Citi ThankYou Points: How To Earn, Redeem and Maximize Your Rewards

Citi ThankYou® points are the flexible rewards currency earned by several Citi credit cards, including the Citi Strata Elite℠ Card, Citi Strata Premier® Card, Citi Strata℠ Card and Citi Double Cash® Card, our advertising partners. You can choose to redeem your Citi ThankYou points in multiple ways, including for cash back, travel booked through the Citi Travel Portal and gift cards.

Citi points are popular with consumers because of their versatility and ease of earning. Most Citi cards that earn ThankYou points don’t charge an annual fee. Plus, you can transfer your points to Citi’s airline and hotel partners and can get even better value from your rewards this way.

How To Earn Citi ThankYou Points

You have numerous options for earning Citibank card rewards points, ranging from the $595-annual-fee Citi Strata Elite, a premium travel rewards card, to the beginner-friendly Citi Double Cash Card, one of the top cash-back credit cards on the market. Each offers a welcome bonus and an earning structure that can complement your spending habits by awarding bonus rewards in certain categories.

Here’s a quick look at what to expect with the Citi cards that are currently open to new applications:

| Card | Welcome Bonus | Earning Rate | Unique Feature |

| Citi Strata Elite℠ Card | For a limited time, earn 80,000 bonus Points after spending $4,000 in the first 3 months of account opening | Earn 12 Points per $1 spent on Hotels, Car Rentals, and Attractions booked on cititravel.com and 6 Points per $1 spent on Air Travel booked on cititravel.com Earn 6 Points per $1 spent at Restaurants including Restaurant Delivery Services on CitiNights℠ purchases, every Friday and Saturday from 6 PM to 6 AM ET. Earn 3 Points per $1 spent any other time Earn 1.5 Points per $1 spent on All Other Purchases | Airport lounge access |

| Citi Strata Premier® Card | Earn 60,000 bonus ThankYou® Points after spending $4,000 in the first 3 months of account opening, redeemable for $600 in gift cards or travel rewards at thankyou.com. | 10x on Hotels, Car Rentals, and Attractions booked through CitiTravel.com. Earn 3 Points per $1 spent on Air Travel and Other Hotel Purchases. Earn 3 Points per $1 spent on Restaurants. Earn 3 Points per $1 spent on Supermarkets. Earn 3 Points per $1 spent on Gas and EV Charging Stations. Earn 1 Point per $1 spent on All Other Purchases $100 Annual Hotel Benefit: Once per calendar year, enjoy $100 off a single hotel stay of $500 or more (excluding taxes and fees) when booked through CitiTravel.com. Benefit applied instantly at time of booking. Travel insurance protection: Trip Cancellation and Trip Interruption (Common Carrier), Trip Delay, Lost or Damaged Luggage, MasterRental Coverage (Car Rental). | Annual Citi Travel hotel credit |

| Citi Strata℠ Card | For a limited time, earn 30,000 bonus Points after spending $1,000 in the first 3 months of account opening. | Earn 3 ThankYou® Points for each $1 spent in an eligible Self-Select Category of your choice (Fitness Clubs, Select Streaming Services, Live Entertainment, Cosmetic Stores/Barber Shops/Hair Salons, or Pet Supply Stores). Choose your eligible Self-Select Category on Citi Online or by calling customer service. The default Self-Select Category is Select Streaming Services. Earn 5 ThankYou® Points for each $1 spent on Hotels, Car Rentals and Attractions booked on Citi Travel® via cititravel.com; earn 3 ThankYou Points for each $1 spent at Supermarkets, on Select Transit purchases, and at Gas & EV Charging Stations. Earn 2 ThankYou® Points for each $1 spent at Restaurants; earn 1 ThankYou® Point for each $1 spent on All Other Purchases. | Self-select bonus category |

| Citi Double Cash® Card | Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back. | Earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases. To earn cash back, pay at least the minimum due on time. Plus, earn 5% total cash back on hotel, car rentals and attractions booked with Citi Travel. | 0% Intro APR on balance transfers for 18 months, then 18.24% - 28.24% (Variable). A 18.24% - 28.24% (Variable) APR will apply for purchases. |

| Citi Custom Cash® Card | Earn $200 in cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back. | Earn 5% cash back on purchases in your top eligible spend category each billing cycle, up to the first $500 spent, 1% cash back thereafter. Also, earn unlimited 1% cash back on all other purchases. Plus, earn an additional 4% cash back on hotels, car rentals, and attractions booked with Citi Travel®. | Automatically maximizes rewards in the eligible category you spend the most in each billing cycle (from restaurants, gas stations, grocery stores, select travel, select transit, select streaming services, drugstores, home improvement stores, fitness clubs and live entertainment) |

| AT&T Points Plus® Card | Earn a $200 statement credit after you spend $1,000 on purchases in the first 3 months of account opening | – 3x points at gas and EV charging stations – 2x points at grocery stores (including grocery delivery services) – 1x point on other purchases | Earn up to $240 back toward your qualifying AT&T wireless bills every year |

Although some Citi cards, such as the Double Cash Card, are marketed as earning cash back, you actually earn rewards in the form of ThankYou points, where 1 point = 1 cent in cash back.

