Does Freezing Your Credit Mean You Can’t Use Your Credit Card?

Identity theft and credit card fraud are on the rise as scammers find new ways to access your data. Using strong online passwords and monitoring your accounts and credit reports for unusual activity can help safeguard your personal information. And you can take additional steps to prevent fraud by freezing your credit.

Putting a freeze on your credit means third parties can’t access your credit reports for the purpose of issuing you new credit. This prevents criminals from opening new accounts in your name, because banks and other lenders typically won’t let you borrow money without viewing your reports. You might consider a credit freeze if your information was leaked in a data breach or if you think someone’s trying to steal your identity, for instance.

But does freezing your credit mean you can’t use your credit card? In short, no — you can still use your credit cards with frozen credit reports. That said, you can take separate actions to prevent unauthorized use of your cards.

How a Credit Freeze Works

When you apply for a credit card, mortgage or other loan, the lender will usually request to view one or more of your credit reports. This allows them to assess your creditworthiness — that is, the likelihood you’ll pay back what you borrow — by looking at factors such as your payment history, overall debt, and how long you’ve been using credit.

Sometimes called a security freeze, a credit freeze will block lenders from seeing your report from the main credit bureaus (Equifax, Experian and TransUnion). When your credit is frozen, you won’t be able to open new lines of credit — but neither will a fraudster trying to borrow money using your identity. Freezing your credit is free, but you’ll have to request a freeze from each credit bureau separately.

While a credit freeze prevents lenders from viewing your reports to give you new credit, other parties may still have access to your reports, including:

- Yourself: You’ll still be able to view your credit reports from all three bureaus once per week at no cost.

- Companies that monitor your credit or provide your credit score: This includes free and paid credit monitoring services from banks and other companies.

- Government agencies and courts: In certain circumstances, such as child support proceedings, these entities may view your reports.

- Potential employers, insurers and landlords: Your reports may be requested as part of a background check when you apply for a job, insurance or rental housing.

- Identity protection services: These and other organizations that investigate or prevent fraud may still see your credit reports.

- Collection agencies: If you have unpaid bills, a collection agency may request your reports on behalf of the creditor.

- Lenders you already have a relationship with: For example, if you have a Chase credit card and request a credit limit increase, the bank may view your reports to decide whether or not to approve the higher limit.

- Pre-screened offers from insurance companies and card issuers: This could include pre-approved credit card mailers or offers for new insurance.

After you’ve frozen your credit, you can unfreeze or “thaw” it at any time.

The Impact of Freezing Your Credit on Credit Cards

Freezing your credit does not affect your ability to use your credit cards. You can use your credit cards as usual with frozen credit, but what changes is your ability to apply for new credit (including cards). If you were to apply for a new credit card with your credit reports frozen, your application would be denied (unless the card application specifically states it doesn’t require a credit check, which is rare).

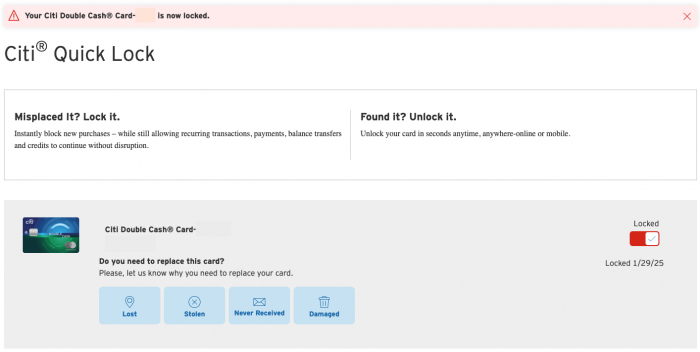

The terminology might seem confusing because some card issuers allow you to “freeze” an individual card account to prevent it from being used. This is often called a card lock, and it’s helpful if you’ve lost your card or suspect it’s been stolen.

For example, if you’ve misplaced your Citi credit card, you can access a Quick Lock feature in the credit card services section of your online account. This lets you lock or unlock your card instantly with a toggle button.

