American Express Transfer Partners: Travel to Just About Anywhere on the Cheap

If the goal is inexpensive airfare and hotel stays, few credit card point currencies are more valuable than American Express Membership Rewards®. Amex transfer partners can help you get to just about anywhere in the world for pennies on the dollar.

400+ Credit Cards

Analyzed independently across 50+ data points in 30+ product categories

Reviewed

By a team of credit card experts with an average of 9+ years of experience

Trusted by

More than one million monthly readers seeking unbiased credit card guidance

CardCritics™ editorial team is dedicated to providing unbiased credit card reviews, advice and comprehensive comparisons. Our team of credit card experts uses rigorous data-driven methodologies to evaluate every card feature, fee structure and rewards program. In most instances, our experts are longtime members or holders of the very programs and cards they review, so they have firsthand experience maximizing them. We maintain complete editorial independence — our ratings and recommendations are never influenced by advertiser relationships or affiliate partnerships. You can learn more about our editorial standards, transparent review process and how we make money to understand how we help you make informed financial decisions.

Here’s everything you need to know about Amex travel partners — and how to earn the points you need from the best travel credit cards.

American Express Membership Rewards Transfer Partners

Here’s a look at the current Amex transfer partners — along with each program’s transfer ratio and minimum transfer requirement.

| Loyalty Program | Transfer Ratio | Minimum Transfer Amount |

| Aer Lingus AerClub | 1:1 | 1,000 points |

| Aeromexico Rewards | 1:1.6 | 1,000 points |

| Air Canada Aeroplan | 1:1 | 1,000 points |

| Air France-KLM Flying Blue | 1:1 | 1,000 points |

| ANA Mileage Club | 1:1 | 1,000 points |

| Avianca Lifemiles | 1:1 | 1,000 points |

| Cathay Pacific | 1:1 | 1,000 points |

| Choice Privileges | 1:1 | 1,000 points |

| Delta SkyMiles | 1:1 | 1,000 points |

| Emirates Skywards | 1:0.8 | 1,000 points |

| Etihad Guest | 1:1 | 1,000 points |

| Hilton Honors | 1:2 | 1,000 points |

| Iberia Plus | 1:1 | 1,000 points |

| JetBlue TrueBlue | 5:4 | 250 points |

| Marriott Bonvoy | 1:1 | 1,000 points |

| Qantas Frequent Flyer | 1:1 | 500 points |

| Qatar Airways Privilege Club | 1:1 | 1,000 points |

| Singapore Airlines KrisFlyer | 1:1 | 1,000 points |

| The British Airways Club | 1:1 | 1,000 points |

| Virgin Atlantic Flying Club | 1:1 | 1,000 points |

How To Earn Amex Membership Rewards

Earning Membership Rewards isn’t difficult, thanks to the abundance of American Express cards (an advertising partner) that earn these points at high return rates for everyday purchases. Depending on the card, you can receive up to 4 points per dollar at restaurants and grocery stores, 5 points per dollar on travel, 3 points per dollar on transit, and much more.

Another easy way to earn points is by referring friends and family members to your cards. Depending on the card, you may receive 25,000 points per referral (or more).

American Express also partners with popular online shopping portal Rakuten, giving you the option to earn Amex points instead of cash back on eligible purchases.

Cards That Earn Amex Membership Rewards

Below are the American Express cards that earn Amex Membership Rewards points. It’s worth noting that American Express typically only allows you to earn each bonus once per lifetime:

- American Express Platinum Card®: (an advertising partner) $895 annual fee

- The Business Platinum Card® from American Express: $895 annual fee

- American Express® Gold Card: (an advertising partner) $325 annual fee

- American Express® Business Gold Card: $375 annual fee

- American Express® Green Card**: $150 annual fee

- American Express® Business Green Rewards Card: $95 annual fee

- The Blue Business® Plus Credit Card from American Express: No annual fee

You can also apply for additional flavors of the Amex Platinum, such as The Platinum Card® from American Express Exclusively for Charles Schwab and The Platinum Card® from American Express Exclusively for Morgan Stanley. And the invite-only Centurion® Card from American Express** earns Amex points, too.

The information related to The Business Platinum Card® from American Express, American Express® Business Gold Card, American Express® Green Card**, American Express® Business Green Rewards Card and The Blue Business® Plus Credit Card from American Express and Centurion® Card from American Express** was collected by CardCritics™ and has not been reviewed or provided by the issuer of this product/card. Product details may vary. Please see issuer website for current information. CardCritics™ does not receive a commission for these products.