You can also earn Citi ThankYou points from qualifying activities on eligible Citi checking accounts (enrollment required).

How Citi ThankYou Points Work

Citi awards and keeps track of the points you’ve earned from each account separately, although you can see your total ThankYou point balances when you log into your online account at citi.com or thankyou.com.

That said, you can ask Citi to link your accounts to make it easier to use your points. This is particularly helpful if you have cards with different benefits — for instance, the Citi Strata Elite’s benefits outshine those of most other Citi cards. Pooling rewards in this way lets you take advantage of all of your perks no matter which card you earned the points from.

Your Citi points won’t expire as long as the account you earned them with is open and in good standing (there are a few exceptions to this, such as with some older Citi cards that aren’t available to new applicants). If you close an account, you’ll have 60 days to redeem your rewards before they vanish.

Best Ways To Redeem Citi ThankYou Points

You’ve got plenty of choices when you’re ready to redeem Citi ThankYou points, including:

- Points transfer to Citi’s airline and hotel partners

- Travel (flights, hotels, car rentals and attractions) booked through the Citi Travel portal

- Cash back as a statement credit, direct deposit or check

- Gift card purchases through Citi

- Shop with points at select merchants

- Donations to eligible charities

Transferring Citi points to partners could get you an even higher value for your rewards, depending on the partner and type of redemption. However, transfer ratios vary depending on the card you have — the best transfer ratios are reserved for Citi credit cards with an annual fee, such as the Strata Elite, Strata Premier Card and Citi Prestige® Credit Card (no longer available to new applicants).

Maximizing the Value of Your Citi ThankYou Points

When you redeem Citi points through Citi Travel, they’re worth a flat 1 cent each. Gift cards and charitable donations typically offer the same rate of return, although sometimes you can get a better deal when Citi runs a promotion like a gift card sale.

You can also redeem points for cash back, but the rate varies depending on the card you have. For example, with the Double Cash Card and Custom Cash Card, your points are worth 1 cent each when you use them this way. But with the Strata Elite and Strata Premier Card, you’ll only get 0.75 cents per point toward cash back redemptions. And the Strata is even worse, at 0.5 cents per point.

Paying with Citi points at participating merchants is a convenient option, but it’s not a good idea if you want to maximize your rewards. For example, Citi points are only worth 0.8 cents each when you use them to shop at Amazon. If you have the Double Cash Card or Custom Cash Card, you’d be better off using your card to pay for the transaction, then redeeming rewards for cash back at 1 cent apiece!

