How To Maximize the American Express Gold Card Welcome Offer

The iconic American Express® Gold Card, an advertising partner, has been a fixture in the world of travel rewards credit cards for decades, thanks to its combination of generous bonus-earning categories and valuable benefits that can justify its $325 annual fee.

One of its most appealing features is its incentive for new cardholders: You may be eligible for as high as 100,000 Membership Rewards® Points after spending $6,000 in eligible purchases on your new Card in your first 6 months of Membership. Welcome offers vary and you may not be eligible for an offer. The Amex Gold welcome offer is among the best on the market today. While the exact offer varies by user, those bonus points can unlock hundreds of dollars (or more) in travel value.

In this guide, you’ll learn how to maximize the Amex Gold offer as efficiently as possible, how earning the bonus points works, and how to avoid common mistakes that can cost you the offer altogether.

400+ Credit Cards

Analyzed independently across 50+ data points in 30+ product categories

Reviewed

By a team of credit card experts with an average of 9+ years of experience

Trusted by

More than one million monthly readers seeking unbiased credit card guidance

CardCritics™ editorial team is dedicated to providing unbiased credit card reviews, advice and comprehensive comparisons. Our team of credit card experts uses rigorous data-driven methodologies to evaluate every card feature, fee structure and rewards program. In most instances, our experts are longtime members or holders of the very programs and cards they review, so they have firsthand experience maximizing them. We maintain complete editorial independence — our ratings and recommendations are never influenced by advertiser relationships or affiliate partnerships. You can learn more about our editorial standards, transparent review process and how we make money to understand how we help you make informed financial decisions.

What Is the Amex Gold Welcome Offer?

The Amex Gold welcome offer is a one-time, lump-sum award of American Express Membership Rewards® points to new cardholders who meet a minimum spending requirement within a set time period after account approval.

In simpler terms: open the card, spend a certain amount on eligible purchases, and earn a large batch of Membership Rewards points.

Welcome Offer Structure

It’s important to know that the Amex Gold offer is not the same for everyone. The number of bonus points you’re offered can vary based on Amex’s algorithm, which isn’t publicly known. It’s possible that the issuer considers things such as your Amex account history, credit profile and other factors when it creates your offer (if you’re eligible).

That’s why the offer isn’t totally specific: You may be eligible for as high as 100,000 Membership Rewards® Points after spending $6,000 in eligible purchases on your new Card in your first 6 months of Membership. Welcome offers vary and you may not be eligible for an offer.

You’ll learn whether you’re approved and the amount of your offer after you submit your application. Your credit score won’t be affected until you accept the card.

When I opened the Amex Gold several years ago, the offer wasn’t structured this way, and the bonus point award was significantly lower. This is a very good deal if you can qualify for the maximum offer.

How Long Do You Have To Earn the Welcome Offer?

As with most rewards credit cards, new Amex Gold Gold cardholders have several months to meet the minimum spending requirement required to unlock the offer. In this case, you’ll have six months in which to spend at least $6,000 on purchases to earn the bonus points. While this window is fairly generous, with an average monthly spend of $1,000, timing still matters.

The spending requirement can be easier to meet if you plan your application around large upcoming expenses, such as a vacation, insurance payment or seasonal spending. This can make the difference between earning the bonus effortlessly or scrambling to meet the spending deadline.

Why the Amex Gold Welcome Offer Is So Valuable

The Amex Gold Card intro offer stands out because it earns flexible points, not cash back or rewards locked into a fixed value.

What Amex Membership Rewards Points Are Worth

The value of Membership Rewards points varies depending on how you redeem them. You’ll typically get the best possible return when you use points for travel, but there are plenty of options, including:

- Transfer points to partners: American Express transfer partners include Delta SkyMiles, JetBlue TrueBlue, Marriott Bonvoy and Hilton Honors. Transferring points to partners for award flights and stays could get you 2 cents per point or more, depending on the redemption.

- Book through American Express Travel®: You can book flights, hotels, rental cars and cruises through Amex Travel at a rate of 1 cent per point for flights, and 0.7 cents per point for hotels, rental cars and cruises.

- Redeem for gift cards: Amex offers gift cards from many popular retailers, as well as its own branded gift cards. Redemption rates usually vary from 0.5 to 1 cent per point.

- Pay with points: You can redeem points when you check out with several popular merchants and platforms, including Amazon, PayPal, Best Buy and Dell. Typically, you’ll receive a value of 0.7 cents per point.

- Statement credits: We don’t recommend using Amex points this way, because you’ll only receive a value of 0.6 cents per point when you redeem for a statement credit or to offset specific charges on your account.

