Citi Transfer Partners: Maximize Your ThankYou Points

Citi credit cards that earn ThankYou® points offer a variety of ways to redeem your rewards, including for cash back, travel booked through Citi and gift cards. But you may get an even higher value for your rewards when you transfer points to Citi’s airline and hotel partners.

400+ Credit Cards

Analyzed independently across 50+ data points in 30+ product categories

Reviewed

By a team of credit card experts with an average of 9+ years of experience

Trusted by

More than one million monthly readers seeking unbiased credit card guidance

CardCritics™ editorial team is dedicated to providing unbiased credit card reviews, advice and comprehensive comparisons. Our team of credit card experts uses rigorous data-driven methodologies to evaluate every card feature, fee structure and rewards program. In most instances, our experts are longtime members or holders of the very programs and cards they review, so they have firsthand experience maximizing them. We maintain complete editorial independence — our ratings and recommendations are never influenced by advertiser relationships or affiliate partnerships. You can learn more about our editorial standards, transparent review process and how we make money to understand how we help you make informed financial decisions.

While some Citi transfer partners are lesser-known, there are plenty of familiar programs in the mix, including American Airlines AAdvantage, JetBlue TrueBlue, Avianca LifeMiles, Air France-KLM Flying Blue and Wyndham Rewards. Transferring Citi ThankYou points to partners is easy to do through your online account, but transfer ratios vary depending on the card you have.

Let’s take a closer look at how to transfer ThankYou points to Citi travel partners and maximize your credit card rewards.

Citi ThankYou Transfer Partners

Citi has more than a dozen airline and hotel partners covering nearly every corner of the globe. It also partners with Shop Your Way, a retail rewards program.

Citi’s newest partner is American Airlines AAdvantage, which represents a big improvement for the program. Previously, Citi’s only domestic airline partner was JetBlue, so the addition of a large legacy US airline opens up broader coverage around the country. A few partners are unusual, including Leading Hotels of the World Leaders Club, Thai Airways and ALL Accor Live Limitless.

Here’s the full list of Citi transfer partners:

| Loyalty Program | Transfer Ratio | Minimum Transfer Amount |

| ALL Accor Live Limitless | 1:0.5 or 1:0.35, depending on the card | 1,000 points |

| Air France-KLM Flying Blue | 1:1 or 1:0.7, depending on the card | 1,000 points |

| American Airlines AAdvantage | 1:1 or 1:0.7, depending on the card | 1,000 points |

| Avianca LifeMiles | 1:1 or 1:0.7, depending on the card | 1,000 points |

| Cathay Pacific | 1:1 or 1:0.7, depending on the card | 1,000 points |

| Choice Privileges | 1:2 or 1:1.4, depending on card | 1,000 points |

| Emirates Skywards | 1:0.8 or 1:0.56, depending on the card | 1,000 points |

| Etihad Guest | 1:1 or 1:0.7, depending on the card | 1,000 points |

| EVA Air Infinity MileageLands | 1:1 or 1:0.7, depending on the card | 1,000 points |

| JetBlue TrueBlue | 1:1 or 1:0.7, depending on the card | 1,000 points |

| Leading Hotels of the World Leaders Club | 1:0.2 or 1:0.14, depending on the card | 1,000 points |

| Preferred Hotels & Resorts I Prefer Hotel Rewards | 1:4 or 1:2.8, depending on the card | 1,000 points |

| Qantas Frequent Flyer | 1:1 or 1:0.7, depending on the card | 1,000 points |

| Qatar Airways Privilege Club | 1:1 or 1:0.7, depending on the card | 1,000 points |

| Shop Your Way | 1:10 | 1 point |

| Singapore Airlines | 1:1 or 1:0.7, depending on the card | 1,000 points |

| Thai Royal Orchid Plus | 1:1 or 1:0.7, depending on the card | 1,000 points |

| Turkish Airlines Miles&Smiles | 1:1 or 1:0.7, depending on the card | 1,000 points |

| Virgin Atlantic Flying Club and Virgin Red | 1:1 or 1:0.7, depending on the card | 1,000 points |

| Wyndham Rewards | 1:1 or 1:0.7, depending on the card | 1,000 points |

My favorite Citi travel partners are Virgin Red, Air France-KLM Flying Blue and Preferred Hotels and Resorts I Prefer Rewards. I’ve transferred my points over to Preferred Hotels plenty of times to have some exceptional stays in Europe, saving me hundreds of euros.