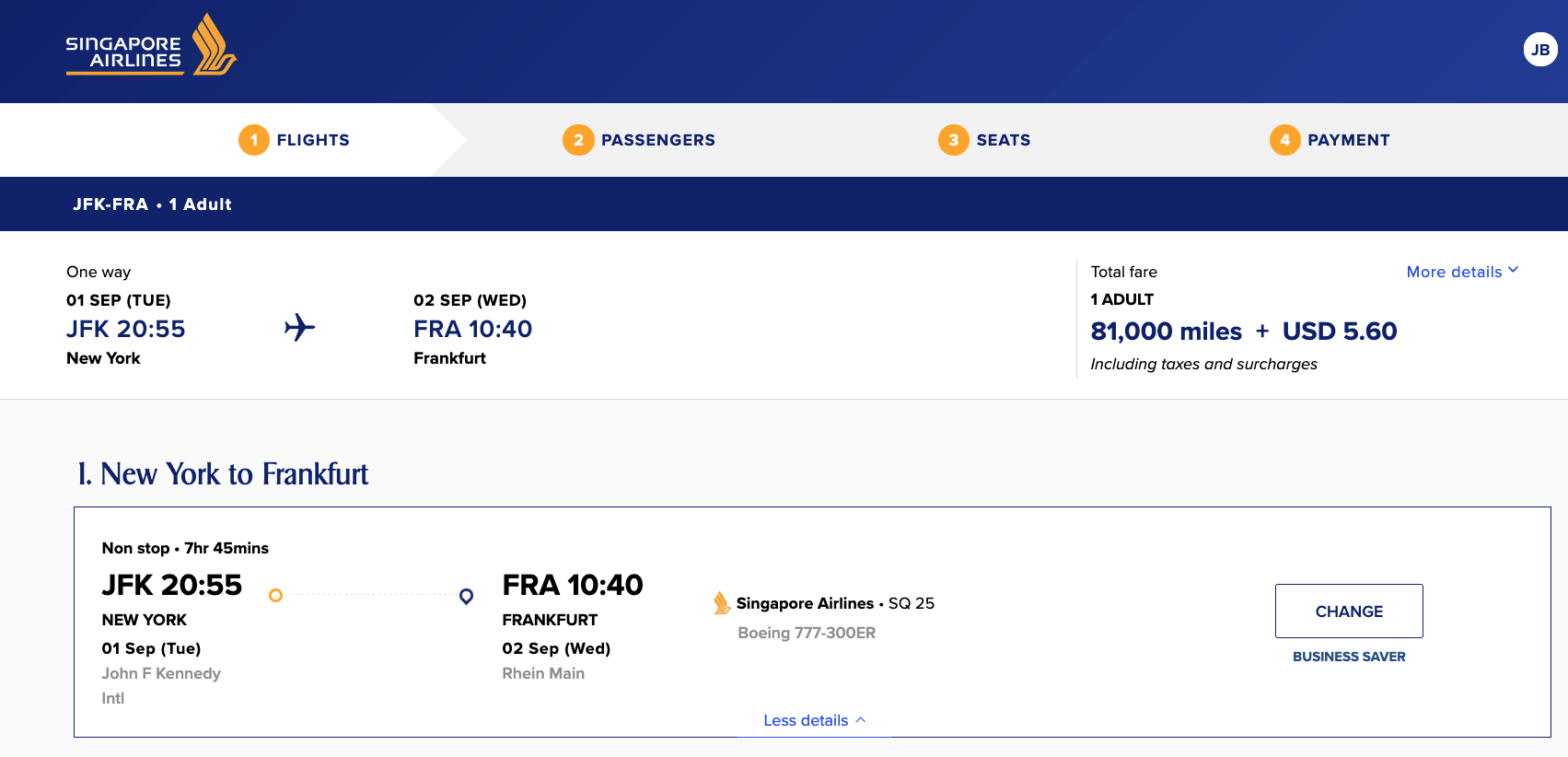

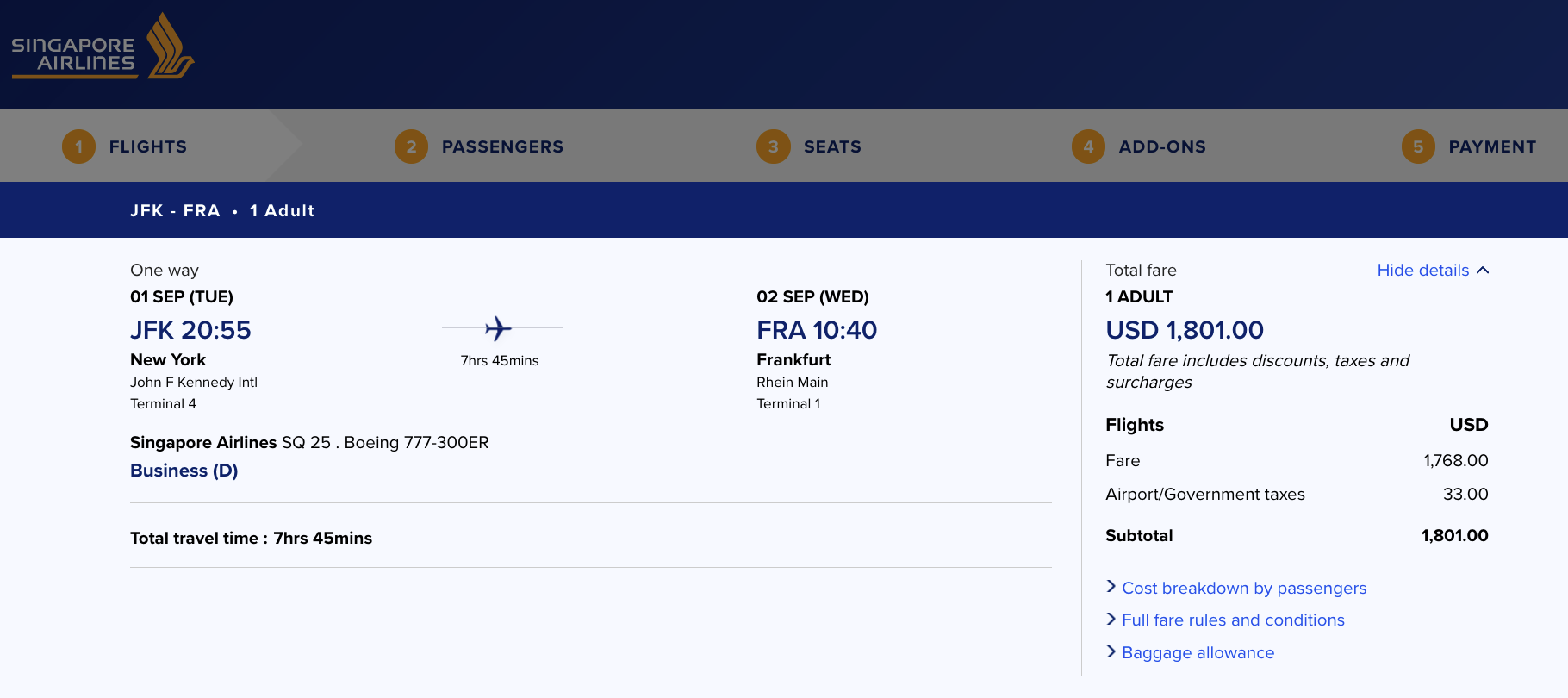

By far the best way to get the highest value per Citi point is by transferring them to airline and hotel partners. For example, assuming you have the Strata Elite or Strata Premier Card, you could transfer 81,000 Citi points at a 1:1 ratio to partner Singapore Airlines and book a comfy lie-flat business class seat between New York (JFK) and Frankfurt (FRA) with just an additional $5.60 in taxes.

If you paid cash for the exact same ticket, it would cost $1,801.

In this case, you’re getting a value of over 2.2 cents per point ($1,801 – $5.60 = $1,795.40, and $1,795.40 / 81,000 points = 2.21 cents per point*. That’s more than double what you’d get if you cashed in your points for a statement credit or redeemed them through Citi Travel.

You’ll typically get the highest rate of return when you transfer points and book expensive business or first-class seats. However, it’s possible to get a good value with less-fancy redemption, too, especially during peak travel periods such as summer break or holidays.

