Understanding Citi ThankYou Points Value: A Comprehensive Guide

Citi, an advertising partner, offers several credit cards that earn ThankYou® points, the issuer’s proprietary rewards currency. These versatile points can be redeemed for cash back, travel, gift cards and more — but the value you’ll get can vary significantly depending on the card you have and the redemption method you choose.

Let’s take a closer look at what Citi ThankYou points are worth, the best ways to earn them, and how to get the maximum value from your rewards.

400+ Credit Cards

Analyzed independently across 50+ data points in 30+ product categories

Reviewed

By a team of credit card experts with an average of 9+ years of experience

Trusted by

More than one million monthly readers seeking unbiased credit card guidance

CardCritics™ editorial team is dedicated to providing unbiased credit card reviews, advice and comprehensive comparisons. Our team of credit card experts uses rigorous data-driven methodologies to evaluate every card feature, fee structure and rewards program. In most instances, our experts are longtime members or holders of the very programs and cards they review, so they have firsthand experience maximizing them. We maintain complete editorial independence — our ratings and recommendations are never influenced by advertiser relationships or affiliate partnerships. You can learn more about our editorial standards, transparent review process and how we make money to understand how we help you make informed financial decisions.

How To Earn Citi ThankYou Points

Citi credit cards that earn ThankYou points range from no-annual-fee cash-back cards to premium travel rewards cards with upscale perks. These include:

- Citi Strata Elite℠ Card

- Citi Strata Premier® Card

- Citi Strata℠ Card

- Citi Double Cash® Card

- Citi Custom Cash® Card

- Citi Prestige® Credit Card (no longer available to new applicants)

Each card has different earning rates and bonus categories, and some offer different returns for certain redemptions (e.g., cash back). You’ll want to carefully consider your spending habits and redemption preferences before choosing the right card for your lifestyle.

For example, the $95-annual-fee Citi Strata Premier Card is a terrific all-around card because of its high earning rates in popular bonus categories. It earns 5 Citi ThankYou points per dollar on hotels, vacation rentals and car rentals booked through Citi Travel, and 3 ThankYou points per dollar on airfare, other hotel bookings, restaurants, supermarkets and gas stations.

Other Citi Strata Premier Card benefits include an annual credit worth $100 off a Citi Travel hotel booking of $500 or more (before taxes and fees) and access to Citi’s airline and hotel partners at the most favorable transfer ratio (1:1 in most cases).

However, the Strata Premier Card has a major drawback: If you redeem your rewards for cash back, you’ll only get a value of 0.75 cents per point.

If you have multiple eligible Citi credit cards, you can pool your combined points into a single ThankYou account to keep things simple. And, depending on the card(s) you have, you may get a different value on certain redemptions.

Citi ThankYou Points Value by Redemption Method

Here’s a comparison of the value you’ll receive from your Citi ThankYou points with various redemption options.

| Redemption Method | Value per Point | Additional Considerations |

| Citi Travel | 1 cent | Reserve hotels, flights, car rentals and attractions with points |

| Cash Back / Statement Credits | 0.5 to 1 cent, depending on the card | For example, the Double Cash Card and Custom Cash Card offer 1 cent per point, the Strata Premier Card and Strata Elite offer 0.75 cents per point, and the Strata offers 0.5 cents per point |

| Transfers to Partners | Varies, often 1 to 2 cents | The premium Strata Elite, Strata Premier Card and Prestige Card unlock the best transfer ratios; the no-annual-fee cards allow transfers at a slightly lower rate with exclusions |

| Gift Cards | 1 cent | May get a slightly higher value when gift cards go on sale |

| Charitable Donations | 1 cent | Choose from options such as the American Red Cross, World Central Kitchen, Unicef USA and Susan G. Komen |

| Shop With Points | Typically 0.8 cents | Merchants include Amazon, Best Buy, CVS and Walmart |

At a minimum, you should aim for a value of at least 1 cent per point when redeeming your Citi ThankYou Rewards. But, as noted above, it’s possible to get an even higher return when you transfer points to Citi’s airline and hotel partners to book award travel.

Maximizing the Value of Citi ThankYou Points for Travel

It’s easy to reserve travel through Citi’s portal and earn a consistent 1 cent per point, no matter what you book. This can be an excellent strategy if you don’t have time to fuss with award charts and blackout dates, prefer independent hotels or smaller airlines, or find a cheap paid fare.

