

- Chase Sapphire Preferred Card

- Chase Sapphire Reserve

JetBlue TrueBlue — Best for East Coast Flyers

With most airline miles, the value you receive can vary dramatically depending on factors such as your travel date and class of service. This is not the case with JetBlue. Award prices are directly tied to the cash value of the seat, meaning a JetBlue sale will result in both low cash fares and low award flight prices.

This makes it much easier to understand what your points are worth. The trade-off is that you can’t get the massively outsized rewards value possible with airline programs like Alaska Airlines Atmos Rewards and American Airlines AAdvantage.

JetBlue is hyper concentrated on the East Coast, with its biggest hubs in New York (JFK), Boston (BOS), Fort Lauderdale (FLL) and Orlando (MCO). It also has a hub at Los Angeles International Airport (LAX), but it’s best suited for East Coasters.

Best Credit Cards for JetBlue Points

Barclays issues a handful of credit cards that earn JetBlue points directly, but you can also transfer rewards to JetBlue from several bank loyalty programs, including Chase Ultimate Rewards and Amex Membership Rewards:

- JetBlue Card

- JetBlue Plus Card

- JetBlue Premier Card

- Chase Sapphire Preferred Card

- Chase Sapphire Reserve

- Amex Gold

- Amex Platinum

Air Canada Aeroplan — Best for Awards With a Lap Infant

Air Canada Aeroplan has many valuable uses, from booking coveted Emirates first-class award seats (something that can otherwise only be done via Qantas or Emirates itself) to adding stopovers to eligible flights for a reasonable 5,000 points each.

But Aeroplan touts one superpower that doesn’t get enough love: It lets you add a lap infant to your international award seat for just 2,500 miles (or $25). If you’ve previously only traveled domestically with a lap infant, you may be confused as to why you need to pay anything. After all, lap infants are generally free for flights within the U.S.

But that’s not the case for flights abroad. You’ll usually be charged a flat percentage of an adult’s cash fare. That can get expensive, especially when you use rewards to book a premium cabin.

For example, Qatar Airways charges 10% of an adult fare for a lap infant. I reserved a Qsuite business-class seat and had to pay nearly $1,000 for my infant. But when booking a business-class award flight on Air Canada, I paid just 2,500 Aeroplan points. This is a huge money saver for families.

Best Credit Cards for Air Canada points

Air Canada Aeroplan is a transfer partner of several bank currencies, including Capital One miles, Chase Ultimate Rewards and Amex Membership Rewards. Chase also issues a co-branded Aeroplan card:

- Aeroplan® Credit Card

- Chase Sapphire Preferred Card

- Chase Sapphire Reserve

- Amex Gold

- Amex Platinum

- Capital One Venture Rewards Credit Card

- Capital One Venture X Rewards Credit Card

The British Airways Club — Best for Easy-To-Accrue Rewards

You may never have stepped foot on a British Airways plane. You may never visit the UK. But that doesn’t mean British Airways is an irrelevant tool for a travel rewards enthusiast.

In fact, The British Airways Club is one of the most powerful airline loyalty programs in existence. That’s because of its myriad valuable partners (think American Airlines, Alaska Airlines, Qantas and more). Its rewards are also unbelievably easy to earn. British Airways calls its miles “Avios,” a rewards currency it shares with five other airlines:

- Aer Lingus

- Finnair

- Iberia

- Qatar Airways

- Vueling

When you earn Avios with these airlines, you can instantly transfer them to British Airways (and vice versa). On top of that, British Airways is a transfer partner of all major transferable rewards currencies:

- Bilt Rewards

- American Express Membership Rewards

- Chase Ultimate Rewards

- Capital One miles

- Citi ThankYou points

- Wells Fargo Rewards

This makes British Airways perhaps the single easiest airline rewards currency to earn.