I especially appreciate that, unlike traditional cash-back credit cards, you’re not capped at a fixed rate when redeeming Membership Rewards points. With a little research and know-how about airline frequent flyer programs and hotel loyalty programs, savvy redemptions can significantly increase the offer’s real value.

Best Ways To Redeem Points From the Offer

One of the biggest advantages of the Amex Gold welcome offer is the flexibility of Membership Rewards points, especially when you transfer them to airline and hotel partners for outsized value. Points redeemed this way can open the door to experiences that far exceed the value you’d get from simple statement credits or cash-back redemptions.

My favorite way to use Amex points is transferring them to partners. Over the years, I’ve moved Amex points to Air Canada Aeroplan for flights to the Philippines, British Airways Club for a trip to Ireland, Singapore Airlines KrisFlyer for flights to Europe and Asia, and Delta SkyMiles for short domestic hops. All told, I’ve received tens of thousands of dollars in travel value — that’s one of the many reasons the Amex Gold remains at the top of my wallet.

Here are some of the most valuable transfer partners and how you might use them.

Air Canada Aeroplan (Star Alliance Flights)

Even if you don’t fly Air Canada, transferring your Amex points to Air Canada Aeroplan gives you access to flights across the entire Star Alliance network, including United, Lufthansa, ANA and Singapore Airlines.

A popular Aeroplan sweet spot is booking long-haul international flights or stopover itineraries where you can include an extra city on an international award ticket for just 5,000 extra Aeroplan points. Aeroplan’s flexible award chart and routing rules make it a go-to for many travelers looking to squeeze maximum value out of their points.