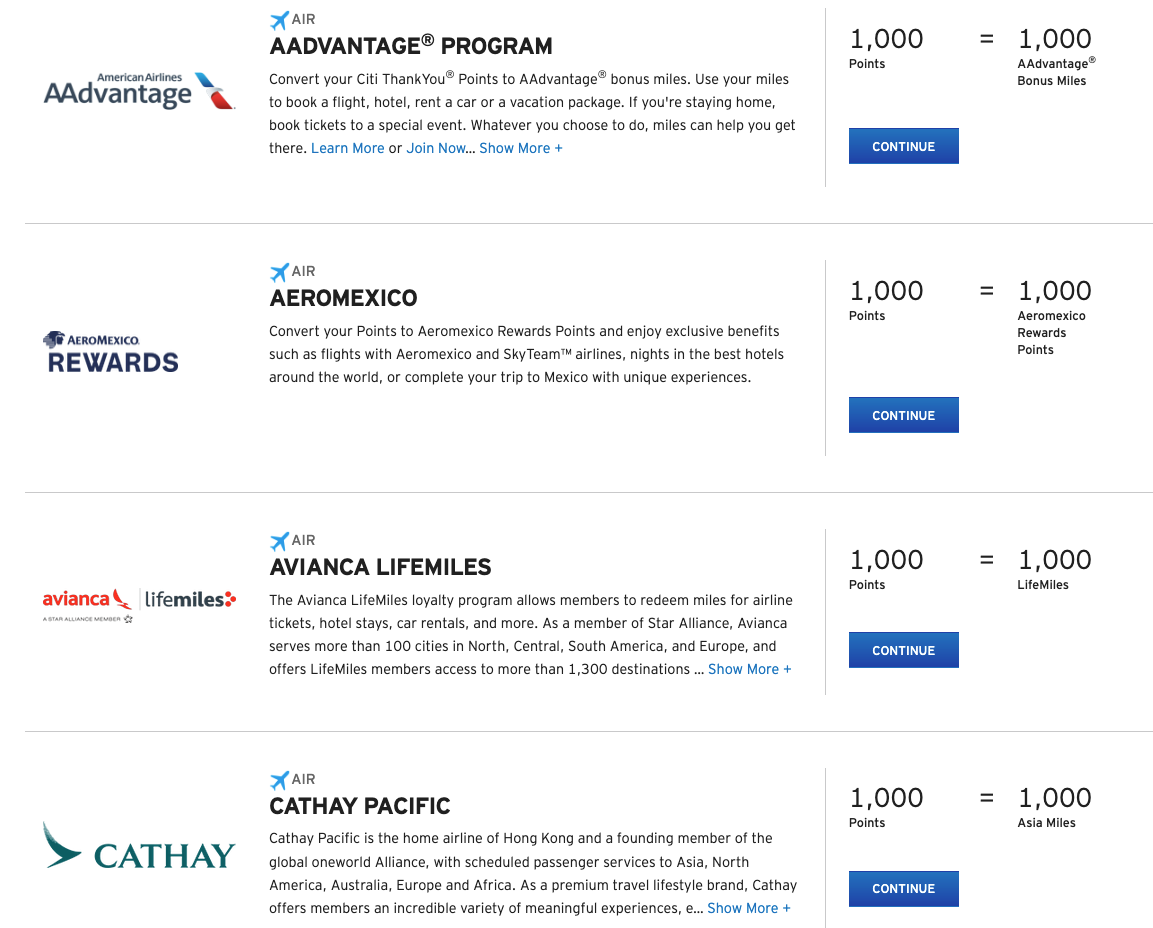

Citi ThankYou Transfer Partners

Citi partners with over a dozen airline and hotel loyalty programs, including popular brands like American Airlines, JetBlue, Cathay Pacific, Singapore Airlines and Wyndham. Citi’s partners aren’t generally as useful as those of Chase Ultimate Rewards® or American Express Membership Rewards®, although the recent addition of American Airlines AAdvantage as a transfer partner is a huge win for cardholders.

If you know how to take advantage of airline alliances and partnerships, Citi’s range of partners might suit you just fine. For example, you could transfer Citi points to Singapore Airlines or Avianca to book United Airlines flights, because all three airlines are part of the Star Alliance.

Here’s the full list of Citi’s transfer partners:

| Loyalty Program | Transfer Ratio | Minimum Transfer Amount |

| ALL Accor Live Limitless | 1:0.5 or 1:0.35, depending on the card | 1,000 points |

| Air France-KLM Flying Blue | 1:1 or 1:0.7, depending on the card | 1,000 points |

| Aeromexico Rewards | 1:1 or 1:0.7, depending on the card | 1,000 points |

| American Airlines AAdvantage | 1:1 or 1:0.7, depending on the card | 1,000 points |

| Avianca LifeMiles | 1:1 or 1:0.7, depending on the card | 1,000 points |

| Cathay Pacific | 1:1 or 1:0.7, depending on the card | 1,000 points |

| Choice Privileges | 1:2 or 1:1.4, depending on card | 1,000 points |

| Emirates Skywards | 1:0.8 or 1:0.56, depending on the card | 1,000 points |

| Etihad Guest | 1:1 or 1:0.7, depending on the card | 1,000 points |

| EVA Air Infinity MileageLands | 1:1 or 1:0.7, depending on the card | 1,000 points |

| JetBlue TrueBlue | 1:1 or 1:0.7, depending on the card | 1,000 points |

| Leading Hotels of the World Leaders Club | 1:0.2 or 1:0.14, depending on the card | 1,000 points |

| Preferred Hotels & Resorts I Prefer Hotel Rewards | 1:4 or 1:2.8, depending on the card | 1,000 points |

| Qantas Frequent Flyer | 1:1 or 1:0.7, depending on the card | 1,000 points |

| Qatar Airways Privilege Club | 1:1 or 1:0.7, depending on the card | 1,000 points |

| Shop Your Way | 1:10 | 1 point |

| Singapore Airlines | 1:1 or 1:0.7, depending on the card | 1,000 points |

| Thai Royal Orchid Plus | 1:1 or 1:0.7, depending on the card | 1,000 points |

| Turkish Airlines Miles&Smiles | 1:1 or 1:0.7, depending on the card | 1,000 points |

| Virgin Atlantic Flying Club and Virgin Red | 1:1 or 1:0.7, depending on the card | 1,000 points |

| Wyndham Rewards | 1:1 or 1:0.7, depending on the card | 1,000 points |

Without a premium Citi travel credit card such as the Citi Strata Premier Card or Strata Elite, you’ll get a lesser transfer ratio. For example, if you only have the Citi Double Cash Card, instead of a 1:1 ratio with most partners, it’s 1:0.7.