Air France also offers great value during the off season on its own flights to and from Europe, allowing you to experience a great vacation for not a lot of points.

How To Earn Citi ThankYou Points

You can earn Citi ThankYou points from several Citi credit cards, but to get the best transfer ratios, you’ll need a card that charges an annual fee:

- Citi Strata Premier® Card (an advertising partner): $95 annual fee

- Citi Strata Elite℠ Card $595 annual fee

- Citi Prestige® Credit Card: No longer available to new applicants

- AT&T Access More: No longer available to new applicants (this card does not allow transfers to American Airlines AAdvantage)

The Strata Premier Card is great for earning lots of rewards on everyday spending, offering 10x points on hotels, car rentals and attractions booked through Citi Travel, and 3x points on air travel, other hotel purchases, restaurants, supermarkets, gas stations and EV charging stations. All other purchases earn 1 point per dollar.

Meanwhile, the recently launched Strata Elite is a premium credit card that offers elevated rewards rates and more perks, including airport lounge access and hundreds of dollars in annual statement credits.

With other Citi cards, you can access Citi’s partners, but at a poorer ratio. That can eat into the value of your rewards, so be sure to run the numbers to make sure a transfer is worth it versus other redemption options.

No-annual-fee Citi cards available to new applicants include:

- Citi Double Cash® Card (an advertising partner)

- Citi Strata℠ Card (an advertising partner)

- Citi Custom Cash® Card

- AT&T Points Plus® Card From Citi (this card does not allow transfers to American Airlines AAdvantage)

