You Can Earn $1,092 Cash Back Your First Year

Rack up 5% cash back on everyday purchases at different places each quarter up to the quarterly maximum when you activate & have your cash back matched your first year!

Apply NowWho doesn’t want more cash? There’s no doubt about it: If you’re not using turning your everyday expenses into more cash back, you’re missing out.

How do you do that? With the Discover it® Cash Back card. This card offers generous rewards and one of the most unique cash back opportunities we’ve seen: Whatever cash back you earn in the first year, Discover will double it. That’s right, double! That means the average spender can earn an incredible $1,092.72 cash back in the first year.

Incredible Cash Back Opportunities

The Discover it® Cash Back card allows you to earn 1% cash back on all purchases, unlimited by category or earning caps. Plus, each quarter there will be specific categories in which you’ll earn 5% cash back on up to $1,500 in purchases. After hitting the maximum, you keep earning the usual 1%. Past 5% Cashback Bonus® opportunities have included categories like Restaurants and Wholesale Clubs, and major online stores like Target, and Walmart. You do have to remember to activate your rewards for the quarterly cash back opportunities, but Discover makes it very easy to activate.

The unlimited 1% cash back and quarterly 5% cash back provide the best of both worlds between cards that let you earn a small amount on everything, and those that let you earn a larger amount on specific purchases. These rewards never expire, and the card has no annual fee to eat up your earnings.

Unlimited Cashback Match® Your First Year

Discover it® Cash Back card has one of the most attractive bonuses in the business: whatever cash back you earn in your first year, Discover will double it. There are no minimums or maximums to how much they’ll match.

Simple Rewards System

This card is all about ease of use. From 1% cash back on everything with no need to opt in or activate, to cutting out annual fees, to the way rewards work, Discover keeps it simple. You don’t earn points, you earn money: $1 earned is $1 you can spend later. You can redeem any amount of your rewards at any time, as statement credit, or a bank account deposit.

0% Intro APR

For your first 15 months, you get a 0% Intro APR on purchases and balance transfers, followed by 17.74% - 26.74% Variable APR *Rates as of December 15, 2025. There is an intro balance transfer fee of 3% that goes up to 5% on future balance transfers (see terms), which is more than worth it if you’re looking to transfer a large balance currently charging interest.

Discover it® Cash Back

Earn 1% Unlimited Cash Back On All Other Purchases – Automatically

How to Get $1092.72 Back Your First Year

As long as you are maxing out your 5% category bonuses and putting as many of your other chargeable expenses on your card each month, you can easily earn over $1,000 cash back in your first year of card membership.

Once activated, the 5% quarterly categories alone will bank you $600 cash back since you’ll earn $300 back from $6,000 spent in qualifying categories ($1,500 each quarter), plus an additional $300 with the end-of-year cashback match.

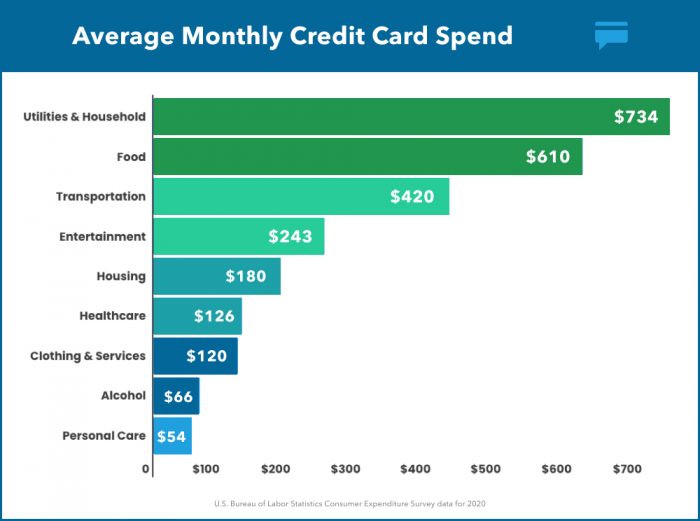

You can also earn an estimated $492.72 in year one from all other credit card spending that will qualify for the 1% rewards rate between your housing, transportation, entertainment, food purchases and more. These monthly expenditures were estimated based on the Bureau of Labor Statistics 2021 Consumer Expenditures Report, but will vary from person to person and you may be able to earn far more cash back if your spending is higher than the average person.

Bottom Line

The Discover it® Cash Back card is a fantastic option if you are looking for a credit card that offers rewards in the form of cash back, as well as low introductory APR rates. If you’re considering a decent intro APR on both purchases and balance transfers, look no further than the Discover it® Cash Back card and start maxing out your first year rewards right away.

Other Card Options

We think the Discover it® Cash Back card is tough to beat but we have rounded up some other options from our partners that may appeal to you as well.

Generous Bonus & Intro APR

Apply Now

Apply Now

Bank of America® Travel Rewards credit card

If you prefer a $0 annual fee card that will help you earn points towards travel and dining purchases then this card is likely your top option. With the Bank of America® Travel Rewards credit card you will earn a straightforward, unlimited 1.5 points per $1 spent on all purchases. You can also earn 25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening. These bonus points can be redeemed for a $250 statement credit toward travel and dining purchases. Unlike most travel cards this option also offers a generous intro APR. Select ‘Apply Now’ to see the current offer terms.

Earn Unlimited 2% Cash Rewards Plus A Bonus

Wells Fargo Active Cash® Card

If you are more interested in a flat rate cash rewards card then this card from Wells Fargo is an exciting option that also has a $0 annual fee. You can earn an unlimited 2% cash rewards on purchases which means there are no activation requirements for special categories or monthly caps to worry about. Earning 2% rewards on your purchases is tough to beat making it a stand out option for anyone looking for a low maintenance cash rewards card that will allow you to accumulate cash rewards really quickly. There is also a welcome bonus worth $200 in cash rewards that can be earned by spending at least $500 in purchases in the first three months after you are approved. It also offers a 0% intro APR for 12 months from account opening on purchases and on qualifying balance transfers, then a 18.49%, 24.49%, or 28.49% Variable APR.

As you can see, it is a great time to be in the market for a new credit card. Issuers are really stepping up their game and offering incredible perks to win your business. If you have good to excellent credit in the 670 – 850* range and have not recently applied for a new credit card then you should definitely apply for one of these stand out options today.

Editorial Note: Any opinions, analyses, reviews or recommendations expressed are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer.

*CardCritics™ references a FICO® 8 score, which is one of many different types of credit scores. A financial institution may use a different score when evaluating your application.