Access to all of Citi’s partners is one reason why paying the $95 annual fee on the Citi Strata Premier is worth it for many award travelers.

How To Transfer Citi Points to Partners

Regardless of the card(s) you have, the process of transferring points to partners is easy through your online Citi account. Once you’ve signed into your account, find the redeem rewards section for the card you want to use, then navigate to the “points transfer” option.

You should see a menu like this if you have a premium card like the Citi Strata Premier Card or Strata Elite:

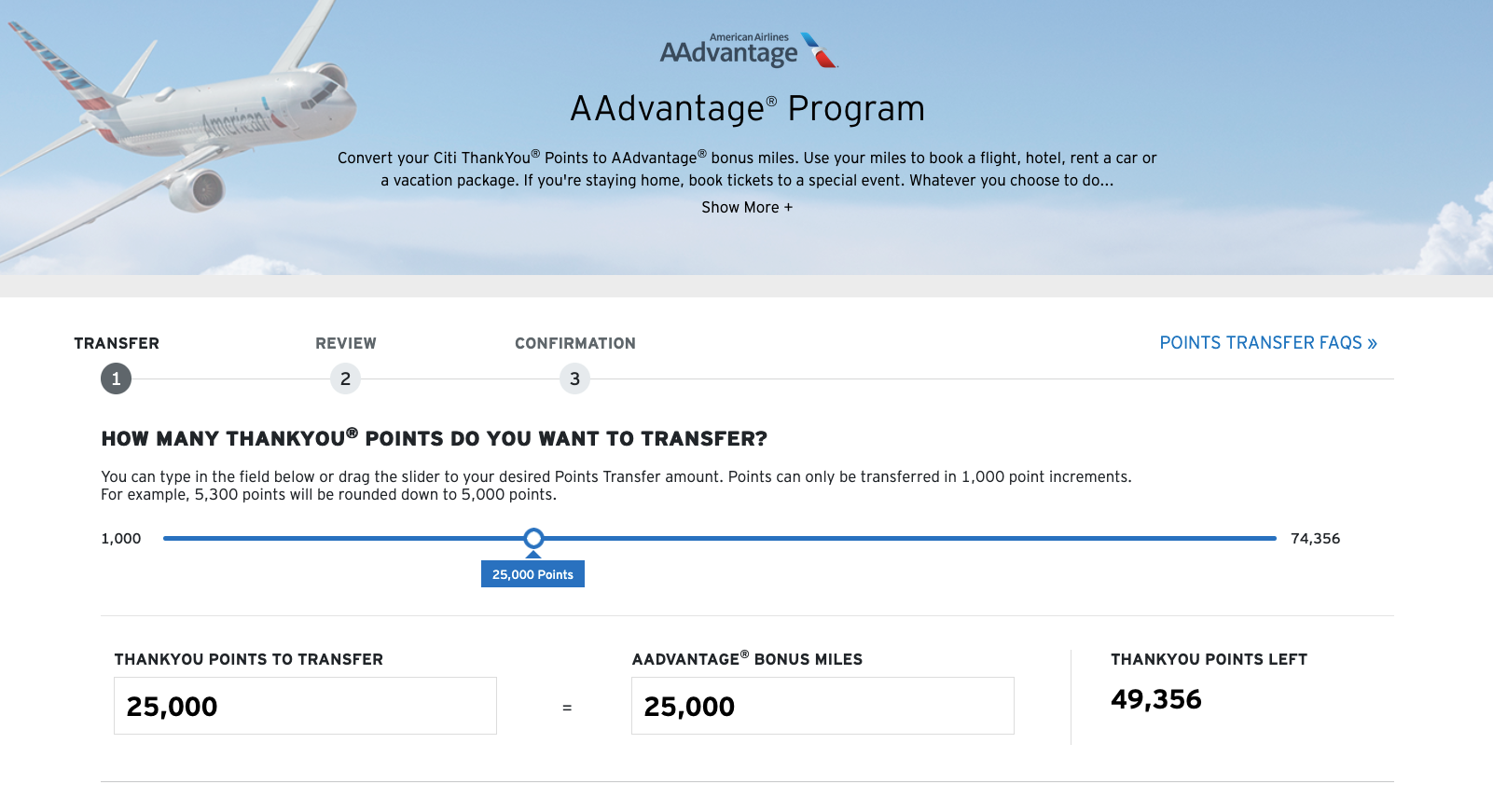

Scroll down and find the transfer partner you want, then click continue. The screenshot below uses American Airlines AAdvantage as an example, but the process is similar for other partners.