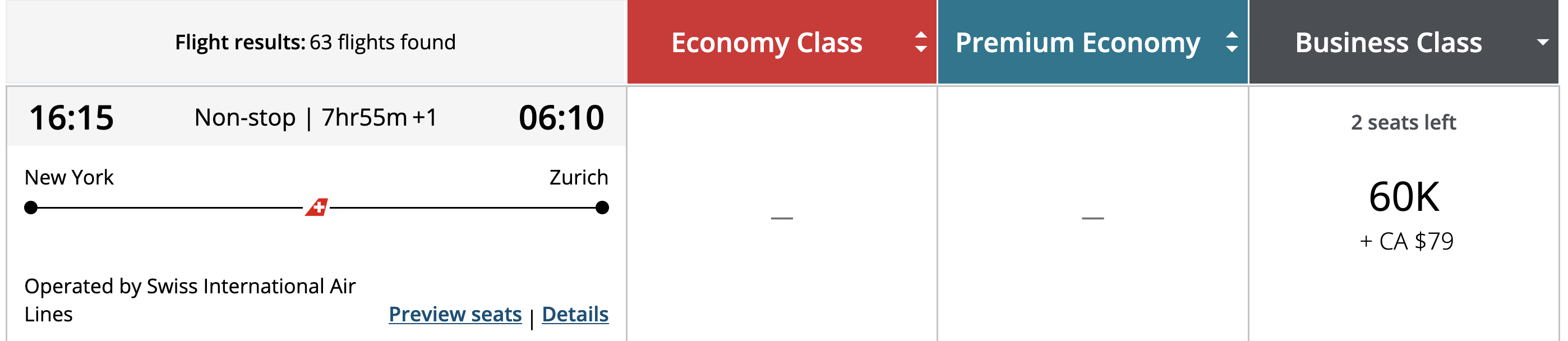

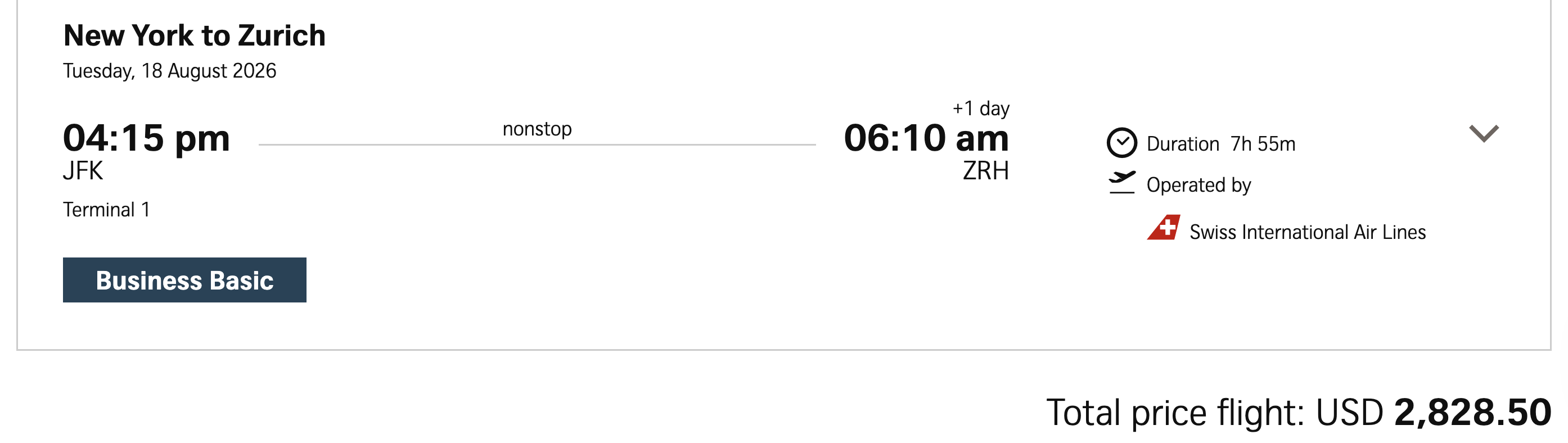

For example, you could transfer 60,000 Amex points to Aeroplan and book a business-class award seat on SWISS from New York (JFK) to Zurich (ZRH), with taxes and fees of 79 Canadian dollars (about $58).

The same flight would cost $2,828.50 if paid in cash.

In this case, you’d receive an excellent value of about 4.6 cents per point ($2,828.50 minus $58, divided by 60,000 points). That’s a far better deal than if you used points at 1 cent each to book this flight through Amex Travel.

Air France-KLM Flying Blue (SkyTeam Flights and Promo Rewards)

Flying Blue is the loyalty program of Air France and KLM, and it’s another solid choice for booking flights across the SkyTeam alliance, which also includes Delta Air Lines, Virgin Atlantic and Korean Air.

Flying Blue stands out for its Promo Rewards, which are discounted award prices (typically 25% off) on select Air France and KLM routes offered each month. You can often find award flights between North America and Europe for just 18,750 miles in economy, 30,000 miles in premium economy or 45,000 miles in business class (plus taxes and fees). These rates are far lower than what competing loyalty programs charge for similar itineraries, but you’ll need to be flexible with your travel dates and airports to take full advantage.