Freezing Your Credit vs. Fraud Alerts

You might not want to completely freeze your credit if you think you’ll be applying for new credit in the future and don’t want the hassle of unfreezing and freezing your credit repeatedly with all three bureaus. Because a credit freeze blocks access to your credit reports, you (or anyone else) won’t be able to get new credit while the freeze is in place.

Another option called a fraud alert, can let credit bureaus know to verify your identity before approving you for new credit. It essentially requires lenders to take extra steps and make sure you are who you say you are before letting you borrow money.

You might choose to set a fraud alert if your identity has been stolen or you’ve previously been a victim of fraud. Several different fraud alert options exist, and all are free:

- Initial fraud alert: This lasts for one year but can be renewed, and you can use it even if you don’t have a documented case of identity theft.

- Extended fraud alert: If your identity has been stolen and you’ve filed a police report or an FTC identity theft report at identitytheft.gov, you can set this type of alert, which lasts for seven years. This type of alert gets you removed from credit bureau marketing lists for unsolicited credit and insurance offers for five years (unless you ask to stay signed on).

- Active duty alert: Active duty military who might not be able to monitor their credit regularly can use this alert for one year (with the option to extend for the length of their deployment). This also removes you from credit card marketing lists for two years.

A fraud alert won’t completely prevent someone from opening new accounts in your name, but it certainly makes it more difficult. As an added benefit, once you set a fraud alert with one bureau, it will notify the other bureaus to do the same — you won’t have to notify each bureau individually. However, if you choose to remove a fraud alert, you’ll have to let each bureau know separately, and you’ll have to be mindful of the expiration date of the alert you set.

Reasons to Freeze Your Credit

Suspected or actual identity theft is the main reason to freeze your credit. However, even if you don’t think you’ve been the victim of identity theft, you may choose to freeze your credit as a preventative measure.

For example, you may have been notified that your information was accessed by bad actors in a data breach. Or you might think you’re vulnerable to fraudsters because of your line of work or other personal circumstances.

Freezing your credit is probably not necessary outside of these situations, but if you’re extra cautious about protecting your identity and finances, a credit freeze can give you peace of mind by offering control over who can see your credit reports.

How to Freeze Your Credit: A Step-by-Step Guide

You’ll need to freeze your credit separately with each credit bureau, but it’s not that difficult. The easiest method is to set up online accounts with Equifax, Experian, and TransUnion, then request a freeze. You can also call the bureau or ask for a freeze by mail.

When you freeze your credit report online or by phone, the credit bureau is required to implement the freeze within one business day. Mail takes longer — three days after the request is received — so if your situation is urgent, it’s better to go online or call.

Here’s how to contact each credit bureau to freeze your credit or set a fraud alert:

| Online | By Phone | By Mail | |

| Equifax | Equifax Credit Freeze Equifax Fraud Alert | 888-298-0045 | Equifax Info Services LLC P.O. Box 105788 Atlanta, GA 30348-5788 |

| Experian | Experian Credit Freeze Experian Fraud Alert | 888-397-3742 | Experian Security Freeze P.O. Box 9554 Allen, TX 75013 |

| TransUnion | TransUnion Credit Freeze TransUnion Fraud Alert | 800-916-8800 | TransUnion P.O. Box 160 Woodlyn, PA 19094 |

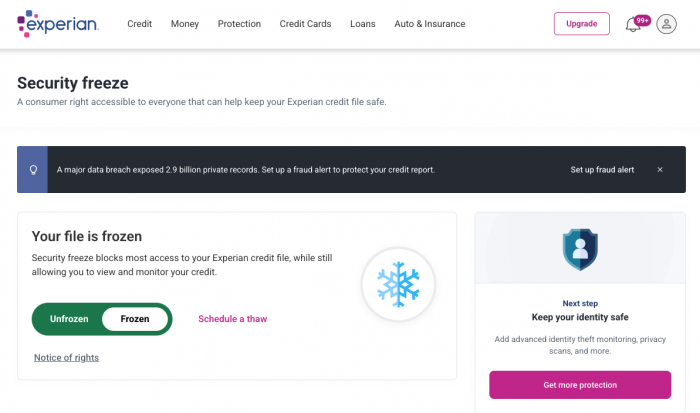

When you contact each credit bureau, you’ll be asked for information to verify your identity. For example, if you’re registering for an Experian account for the first time, you’ll need to provide the last four digits of your Social Security number and a cell phone number for verification. Experian will send you a text message with a link to click to continue the process of creating your account.