You can type in the number of points you want to transfer or use the slider to make your selection.

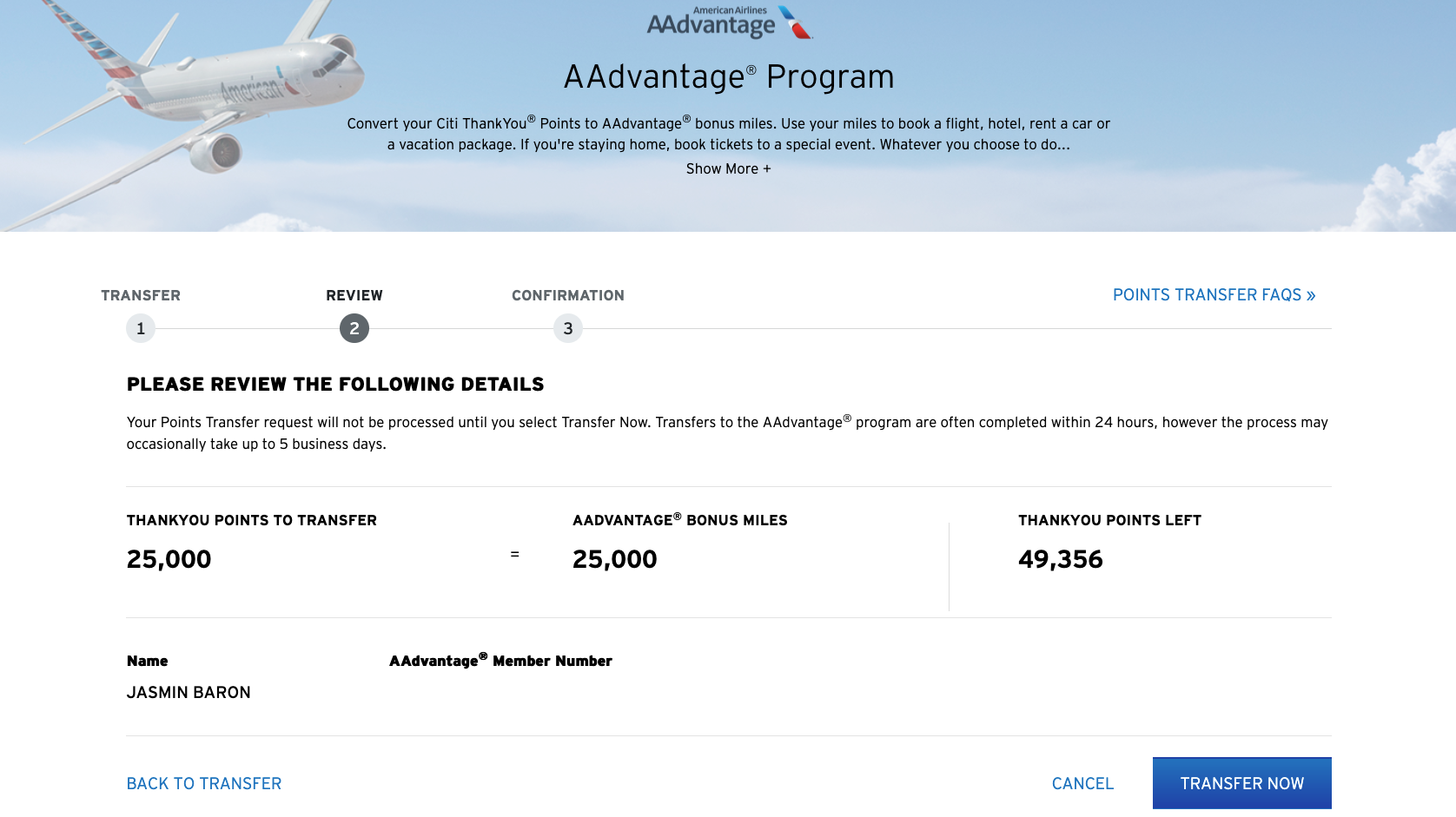

You’ll then be asked to enter your name and loyalty program number. Once you hit continue, you’ll be brought to a confirmation screen to review the transfer. If everything is in order, click “transfer now”.

Keep in mind transfers aren’t reversible, so be sure to double-check your details before confirming a transfer. Transfers may be instant, although in rare cases they can take a day or two.

Citi ThankYou Points and Citibank Card Rewards

Citi ThankYou points are the proprietary currency of Citibank cards, so the term “Citibank card rewards” is often used interchangeably with ThankYou points. That said, Citi also issues co-branded credit cards with American Airlines, Costco and other retailers. The rewards you earn with these cards aren’t connected to the Citi ThankYou program and can’t be combined.