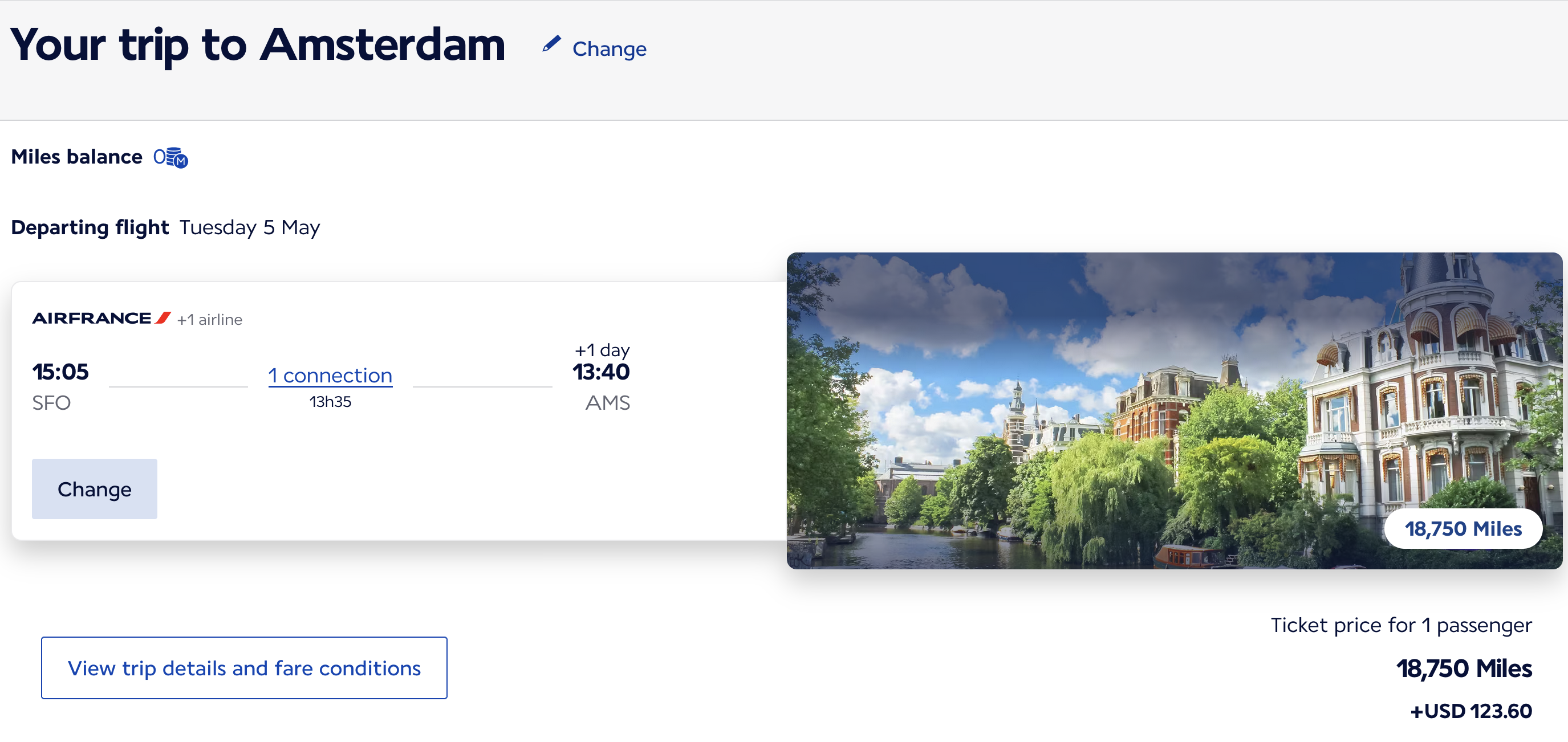

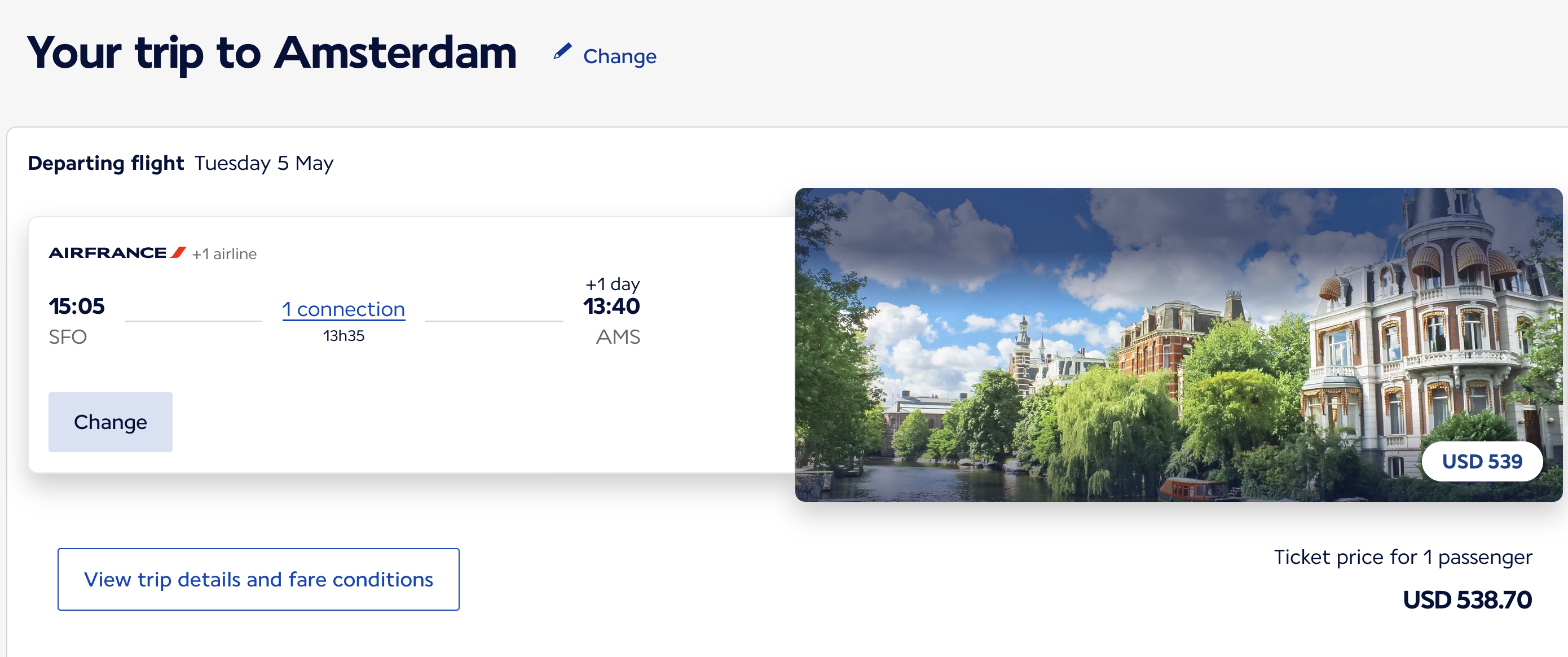

For example, you could transfer Amex points to Flying Blue to book this itinerary from San Francisco (SFO) to Amsterdam (AMS) via Paris (CDG) for just 18,750 miles and $123.60 in taxes and fees.