But in some cases, you can do better. Citi partners with more than a dozen airline and hotel loyalty programs (and one retail program), and most ThankYou points-earning cards allow transfers to all partners, albeit at different rates. Again, you’ll get the best transfer ratios with premium cards such as the Citi Strata Elite, Citi Strata Premier Card and Citi Prestige (no longer available to new applicants).

Check out the full list of Citi transfer partners:

| Loyalty Program | Transfer Ratio | Minimum Transfer Amount |

| ALL Accor Live Limitless | 1:0.5 or 1:0.35, depending on the card | 1,000 points |

| Air France-KLM Flying Blue | 1:1 or 1:0.7, depending on the card | 1,000 points |

| American Airlines AAdvantage | 1:1 or 1:0.7, depending on the card | 1,000 points |

| Avianca LifeMiles | 1:1 or 1:0.7, depending on the card | 1,000 points |

| Cathay Pacific | 1:1 or 1:0.7, depending on the card | 1,000 points |

| Choice Privileges | 1:2 or 1:1.4, depending on card | 1,000 points |

| Emirates Skywards | 1:0.8 or 1:0.56, depending on the card | 1,000 points |

| Etihad Guest | 1:1 or 1:0.7, depending on the card | 1,000 points |

| EVA Air Infinity MileageLands | 1:1 or 1:0.7, depending on the card | 1,000 points |

| JetBlue TrueBlue | 1:1 or 1:0.7, depending on the card | 1,000 points |

| Leading Hotels of the World Leaders Club | 1:0.2 or 1:0.14, depending on the card | 1,000 points |

| Preferred Hotels & Resorts I Prefer Hotel Rewards | 1:4 or 1:2.8, depending on the card | 1,000 points |

| Qantas Frequent Flyer | 1:1 or 1:0.7, depending on the card | 1,000 points |

| Qatar Airways Privilege Club | 1:1 or 1:0.7, depending on the card | 1,000 points |

| Shop Your Way | 1:10 | 1 point |

| Singapore Airlines | 1:1 or 1:0.7, depending on the card | 1,000 points |

| Thai Royal Orchid Plus | 1:1 or 1:0.7, depending on the card | 1,000 points |

| Turkish Airlines Miles&Smiles | 1:1 or 1:0.7, depending on the card | 1,000 points |

| Virgin Atlantic Flying Club and Virgin Red | 1:1 or 1:0.7, depending on the card | 1,000 points |