So which Citi cards are best if you’re looking for a rewards credit card? Simply, if you value flexibility in how you redeem rewards, any of the ThankYou points-earning cards are a good starting point. The Strata Premier Card and Strata Elite, in particular, are the best options if you’re looking to book travel with your rewards.

Otherwise, if you’re loyal to a certain brand, a co-branded card might be a better option. If you’re a frequent American Airlines flyer, for instance, a card like the Citi® / AAdvantage® Platinum Select® World Elite Mastercard®, an advertising partner, could save you money because it comes with perks on AA flights such as a free first checked bag on domestic itineraries and in-flight discounts.

Pros and Cons of the Citi ThankYou Points Program

As with other rewards programs, Citi ThankYou Rewards comes with advantages and disadvantages. Be sure to consider your spending habits, rewards goals and desired benefits before you choose a credit card that earns ThankYou points.

Advantages:

- Flexibility: You can choose how to redeem your points whether you prefer cash back, travel or merchandise

- Travel perks: If you have the Strata Premier Card or Strata Elite, you’ll get benefits such as travel insurance and statement credits

- Transfer partners: You may get higher value from your rewards when you transfer points to Citi’s partners

Disadvantages:

- Partner limitations: You’ll only get the best transfer ratios with annual-fee Citi ThankYou cards, and Citi’s partner list isn’t as robust as some competing programs

- Low-value redemptions: In many cases, you’ll get a value of 1 cent per point, although you could do even worse than that when you redeem for cash back or shop with points, depending on the card

- Few benefits: With the exception of the Strata Elite and Strata Premier Card, the Citi ThankYou cards available right now don’t come with a ton of extra frills

The Citi ThankYou program may be a good fit for you if your spending habits line up with its card bonus categories and you prefer to choose how you redeem your rewards. It’s also a strong option if you’re willing to pay the annual fee on the Strata Premier Card or Strata Elite to unlock a better transfer ratio to Citi’s partners, particularly if you’re comfortable with partner airline award charts and redemptions.

However, if you’re a rewards travel newbie, Citi ThankYou is probably not the best starting point. Chase offers better transfer partners and a wider, more lucrative range of Ultimate Rewards redemption options.

*The valuation is an estimate made by CardCritics™ and results may vary.

*The information related to the Citi Custom Cash® Card has been collected by CardCritics™ and has not been reviewed or provided by the issuer or provider of this product or service.

Frequently Asked Questions About Citi ThankYou Points

Can you combine Citi ThankYou Points from multiple accounts?

Yes, you can link your accounts by calling Citi.

Do Citi points have a fixed value?

Citi points value varies depending on how you redeem them, but most commonly they’re worth 1 cent each for Citi Travel bookings and gift cards, and 0.5 to 1 cent apiece for cash back.

Can you transfer Citi ThankYou Points to another person?

Yes, you can transfer Citi ThankYou points to another person with a Citi ThankYou account. Just be aware that transferred points will expire 90 days after the transfer is made.

What happens to your points if you close your Citi card?

You have 60 days to redeem your points after you close a Citi card as long as the card was in good standing.

How do I redeem Citi ThankYou Points for cash back?

To redeem Citi ThankYou points for cash back, log into your Citi online account and navigate to the redeem rewards section. You can choose to redeem points for a statement credit, direct deposit or paper check.

Can Citi ThankYou Points be used for Amazon purchases?

Yes, if you link your Amazon and Citi accounts you can redeem your ThankYou points at Amazon checkout. This is not a good deal, because you’ll only get a value of 0.8 cents per point when you redeem this way.

What is the easiest way to book travel with Citi ThankYou Points?

Using your points to book flights, hotels, car rentals and attractions through Citi Travel is straightforward and doesn’t require much effort, although you’ll only ever get a value of 1 cent per point when you use them this way.

Do I need a specific Citi card to transfer points to travel partners?

You can access all of Citi’s travel partners with most cards, except American Airlines AAdvantage. Transfers to that program aren’t available with AT&T-branded cards or with the discontinued Citi ThankYou® Mastercard. In addition, you’ll need an annual-fee Citi card, such as the Strata Premier Card or Strata Elite, to get the best transfer ratios.

How often does Citi update point values?

Citi usually keeps its points values steady. What’s more variable is the value you get when you transfer points to partners to book travel. This can vary widely depending on the partner, type of redemption, paid ticket price, time of year and other factors.