If you paid cash for the same ticket, it would cost $538.70.

Here, you’d get about 2.2 cents per mile ($528.70 minus $123.60, divided by 18,750 miles). That’s a solid return, even factoring in the taxes and fees.

British Airways Club (Oneworld Flights)

Transferring points to British Airways Club converts them to Avios, the currency used by BA, Iberia, Aer Lingus, Qatar Airways, Finnair and others. British Airways Avios are particularly valuable for short-haul flights, since award prices are distance-based.

This program is useful for booking short, expensive flights within the U.S. on Oneworld partners American Airlines and Alaska Airlines — especially during peak travel times or for last-minute trips. If used for longer international flights, be aware that British Airways often adds significant fuel surcharges to certain awards, which can erode some of the value.

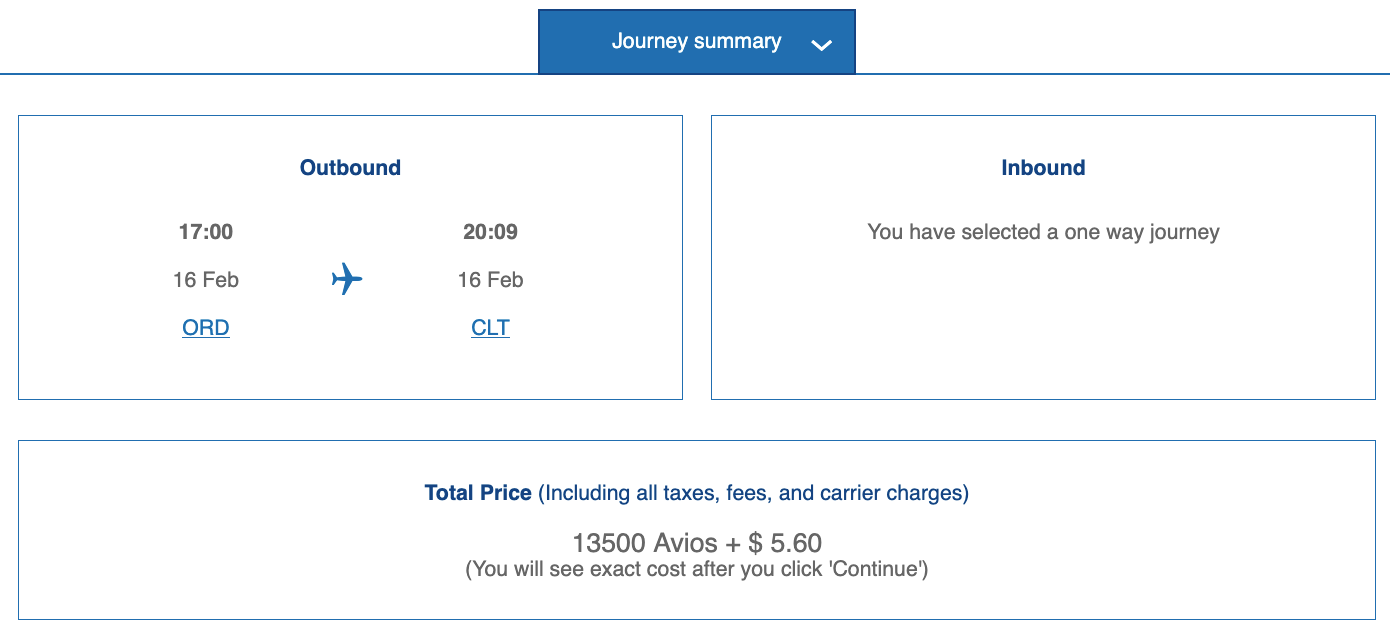

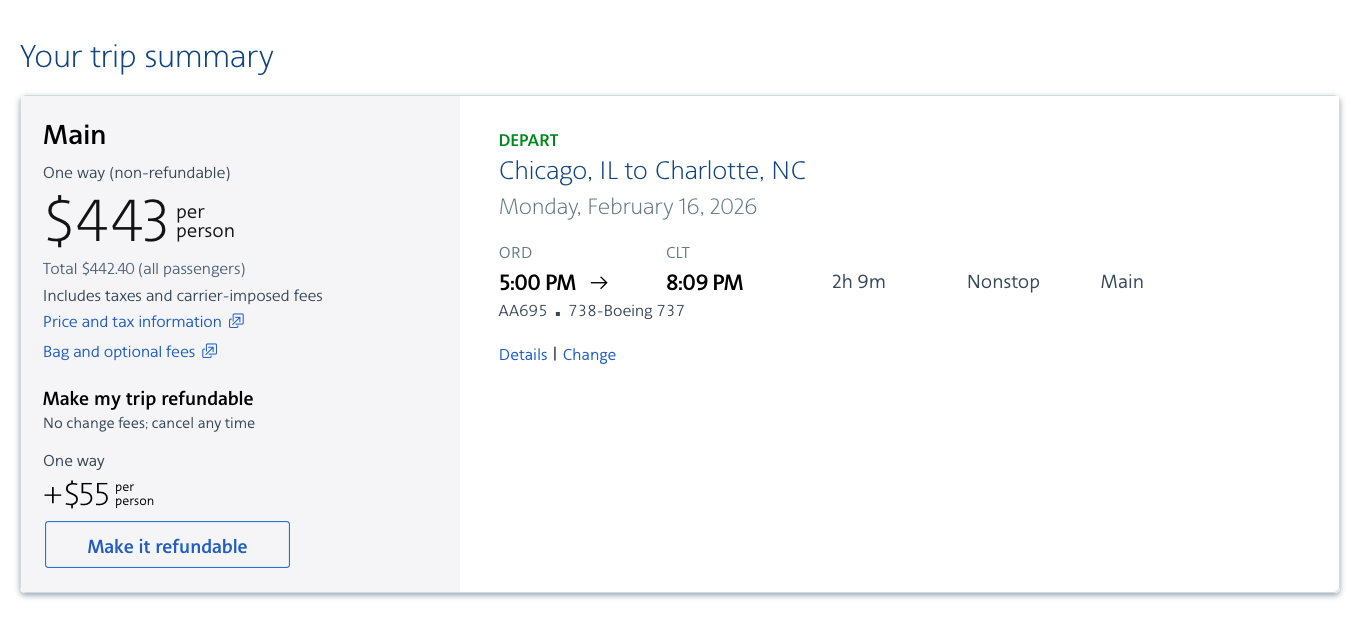

Here’s an American Airlines flight from Chicago O’Hare (ORD) to Charlotte (CLT) on President’s Day, a popular travel day. You’d pay just 13,500 Avios plus $5.60 in taxes and fees in economy class.

Booked with cash, the same flight costs $442.40 — higher than usual since it’s a last-minute booking on a holiday.

Even though it’s a run-of-the-mill domestic economy seat and not a fancy international premium cabin, you’d get a stellar value here of about 3.2 cents per Avios ($442.40 minus $5.60, divided by 13,500 Avios).

Hotel Transfer Options (Typically Lower Value, but Useful Sometimes)

While airline transfers typically yield the highest cents-per-point value, Amex also partners with a handful of hotel programs that might better suit your travel goals.

- Hilton Honors (1:2 ratio): The transfer ratio here can result in a decent return, particularly at expensive luxury brands or when taking advantage of Hilton Honors’ fifth night free on award stays (if you have Hilton elite status).