| Wyndham Rewards | 1:1 or 1:0.7, depending on the card | 1,000 points |

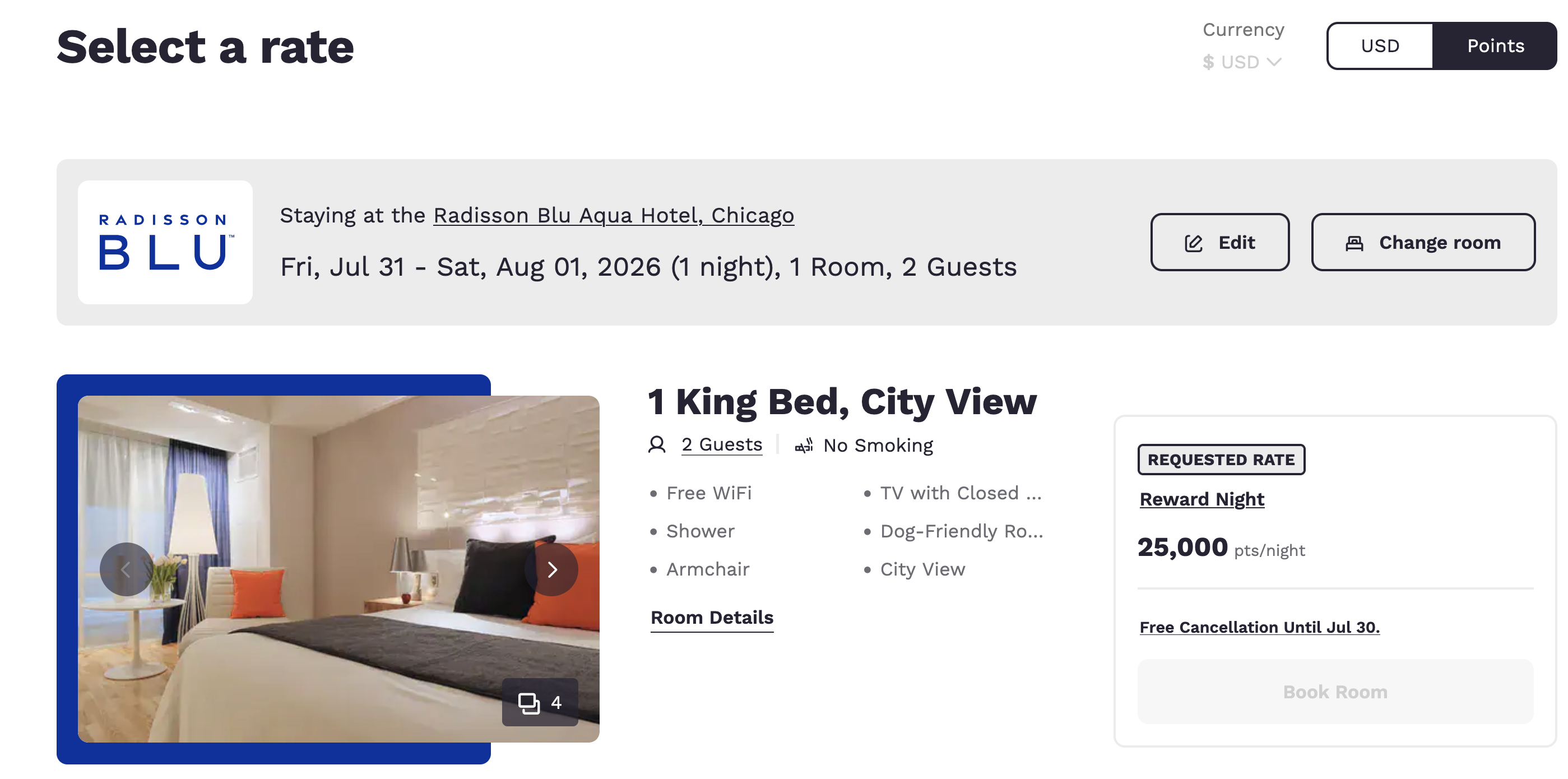

Let’s look at an example of how this works in practice. I have the Strata Premier Card, which offers a 1:2 transfer ratio to Choice Privileges (1 ThankYou point equals 2 Choice points).