How To Transfer American Express Membership Rewards to Partners

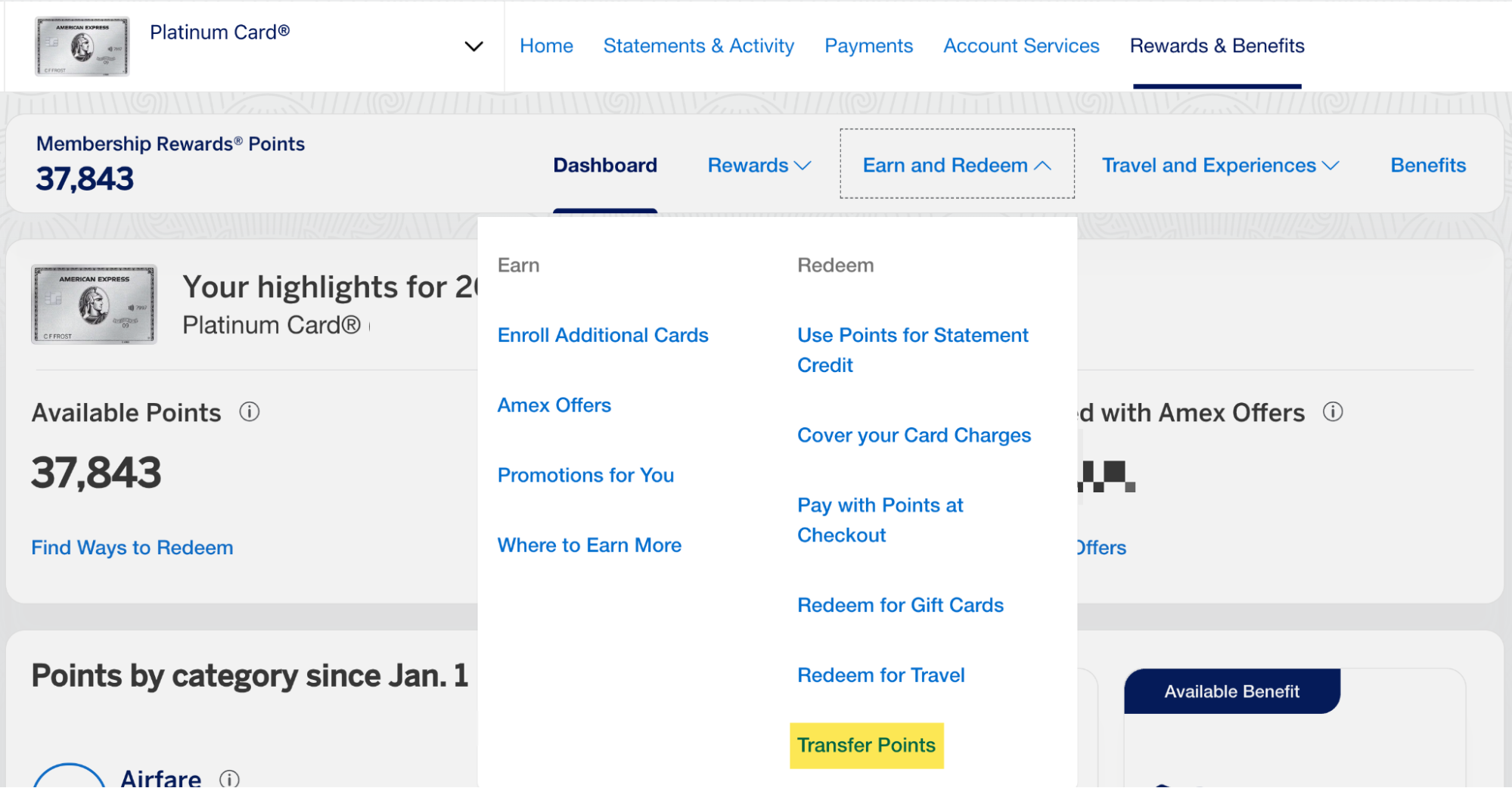

Converting your Amex points to airline and hotel partners is a snap. Simply log into your Membership Rewards-earning account and find the “Rewards & Benefits” tab near the top of the page.

You’ll then be taken to a dashboard that displays your current rewards balance along with a litany of redemption options. Within the “Earn and Redeem” drop-down menu, you’ll find a “Transfer Points” button. Click it to be taken to a page with all American Express transfer partners.