- Marriott Bonvoy (1:1 ratio): It’s harder to get a high value from Marriott Bonvoy points, but the program is useful thanks to its worldwide coverage. Again, you’ll often get a better deal by booking longer stays to maximize the program’s fifth-night-free benefit.

- Choice Privileges (1:1 ratio): Choice Hotels are typically budget-friendly, so it’s challenging to get massive value here. Look for stays during peak times when paid rates are high to get the best deals.

Keep in mind that once you transfer Amex points to a partner, you can’t move them back, so be sure to check award availability and pricing before transferring points.

How To Earn the Amex Gold Welcome Offer Faster

A little strategy can go a long way if you want to unlock the Amex Gold welcome offer quickly. The card awards bonus points in a few popular everyday spending categories, making it easier to meet the minimum requirement organically and giving your rewards balance an extra boost. You can earn:

- 4x points at restaurants worldwide, on up to $50,000 in purchases per year (then 1x points)

- 4x points at U.S. supermarkets, on up to $25,000 in purchases per year (then 1x)

- 3x points on flights booked directly with airlines or through AmexTravel.com

- 2x points on prepaid hotels and other eligible travel bookings made through AmexTravel.com

- 1x points on other eligible purchases

Considering many households have significant grocery and dining expenses each month, using the card for these purchases is a no-brainer.

Smart Spending Strategies To Meet the Minimum Requirement

You might normally lean toward only using the Amex Gold in bonus categories to maximize rewards — that’s certainly what I do — but while you’re trying to meet the minimum spending requirement, aim to use the card for every purchase you make, no matter how small. Even your morning drive-thru coffees or gas station snacks add up, so leave your cash or debit card alone while you’re working toward earning your bonus points.

