Chase Ultimate Rewards Guide: How To Earn, Redeem and Maximize

You want to travel more — but the economy isn’t exactly blessing you with an uptick in disposable income.

400+ Credit Cards

Analyzed independently across 50+ data points in 30+ product categories

Reviewed

By a team of credit card experts with an average of 9+ years of experience

Trusted by

More than one million monthly readers seeking unbiased credit card guidance

CardCritics™ editorial team is dedicated to providing unbiased credit card reviews, advice and comprehensive comparisons. Our team of credit card experts uses rigorous data-driven methodologies to evaluate every card feature, fee structure and rewards program. In most instances, our experts are longtime members or holders of the very programs and cards they review, so they have firsthand experience maximizing them. We maintain complete editorial independence — our ratings and recommendations are never influenced by advertiser relationships or affiliate partnerships. You can learn more about our editorial standards, transparent review process and how we make money to understand how we help you make informed financial decisions.

Fortunately, many of the best Chase credit cards can help you to travel for pennies on the dollar thanks to the hyper valuable Chase Ultimate Rewards® they earn. Let’s take a look at how these points work (and how to collect them in a hurry).

What Are Chase Ultimate Rewards Points?

Ultimate Rewards is Chase’s proprietary credit card rewards program. Chase points are one of the most useful travel rewards currencies because of their flexibility. You can use them to book flights and hotels for (nearly) free, exchange them for cash, redeem them for gift cards and more.

How To Earn Chase Ultimate Rewards Points

Some of the top travel credit cards on the market earn Chase Ultimate Rewards points. Besides top-notch travel benefits and protections, many offer excellent return rates for common purchases (think dining, groceries, drugstores and more). Several come with massive welcome bonuses worth potentially thousands in travel.

Even credit cards that Chase markets as earning cash back earn Ultimate Rewards points. For example, cards that earn 5% cash back actually earn 5 Chase points per dollar.

These are the Chase Ultimate Rewards points-earning credit cards currently open to new applicants:

Chase Sapphire Preferred® Card

Welcome offer: Earn 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening.

Earning points:

- 5 points per dollar on travel purchased through Chase Travel℠

- 3 points per dollar on dining (including eligible delivery services, takeout and dining out)

- 3 points per dollar for online grocery purchases (excluding Walmart, Target and wholesale clubs)

- 3 points per dollar for select streaming services

- 2 points per dollar on all other travel purchases

- 1 point per dollar for all other eligible purchases

Learn more: Chase Sapphire Preferred Card review

Chase Sapphire Reserve®

Welcome offer: Earn 125,000 bonus points after you spend $6,000 on purchases in the first 3 months from account opening.

Earning points:

- 8 points per dollar on Chase Travel purchases (after the first $300 is spent on travel each year)

- 5 points per dollar on Lyft purchases (through Sept. 30, 2027)

- 4 points per dollar on flights and hotels booked directly (after the first $300 is spent on travel purchases annually)

- 3 points per dollar on dining

- 1 point per dollar for all other eligible purchases

Learn more: Chase Sapphire Reserve review

Chase Freedom Unlimited®

Welcome offer: Earn $200 (20,000 points) after you spend $500 on purchases in the first three months from account opening.

Earning points:

- 5% cash back on travel booked through Chase Travel

- 3% cash back on dining

- 3% cash back at drugstores

- 1.5% cash back for all other eligible purchases

Learn more: Chase Freedom Unlimited review

Chase Freedom Flex®

Welcome offer: Earn $200 (20,000 points) after you spend $500 on purchases in the first three months from account opening.

Earning points:

- 5% cash back in rotating bonus categories (up to $1,500 in spending each quarter, then 1%) after you activate

- 5% cash back on travel booked through Chase Travel

- 3% cash back on dining

- 3% cash back at drugstores

- 1% cash back on all other eligible purchases

Learn more: Chase Freedom Flex review

Chase Freedom Rise®

Welcome offer: $25 for enrolling in automatic payments

Earning points:

- 1.5% cash back on all purchases

Ink Business Preferred® Credit Card

Welcome offer: Earn 100,000 bonus points after you spend $8,000 on purchases in the first 3 months from account opening.

Earning points:

- 3 points per dollar on up to $150,000 in spending each cardmember year (then 1x) on shipping purchases, advertising purchases made with social media sites and search engines, internet/cable/phone services, and travel

- 1 point per dollar on all other eligible purchases

Ink Business Unlimited® Credit Card

Welcome offer: Earn $750 bonus cash back after you spend $6,000 on purchases in the first 3 months from account opening.

Earning points:

- 1.5 points per dollar on all purchases

Ink Business Cash® Credit Card

Welcome offer: Earn $750 when you spend $6,000 on purchases in the first three months after account opening

Earning points:

- 5% cash back on up to $25,000 in combined spending each cardmember year (then 1%) at office supply stores and on internet, cable and phone services

- 2% cash back on up to $25,000 in combined spending each cardmember year (then 1%) at gas stations and restaurants

- 1% cash back on all other eligible purchases

Ink Business Premier® Credit Card

Welcome offer: Earn $1,000 bonus cash back after you spend $10,000 on purchases in the first 3 months from account opening.

Earning points:

- 5% cash back on travel booked through Chase Travel

- 2.5% back on purchases of $5,000 or more

- 2% back on all other business purchases

How To Redeem Chase Ultimate Rewards Points

There are a handful of ways to use Chase points — but not all Ultimate Rewards-earning cards qualify for every redemption option.