Best Credit Cards for British Airways Avios

You’ve got a bevy of options for earning British Airways Avios, including:

- British Airways Visa Signature® Card

- Chase Sapphire Preferred Card

- Chase Sapphire Reserve

- Amex Gold

- Amex Platinum

- Capital One Venture Card

- Capital OneVenture X

- Citi Strata Premier Card

- Citi Strata Elite

Common Mistakes With Airline Loyalty Programs

Earning travel rewards (and, in some cases, elite status) is the easy part. The more cerebral activity is squeezing the most value from each airline loyalty program.

Here are a few golden rules to follow to maximize your preferred airline program.

Hoarding Miles Without a Redemption Plan

Airline miles are a currency just like any other. You can’t buy your groceries with them, but they are susceptible to devaluation as they gather dust. Simply put, don’t expect your large airline miles balance to appreciate over time.

The best practice is to earn miles with the intent to spend them in the near future. Airlines sometimes change their award prices with little notice. Your miles will almost never be worth more than they are right now.

Ignoring Transfer Partner Sweet Spots

One of the beautiful aspects of transferable rewards is that each has its own collection of “sweet spots.” Put simply, some airlines charge exponentially less for specific flights than others.

For example, you can book a fancy business-class flight on Air France between New York (JFK) and Paris (CDG) for 90,000 Qantas Frequent Flyer miles. But you can book the same flight for just 60,000 Air France-KLM Flying Blue miles. I recently used Flying Blue to book business-class seats on this route for my family of three.

Chasing Airline Status That Doesn’t Match Travel Habits

Airline elite status is a travel game-changer. Each airline’s status perks are unique, but you can typically count on free seat upgrades, waived bag fees, bonus miles on paid flights, expedited security, priority boarding and much more.

Again, it’s not terribly difficult to earn elite status with some airlines. Carriers like Delta and American Airlines allow you to earn top-tier status purely through credit card spend. Because of this, you may be enticed to put in the effort to earn low-hanging status. But if you rarely fly these airlines, the specific perks you’ll get won’t dramatically affect your travels.

Getting Too Caught Up in the Numbers

When it comes to rewards, you should use your airline miles for whatever makes you the happiest, even if you aren’t getting an astonishing return for them. For example, I’ve recently stopped ferociously chasing the highest value per point and am now willing to pay more miles for the luxury of a nonstop flight. What I once considered a waste of miles I now find worth it for a more pleasant travel experience.

The information related to the Chase Sapphire Reserve®, United℠ Explorer Card, United Quest℠ Card, United Club℠ Card, Southwest Rapid Rewards® Plus Credit Card, Southwest Rapid Rewards® Premier Credit Card, Southwest Rapid Rewards® Priority Credit Card, Citi® / AAdvantage® Executive World Elite Mastercard®, JetBlue Card, JetBlue Plus Card, JetBlue Premier Card, Aeroplan® Credit Card, British Airways Visa Signature® Card, Atmos™ Rewards Ascent Visa Signature® and Atmos™ Rewards Summit Visa Infinite® Credit Card was collected by CardCritics™ and has not been reviewed or provided by the issuer of this product/card. Product details may vary. Please see issuer website for current information. CardCritics™ does not receive a commission for this product.

Frequently Asked Questions About Airline Loyalty Programs

Which loyalty program is better, United or American?

The answer as to whether United or American has a better loyalty program depends on your travel goals and preferences. For example, American Airlines AAdvantage tends to charge fewer miles for many routes but passes along high fuel surcharges depending on the partner airline you fly. United MileagePlus’ award prices are unimpressive, but it never charges excessive taxes and fees.

Which airline has the best redemption program?

The best redemption program is another subjective question, but Alaska Airlines Atmos Rewards tends to consistently rank at or near the top of points and miles enthusiasts’ favorites for excellent value.

How can I find the best airline redemption deals?

To find the best airline redemption deals, try to avoid rigid travel plans. If your vacation dates aren’t set in stone, or if you’re willing to be flexible with your travel destination, you’re bound to find some screaming bargains.