You can also consider these approaches:

- Time large planned purchases with your card application: Perhaps you have a home improvement project or major appliance purchase on the horizon. Opening and using the card for these expenses can fast-track your progress toward earning the offer.

- Move recurring bills or subscriptions: Until you meet the spending requirement, shift payments for streaming subscriptions, utilities and wireless bills to the card.

- Prepay expenses: If your cash flow allows, paying some bills in advance or shopping early for holiday and birthday gifts could prove useful.

- Offer to pay for others: Group meals and events can be a jackpot; offer to put a big bill on your card and have others reimburse you with cash or via Venmo.

- Add authorized users: You can add up to five authorized users to your Amex Gold account at no charge, and their purchases count toward the minimum threshold. Only add people you trust, as any spending they make is your responsibility.

What you want to avoid is spending more than you normally would just to meet the requirement. The trick is to shift your regular purchases to the card — again, an average of $1,000 a month over six months — rather than buying unnecessary stuff.

What Counts (and Doesn’t Count) Toward the Welcome Offer

Generally, most everyday purchases of goods and services count toward the spending requirement for the welcome offer. However, in the terms and conditions, Amex says it excludes:

- Fees and interest charges

- Purchases of traveler’s checks

- Purchases or reloading of prepaid cards

- Purchases of gift cards

- Person-to-person payments

- Purchases of other cash equivalents (including cash advances)

When in doubt, assume anything cash-like won’t qualify. Keep an eye on returns/refunds as well, as those amounts will be deducted from your spending total.

Stacking Value After You Earn the Bonus Points

The welcome offer is just the starting point if you’re looking to squeeze the most value from your card. Layering ongoing perks and earning potential on top of the initial offer makes the Amex Gold well worth it, even with the annual fee.

Use Amex Gold Credits To Justify the Annual Fee

The Amex Gold comes with built-in credits that can significantly reduce the effective cost of holding the card, including:

- Up to $100 per year in Resy credits: Receive up to $50 from January to June, and up to $50 from July to December in statement credits toward purchases at U.S. Resy restaurants (enrollment required).

- Up to $120 per year in dining credits: Earn up to $10 in monthly statement credits toward purchases at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com and Five Guys (enrollment required).

- Up to $84 per year in Dunkin’ credits: Earn up to $7 per month in statement credits toward U.S. Dunkin’ purchases (enrollment required).

- Up to $120 per year in Uber Cash: When you add your card to your Uber account, you’ll get $10 in Uber Cash each month. To use Uber Cash, you must select an American Express card for the transaction, and the benefit only applies to U.S. Uber rides and Uber Eats orders.

Yes, it’s a fair bit to keep track of, and you’ll need to enroll (quick and easy through your online account) to activate each benefit. But it’s worth making the most of these perks, as they offer a total value of up to $424 per year — nearly $100 more than the annual fee. I treat these credits as prepaid value that shouldn’t be wasted, and set calendar reminders to ensure I don’t forget to use them.

Pairing the Amex Gold With Other Cards

Many cardholders, including me, further maximize value by pairing the Amex Gold with other cards in the Amex ecosystem, as well as cards from other banks.

For example, I also have the premium American Express Platinum Card®, an advertising partner, which offers extensive travel perks, including airport lounge access, credits for airline incidental fees, eligible hotel stays booked through Amex, and purchases with partner merchants. All Membership Rewards points earned on these cards pool together, making it easier to build a substantial balance for award flights and stays.

You might also consider using the card for groceries and dining to take advantage of bonus points on those purchases, then using a card that earns a flat, high rewards rate for non-bonused spending. I do this by pairing my Amex Gold with the Capital One Venture X Rewards Credit Card, which earns 2x Capital One miles on purchases (except hotels and rental cars booked through Capital One Travel, which earn 10x miles, and flights and vacation rentals booked through the same platform, which earn 5x miles).

Common Mistakes That Can Cost You the Welcome Offer

Applying When You’re Not Eligible

Amex enforces a one-bonus-per-lifetime rule on most cards, and the Amex Gold is no exception. Additionally, you may not be eligible for the welcome offer if you have or have had any personal version of the Amex Platinum. American Express will also review your history of opening and closing cards and any previous balance transfers when considering your application.

On the upside, Amex’s “Apply With Confidence” feature allows you to see if you’re approved for the card without a hard credit inquiry (sometimes called a “hard pull”), which can negatively impact your credit score. Here’s how it works:

- Submit your application for the card

- Amex will let you know if you’re approved (and, in the case of the Amex Gold, what welcome offer you qualify for)

- You decide whether or not to accept the offer

If you’re approved and you accept, Amex may perform a hard credit pull. The key here is that the pull doesn’t happen until you know you’ve been approved, so applying is risk-free.