The first time you transfer points, you’ll need to link your airline or hotel loyalty account number to your Amex account. If you don’t have one yet, don’t worry — it’s free to enroll in a loyalty program, and it only takes a minute or two.

Once your accounts are linked, enter the number of points you’d like to convert and formally request a transfer. Amex will require multi-stage authentication (enter an emailed temporary passcode, input the three-digit CID number on the back of your Membership Rewards-earning card, etc.). Transfers are often instant, though Amex states that it could take up to four days in some cases for your points to appear in your travel account.

Important: Amex points transfers are a one-way street. Once you convert your rewards into airline miles or hotel points, you can’t change your mind and transfer them back.

How To Maximize Amex Membership Rewards

The best way to maximize your Amex points is typically for airfare. It’s possible to find great value for hotel stays, as well, but converting points into airline miles most often provides the highest return per point. Here are some examples of what you can do with Amex points:

- Book a lie-flat seat to Europe: It’s not difficult to find business-class seats (the ones that convert into a flat bed) across the Atlantic for as little as 60,000 points plus nominal taxes. For example, you could transfer 60,000 points to Air Canada Aeroplan for a one-way premium seat between New York (JFK) and Geneva (GVA) for a total out-of-pocket of 78 Canadian dollars. This seat otherwise costs over $3,300.

- Visit Hawaii in United Airlines economy: Flights to Hawaii are a great deal when transferring Amex points to Singapore Airlines. As an example, you can fly from Washington, D.C. (IAD) to Honolulu (HNL) for just 20,500 miles, flying on Singapore Airlines partner United Airlines.

- Book first-class travel to Japan: Convert your points into ANA miles, and you can fly from the U.S. to Japan in some of the most luxurious seats in existence. For example, a first-class ANA seat from Chicago (ORD) to Tokyo (NRT) costs 75,000 miles and $178 in taxes and fees in the low season. That same flight sells for over $14,000 in cash.

- Convert rewards into Hilton Honors points during a lucrative transfer bonus: The average value of Hilton points isn’t typically anywhere near the value of Amex points. But American Express intermittently offers transfer bonuses of 30% or more when transferring to Hilton. Because the standard transfer rate is 1:2, that means you’ll get 2.6 Hilton points (or more) per Amex point — which could be a good deal.

Is It Worth Transferring Points to Amex Transfer Partners?

As long as you’re willing to learn a bit about award charts and loyalty program sweet spots, it’s well worth transferring Amex points to partners. Outside of points transfers, for instance, the highest value you’ll get per Amex point is 1 cent (and that’s only for flights or Fine Hotels and Resorts bookings through American Express Travel®). Otherwise, you’ll get a value of even less than that — for example, redemptions for statement credits are at 0.6 cents per point.

The trick is to be strategic with your transfers and only redeem points this way when you can get a higher value. If paid airfare is cheap, you might want to redeem points for the flight through Amex Travel® instead of transferring to a partner. It’s best to compare options to make sure you’re getting the best deal.

You’ll also want to consider rewards from other transferable points programs, if you have them. Chase Ultimate Rewards®, for example, has a very different set of partners that might suit your travel goals better.

Frequently Asked Questions About Amex Transfer Partners

How many Amex transfer partners are there?

There are currently 20 Amex transfer partners — 17 airlines and three hotels.

Do Amex transfer partners ever offer transfer bonuses?

Amex transfer partners routinely offer transfer bonuses with popular partners like Air Canada Aeroplan, Hilton Honors, The British Airways Club and more. Sometimes, an Amex transfer partner will offer the transfer bonus instead of American Express, but it’s a rarity.

Are there any fees for transferring Amex points to partners?

There are small fees for transferring Amex points to domestic airline partners, such as Delta and JetBlue. You’ll pay $0.0006 per point, up to $99.

How long do Amex points transfers take?

Amex points transfers are often immediate. In most cases, you should find your airline miles and hotel points in your loyalty account within minutes of initiating the transfer. However, some partners may take hours or even days.

Should I transfer Amex points to partners or book travel directly through Amex?

When you redeem Amex points through Amex Travel, you’ll receive (at best) a value of 1 cent per point. Transferring points to partners will often give you a superior value per point. However, if you prefer simplicity (or if you can’t find award seats for the flight you want) it could be worth booking via Amex Travel.