Transfer Chase Points to Partners

If you hold an annual fee-incurring Chase Ultimate Rewards card, namely, the Sapphire Preferred Card, Sapphire Reserve or Ink Business Preferred, you can transfer your points to Chase’s airline and hotel loyalty program partners at a 1:1 ratio (the notable exception is the Ink Business Premier card, which earns points that can’t be converted into travel rewards).

Aer Lingus AerClub | Marriott Bonvoy |

Air Canada Aeroplan | Singapore Airlines KrisFlyer |

British Airways Executive Club | Southwest Rapid Rewards |

Flying Blue (Air France and KLM) | United Airlines MileagePlus |

Iberia Plus | Virgin Atlantic Flying Club |

IHG One Rewards | World of Hyatt |

JetBlue TrueBlue |

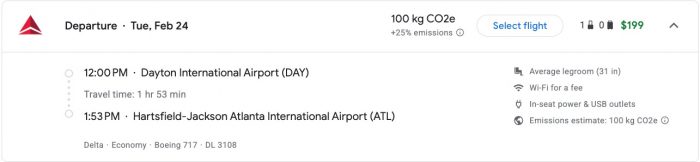

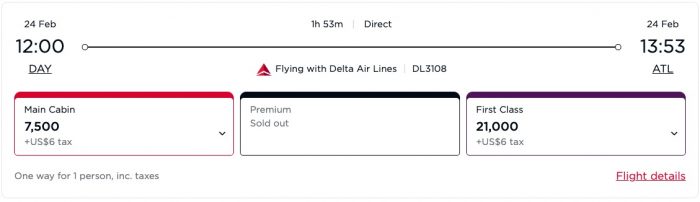

You’ll typically get the highest value for your Chase points by transferring them to these travel partners to book award flights and hotel stays. For example, the flight below from Dayton (DAY) to Atlanta (ATL) costs $199 one way.

But you can reserve the exact same seat by converting 7,500 Chase points into Virgin Atlantic miles and paying a nominal $5.60 in fees. That results in a value of around 2.6 cents per point.

Book Through Chase Travel

Transferring your rewards to airlines and hotels is easy, but you’ll have to navigate award pricing and availability. A simpler option can be using points to buy travel through Chase Travel, which is similar to other online travel agencies like Expedia and Booking.com.

The return you’ll get for your points depends on the card you have:

- Sapphire Reserve: Up to 2 cents per point

- Sapphire Preferred Card: Up to 1.75 cents per point

- Ink Business Preferred: Up to 1.75 cents per point

- All other Ultimate Rewards cards: 1 cent per point

To compare the Chase Sapphire Reserve vs Preferred, 10,000 points equals up to $200 in Chase Travel bookings if you have the Sapphire Reserve, while Sapphire Preferred Card gets up to $175 in value.

Non-Travel Redemptions

If travel isn’t in your foreseeable future, you can also trade your Chase points for cash, gift cards, Apple products and more at a rate of 1 cent per point. You can even pay for your Amazon cart at a rate of 0.8 cents each, although this isn’t the best way to make the most of your rewards.

How To Maximize Chase Ultimate Rewards Points

You shouldn’t obsess too heavily over the value per point you receive when redeeming Chase points. But if you’re trying to wring every last drop of value from your rewards, do the following:

- Open a Chase Sapphire or Ink Business Preferred card: Again, these cards unlock the ability to transfer your points to airlines and hotels and book super cheap travel.

- Book fancy award travel: You’ll often get the highest value for your points when you book international first or business class seats, five-star hotels etc. For example, a $4,000 lie-flat business class seat to Europe may cost just 60,000 miles — giving you a fantastic value per point.

- Be mindful of credit card bonus categories: If you’ve got multiple Ultimate Rewards credit cards (like I do), make sure you’re enrolling in rotating bonus categories and using the right card for every dime you spend. It’s not difficult to earn many tens of thousands of extra points each year with a bit of wallet optimization.

How Much Are Chase Ultimate Rewards Points Worth?

CardCritics™ estimates that Chase points are worth an average of 2 cents each when redeemed with transfer partners. Depending on the card you have, you could get 1 to up to 2 cents per point when you redeem through Chase Travel, and 1 cent per point for cash back and gift cards.

If you don’t plan to redeem points for travel, Chase Ultimate Rewards may not be the best currency for your lifestyle. A pure cash-back credit card may serve you better.

The information related to the Chase Sapphire Reserve®, Chase Freedom Rise®, Chase Freedom Flex®, Ink Business Preferred® Credit Card, Ink Business Unlimited® Credit Card, Ink Business Unlimited® Credit Card, Ink Business Cash® Credit Card and Ink Business Premier® Credit Card was collected by CardCritics™ and has not been reviewed or provided by the issuer of this product/card. Product details may vary. Please see issuer website for current information. CardCritics™ does not receive a commission for this product.

Frequently Asked Questions About Chase Ultimate Rewards Points

What is the best use of Chase Ultimate Rewards points?

The best use of Chase Ultimate Rewards points is for award travel with Chase’s airline and hotel partners, if you have a card that allows transfers.

How much are 100,000 Chase points worth?

The value of your Chase points depends on how you redeem them and which card(s) you have, but at minimum, 100,000 Chase points are worth $1,000 in cash back. If you use them for travel, they could be worth much more.

Do Chase Ultimate Rewards expire?

Chase Ultimate Rewards points don’t expire as long as you’ve got an active Ultimate Rewards-earning credit card in good standing.

How do I use Chase points on Amazon?

To use Chase points on Amazon, link your Chase credit card to the “Shop with Points” option in your Amazon account.

Can I combine my Chase points from multiple cards?

Yes, you can move Chase points between your Ultimate Rewards card accounts. In fact, combining points into the account that gives you the best redemption options is a smart choice.