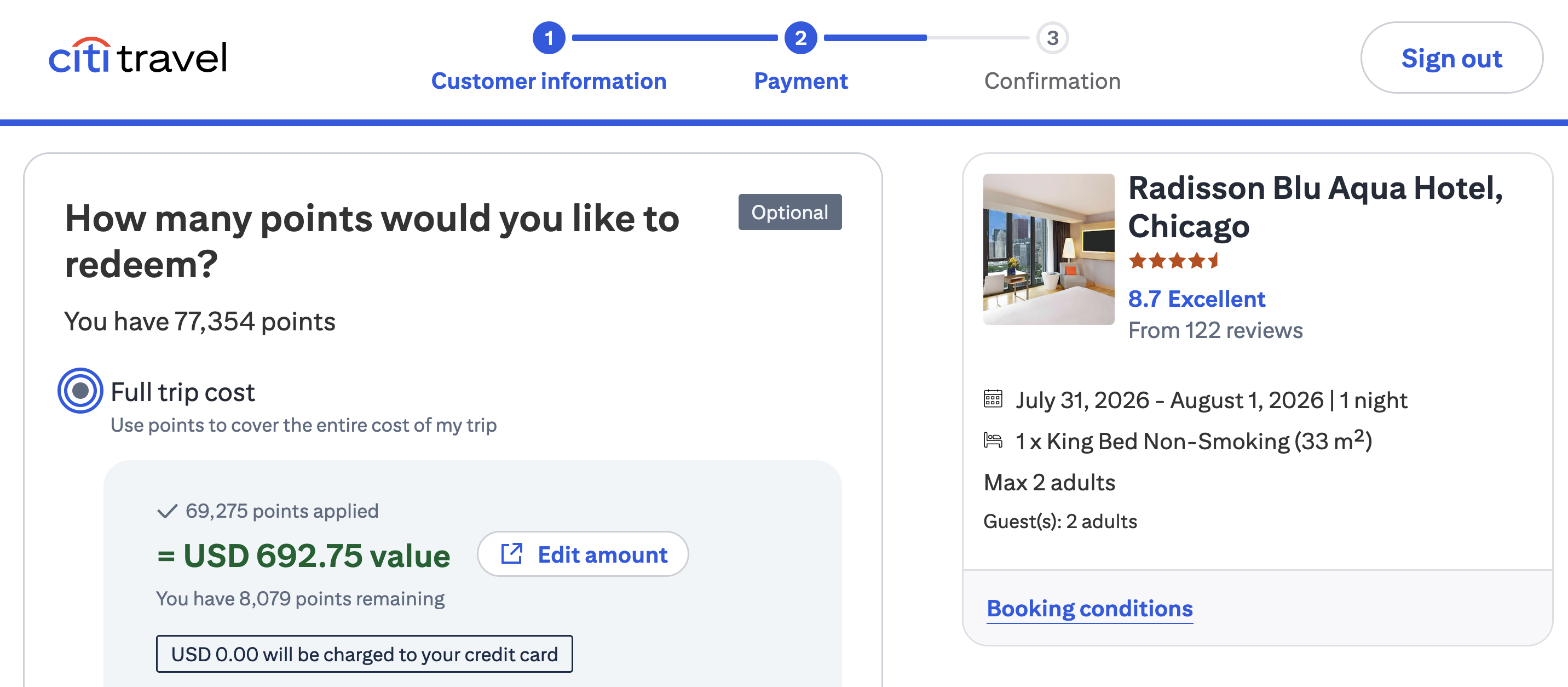

During Lollapalooza this summer in Chicago, you could book a night at the Radisson Blu Aqua Hotel through Citi Travel for $692.75 or 69,275 ThankYou points (1 cent per point). It’s not uncommon to see pricey rates like this during peak travel times such as concerts and sporting events.

Meanwhile, if you booked the exact same room and date as an award stay through the Choice Privileges program, you’d only pay 25,000 Choice points (plus a resort fee of $26).

When you consider the 1:2 transfer ratio, it’s an even better deal. You’d only need to move 13,000 Citi ThankYou points to Choice Privileges to book this award (transfers must be in 1,000-point increments). You’d be looking at a value of over 5 cents per point if you redeemed your ThankYou points this way.

Not all award redemptions will get this high a return, but it just goes to show what’s possible if you learn a bit about partners and award strategies.

Other Redemption Methods Provide Less Value

If travel isn’t a priority for you right now, you can still get a decent return from your Citi ThankYou points — and that’s what makes them so flexible. Just know that you won’t have opportunities to receive outsized value.

Cash Back

Two of Citi’s no-annual-fee cards, the Citi Double Cash Card and Citi Custom Cash Card, offer a rate of 1 cent per point when you redeem for cash back (either as a direct deposit, statement credit or mailed check). It’s best to avoid cash-back redemptions with most other cards, though, since you’ll get a poorer value.

Gift Cards

Redeeming points for gift cards at 1 cent per point can also be a good move, particularly if there’s a sale and you can snag a card at a cheaper rate. Through the Citi ThankYou portal, you can choose gift cards from dozens of popular merchants, including Home Depot, Starbucks, Apple and Staples.

Shop With Points

Cit partners with various retailers that allow you to redeem ThankYou points at checkout, including:

- 1-800-Flowers

- Amazon

- AT&T

- Best Buy

- BP and Amoco

- CVS

- Dollar General

- Giant Eagle

- HomeGoods

- Hy-Vee

- Marshalls

- Murphy USA

- PayPal

- Schnucks

- Shell

- TJ Maxx

- Walgreens

- Walmart

While this is a convenient option, it’s best avoided in most cases. Here, you’ll typically only get a value of 0.8 cents per point. If your card offers 1 cent per point in cash back, it makes more sense to use it to pay for the purchase (and earn rewards), then redeem points for a statement credit to pay off the charge.

How Citi ThankYou Points Value Compares to Other Credit Card Programs

The other major flexible bank currencies — Chase Ultimate Rewards® points, American Express Membership Rewards® points and Capital One miles — offer redemption options that are quite similar to Citi’s. But again, the value you’ll receive depends on the cards you have and the redemption method.