You’ll then be asked for additional details, such as your address and date of birth. Once you’re verified, freezing (and thawing) your credit report is as simple as clicking on a toggle button when you’re logged in to the Experian credit freeze page.

Be sure to record your login details and password/PIN from each bureau so that you can easily freeze and thaw your credit report as needed. You’ll also want to be on the lookout for confirmation from each credit bureau that your report has been frozen — they’re required to send you this within five business days of freezing your credit.

How to Lift or Temporarily Thaw a Credit Freeze

Thawing your credit simply means lifting a credit freeze from your account. When you thaw your credit, lenders can access your credit reports again to decide if they want to give you new credit.

You might want to thaw your credit temporarily. For example, if you know you’ll be applying for a mortgage in the next few weeks, you can set your Experian credit report to be unfrozen between certain dates.

To unfreeze your credit, log into your online account with each bureau (or contact them by phone or mail, as described above). The timelines for lifting a freeze are different. If you want to thaw your credit, bureaus must do so within one hour if you contact them online or by phone, or within three business days if you do so by mail.

Pros and Cons of Freezing Your Credit

Freezing your credit restricts who sees your credit report. However, you’ll want to weigh the pros and cons of a credit score freeze to decide if it’s the best strategy for you.

Advantages of freezing your credit:

- Protection from fraud: When your credit is frozen, it’s much less likely that someone can borrow money in your name.

- Easy on-and-off: You can freeze or unfreeze your credit at any time and at no cost.

- Battling identity theft: If your identity has already been compromised, taking control over who can view your credit reports can insulate you from further damage.

Disadvantages of freezing your credit:

- Mental bandwidth: Setting up and managing credit freezes takes effort and organization. It can be inconvenient to freeze and thaw your credit repeatedly.

- No new credit applications: When your credit is frozen, you won’t be able to apply for new credit. Even minor things like getting a promotional cell phone payment plan or applying for a pre-approved credit card offer could be affected.

- Delays: You might not be able to access new credit when you immediately need it, because thawing your credit isn’t instant.

For those who are anxious about identity theft and fraud but aren’t ready to commit to freezing their credit on their own, there’s a middle ground. Credit monitoring and identity theft protection services can handle much of the legwork for you. However, these services often charge fees.

Common Misconceptions About Credit Freezes

You might be wondering — does freezing your credit affect your credit score? It does not. Your credit score is calculated based on your record of on-time payments, amounts owed across all lenders, length of credit history, recent credit inquiries and the types of credit you have. A credit freeze doesn’t impact any of these factors. It just stops lenders from seeing this information.

And yes, you can still use your credit cards while your credit is frozen! Don’t confuse a credit freeze with a lock on your credit card. These are two totally different things.

Finally, be aware that a credit freeze doesn’t stop all forms of identity theft. Someone could still steal your identity and use it to get a driver’s license or apply for social assistance. Freezing your credit only stops you (and others) from borrowing money in your name.

FAQs About Freezing Your Credit and Credit Card Use

Can I still use my debit card during a credit freeze?

Yes, you can absolutely use your debit card when your credit is frozen.

Will freezing my credit stop me from renting an apartment?

Depending on what information your potential landlord wants to access, a credit freeze may be a sticking point. If the landlord wants to view your full credit report, you might consider thawing your credit to allow them to do so.

Do I need to freeze my credit with all three bureaus?

You don’t have to freeze your credit with all three credit bureaus, but it’s a good idea if you want the best protection against fraud. Lenders may ask any of the bureaus for your credit report, and some might request two or three reports.

How long does a credit freeze last?

A credit freeze lasts until you tell the credit bureau to lift it.

Can I freeze my credit if I’m not a victim of fraud?

Yes, you can freeze your credit at any time whether or not you’re a victim of fraud or identity theft.