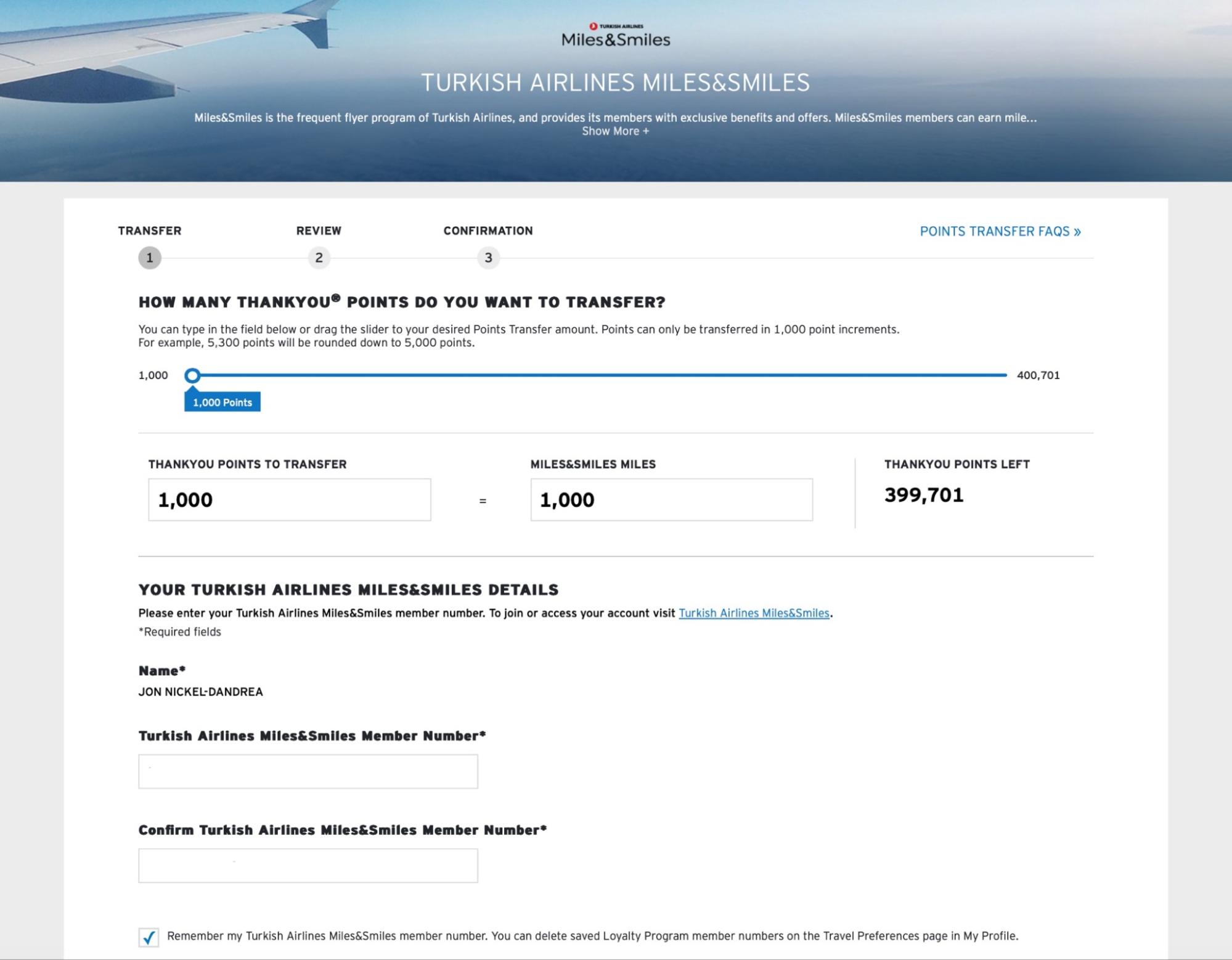

How To Transfer Citi Points to Partners

The easiest way to transfer Citi points to partners is by signing into ThankYou.com with your Citi login credentials. You can also make your way to the site from your main Citi online account.

Once you’re signed in, follow these steps:

- Hover over “Travel” in the dropdown menu: Then, select “Points Transfer.”

- View the list of available transfer partners: You’ll also see the transfer ratio for each partner. Click “Continue” next to the partner you want.

- Enter your frequent traveler details and number of points you want to transfer: If you don’t have a membership number for that loyalty program, you’ll be able to join the program directly. Then click “Continue.”

- Review and finalize the transfer: You’re given one final chance to review before submitting the transfer request.

Transfer times vary but are often instant. However, Citi says it can take up to 14 days for the points to get over to your account.

How To Maximize Citi ThankYou Points

With a limited range of credit cards that allow you to transfer Citi ThankYou points at the best ratios, it’s harder to get maximum value out of your rewards compared to programs like Chase Ultimate Rewards® and American Express Membership Rewards®. But, with a little legwork, you can stretch your points further with these tips:

- Combine ThankYou accounts: If you have multiple cards that earn Citi ThankYou points, you can pool your rewards into a single account. This is handy if you have the Strata Premier Card or Strata Elite and want to be able to transfer all of your points at the highest ratio.

- Wait for a transfer bonus: Occasionally, Citi offers transfer bonuses of 20% or more with select programs, giving you more miles or points for your ThankYou rewards.

- Book high-value hotel redemptions: Hotel award bookings can be very valuable at pricier locations. Wyndham Rewards, for instance, has three award price tiers for its hotels, and during peak times, cash prices can be quite high.

- Leverage airline partnerships: Many of Citi’s international partners, like Turkish Airlines and Air France-KLM, are part of airline alliances that allow you to redeem miles for flights on any alliance partner. For example, Turkish Airlines and United Airlines are part of the Star Alliance, so you can redeem Turkish miles for United award flights.

The information related to AT&T Points Plus® Card From Citi and Citi® / AAdvantage® Executive World Elite Mastercard® was collected by CardCritics™ and has not been reviewed or provided by the issuer of this product/card. Product details may vary. Please see issuer website for current information. CardCritics™ does not receive a commission for these products.

Frequently Asked Questions About Citi Travel Partners

How long do Citi transfers take to show in the partner’s account?

While Citi ThankYou points transfers can be instant, in my experience it sometimes takes 24 hours or more. Once I transferred to Turkish and it took four days for the miles to appear, so you may have to be patient. According to Citi, transfers can take up to 14 days.

Does Citi transfer to American Airlines?

Yes, you can transfer points to American Airlines with most Citi ThankYou points-earning credit cards. In addition, Citi issues several co-branded American Airlines AAdvantage credit cards, including the Citi® / AAdvantage® Platinum Select® World Elite Mastercard® and American Airlines AAdvantage® MileUp® Card (both advertising partners) and the Citi® / AAdvantage® Executive World Elite Mastercard®, a premium airline credit card.

Are Citi ThankYou points worth it?

Citi ThankYou points are worth it if you prefer earning flexible rewards to redeem for a nearly unlimited variety of travel experiences, along with other options like cash back and gift cards.

Can I transfer Citi points to a spouse or partner?

Yes, Citi offers a program called Points Sharing, where eligible cardholders can send points to someone else who has a ThankYou account. The catch is that those points are valid only for 90 days. Make sure you have a use in mind when you transfer those points over, or you might risk losing them.