You may have heard the term “pop-up jail,” where Amex warns you that you’re not eligible for the offer before you finalize your application. Seeing that pop-up warning means you shouldn’t proceed.

Missing the Spending Deadline

Spending $6,000 on purchases in six months seems straightforward enough. However, you’ll want to pay close attention to detail here, as there are pitfalls that can easily derail your success if you’re not careful:

- Note when the clock starts: Your six-month window begins on the day you’re approved for the card, not when you receive it in the mail or make your first purchase. It can take a week or two for your card to arrive, so factor this into your spending plan.

- Monitor your progress: Keep an eye on your spending totals, particularly as the six-month deadline approaches.

- Don’t leave spending until the last minute: Purchases must post to your statement, not just be made, before the deadline. Be especially mindful of online purchases, as they may not post until the item ships. Leaving spending until the final days can backfire if transactions are delayed.

- Give yourself a buffer: Aim to exceed the minimum spending requirement, not meet it exactly. This gives you wiggle room in case you need to return an item or if a purchase doesn’t post to your statement immediately.

Not Having Enough Organic Expenses

We’ve mentioned this before, but it bears repeating: Don’t overspend just to earn the welcome offer. If your regular expenses aren’t sufficient to hit the $6,000 spend requirement in the allotted time, you might be tempted to buy things you can’t afford. No bonus is worth going into unnecessary debt.

Is the Amex Gold Welcome Offer Worth It?

The Amex Gold Card welcome offer is worth it for the right cardholder, but it’s not a good fit for everyone.

Best for These Types of Cardholders

- Heavy grocery and dining spenders

- Travelers who can use Amex transfer partners strategically

- Consumers who will actively use the monthly credits

When Another Card Might Be Better

- Low spenders who may miss the bonus

- People who prefer simple cash back

- Anyone unlikely to use dining credits and/or Uber Cash

If the welcome offer excites you but the ongoing perks don’t fit your lifestyle, or if you’re unwilling to pay the $325 annual fee upfront, another card may offer better long-term value.

A no-annual-fee travel credit card can be an affordable choice, although these cards typically offer fewer benefits. Alternatively, several less-expensive travel credit cards offer competitive welcome offers and meaningful perks, with annual fees under $100. These include:

- Chase Sapphire Preferred® Card ($95 annual fee): Earn 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening. Read our guide to Chase Sapphire Preferred Card benefits.

- Capital One Venture Rewards Credit Card ($95 annual fee): LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel. Read our guide to Capital One Venture Card benefits.

- Citi Strata Premier® Card (an advertising partner, $95 annual fee): Earn 60,000 bonus ThankYou® Points after spending $4,000 in the first 3 months of account opening, redeemable for $600 in gift cards or travel rewards at thankyou.com. Read our guide to Citi Strata Premier Card benefits.

- Wells Fargo Autograph Journey℠ Card ($95 annual fee): Earn 60,000 bonus points when you spend $4,000 in purchases in the first 3 months – that’s $600 toward your next trip. Read our guide to Wells Fargo Autograph Journey Card benefits.

- Bank of America® Premium Rewards® credit card ($95 annual fee): Receive 60,000 online bonus points – a $600 value – after you make at least $4,000 in purchases in the first 90 days of account opening. Read our guide to Bank of America Premium Rewards credit card benefits.

The Amex Gold welcome offer can be a powerful entry point into the Membership Rewards ecosystem, especially if you plan ahead and stack value beyond the initial influx of bonus points. Read our Amex Gold review for a closer look at everything the card has to offer.

Frequently Asked Questions About the Amex Gold’s Welcome Offer

How much is the Amex Gold welcome offer worth?

The value of the Amex Gold welcome offer depends on how you redeem your points. Many cardholders get hundreds of dollars in value, with significantly more possible through travel redemptions.

Can I get the Amex Gold welcome offer if I’ve had another Amex card?

Yes, you can get the Amex Gold if you have other American Express cards, with some eligibility restrictions. You typically won’t qualify if you’ve had the card before, and may not be eligible if you have or had a version of the Amex Platinum.

What is Amex pop-up jail?

Amex’s “pop-up jail” is a warning Amex shows during the application process, indicating you’re not eligible for the welcome offer. If you see it, you won’t receive the bonus points if you proceed.

Do purchases by authorized users count toward the welcome offer’s minimum spend requirement?

Yes, eligible spending by Amex Gold authorized users counts toward the primary cardholder’s minimum spending requirement.

When do Amex Gold bonus points post to my account?

Bonus points from the Amex Gold welcome offer usually post shortly after you meet the spending requirement, often following the statement closing date at which you cross the threshold.