Citi ThankYou vs. Chase Ultimate Rewards

Chase credit cards that earn Ultimate Rewards points include the Chase Sapphire Preferred® Card, Chase Sapphire Reserve®, Chase Freedom Unlimited® and Chase Freedom Flex®. You’ll get the best bang for your rewards with the annual-fee Sapphire cards, because those unlock transfers to Chase’s airline and hotel partners and better redemption rates through Chase Travel℠. Here, too, it’s important to compare your options to ensure you’re getting the best deal.

With the no-annual-fee Freedom cards, you typically receive 1 cent per point (cash back, Chase Travel, gift cards) and have no way to transfer rewards to partners. Citi has a bit of an edge; its no-annual-fee ThankYou cards allow point transfers, albeit at a slightly inferior ratio.

Citi ThankYou vs. American Express Membership Rewards

American Express cards that earn Membership Rewards points, such as the American Express Platinum Card® and American Express® Gold Card (both advertising partners), are not well-suited for those who prefer cash back, offering a relatively low 0.6 cents per point when redeemed this way.

Where the program excels is in its airline and hotel partnerships. Amex transfer partners include popular domestic airline programs like Delta SkyMiles, as well as useful hotel programs such as Hilton Honors and Marriott Bonvoy.

Citi ThankYou vs. Capital One Miles

Capital One cards that earn miles are interesting because they generally offer the same redemption methods and value, whether the card charges an annual fee or not. For example, whether you have the premium, $395-annual-fee Capital One Venture X Rewards Credit Card or no-annual-fee Capital One VentureOne Rewards Credit Card, you can redeem your miles for:

- Transfers to Capital One’s airline and hotel partners (value varies by partner and redemption)

- Capital One Travel bookings (1 cent per mile)

- Erasing eligible travel purchases from your statement (1 cent per mile)

- Gift cards (usually 0.8 to 1 cent per mile)

- Pay with miles at PayPal or at Amazon checkout (0.8 cents per mile)

- Cash back (0.5 cents per mile)

- Experiences such as tickets to exclusive events, concerts, sports games and theater productions (value varies)

Bottom Line

Citi ThankYou points are a worthwhile rewards currency to collect, in part because they’re so flexible. You’ve got plenty of options between travel, cash back, gift cards and shopping when it comes time to redeem your points, but you won’t always get the same value.

You’ll usually get the best return when you redeem Citi points for travel, especially if you transfer them to airline and hotel partners — this can result in a value of 2 cents per point or more. Otherwise, your Citi ThankYou points are typically worth 1 cent each (or less), depending on the card you have and how you redeem your rewards.

For a closer look at everything this program has to offer, read our guide to maximizing Citi ThankYou points.

The information related to the Citi Custom Cash® Card , Chase Sapphire Reserve® and Chase Freedom Flex® was collected by CardCritics™ and has not been reviewed or provided by the issuer of this product/card. Product details may vary. Please see issuer website for current information. CardCritics™ does not receive a commission for this product.

Frequently Asked Questions About Citi ThankYou Points Value

What’s the best way to redeem Citi ThankYou points?

The best way to redeem Citi ThankYou points depends on your priorities. For travelers, you can usually get the most value from your rewards by transferring them to airline and hotel partners and booking award flights and stays. But some may prefer the simplicity of booking through Citi’s travel portal or trading in their points for cash back or gift cards.

What’s the worst way to redeem Citi ThankYou points?

If you define “worst” by lowest value, you’ll want to avoid cash-back redemptions with the Strata (0.5 cents per point) or Strata Premier Card and Strata Elite (0.75 cents per point). That’s a lower value than you’d get from simply redeeming points through Citi Travel or for gift cards (1 cent per point), and almost certainly inferior to transferring points to partners in most cases.

Can you share Citi ThankYou points with friends and family?

Yes, with most cards, you can share up to 100,000 points each calendar year with others, provided they have an active Citi ThankYou account. However, Citi Custom Cash Card cardholders are not allowed to share points.

Do Citi ThankYou points expire?

Citi ThankYou points typically do not expire as long as your account is open and in good standing. One exception: Shared points will expire within 90 days.