How To Maximize the Capital One Venture X’s 100K Mile Limited-Time Offer

Update: The information below for the Capital One Venture X Rewards Credit Card was correct at the time of publishing, but one or more offers are no longer available. Please see our review for the most up to date information.

The Capital One Venture X Rewards Credit Card is one of the best travel credit cards on the market, and right now it’s an even better deal. For a limited time, new Venture X cardholders can earn 100,000 bonus miles after spending $10,000 on purchases in the first six months of account opening. This offer is ending soon, so act now if you want to apply.

Capital One miles are worth 1 cent each when you redeem them to “erase” eligible travel purchases from your statement or use them toward Capital One Travel bookings, making this offer worth a cool $1,000.

However, since the card earns 2x miles on most purchases, that $10,000 in required spending to earn the offer generates at least another 20,000 miles — giving you at least 120,000 miles total. With a baseline value of 1 cent per mile, that’s $1,200 in travel.

But savvy travelers can easily stretch that to $2,000 or more in value by transferring miles to Capital One’s airline and hotel partners to book award flights and stays. Let’s explore how to make the most of the Capital One Venture X’s limited-time offer.

400+ Credit Cards

Analyzed independently across 50+ data points in 30+ product categories

Reviewed

By a team of credit card experts with an average of 9+ years of experience

Trusted by

More than one million monthly readers seeking unbiased credit card guidance

CardCritics™ editorial team is dedicated to providing unbiased credit card reviews, advice and comprehensive comparisons. Our team of credit card experts uses rigorous data-driven methodologies to evaluate every card feature, fee structure and rewards program. In most instances, our experts are longtime members or holders of the very programs and cards they review, so they have firsthand experience maximizing them. We maintain complete editorial independence — our ratings and recommendations are never influenced by advertiser relationships or affiliate partnerships. You can learn more about our editorial standards, transparent review process and how we make money to understand how we help you make informed financial decisions.

Capital One Venture X 100K Offer: At a Glance

The new Capital One Venture X offer is a big upgrade from the standard 75,000-mile offer, and matches the best public offer we’ve ever seen for the card. The 100,000-mile offer requires a significant amount of spending, but you’ll have six months to meet the $10,000 requirement, which averages out to $1,667 per month. If that’s manageable for you, and you’ve had your eye on the Venture X, now is the time to apply.

I’ve held this card for several years despite its $395 annual fee. The Venture X is worth it for my family and me: between a yearly $300 Capital One Travel credit, 10,000 bonus miles each account anniversary, access to Priority Pass after you enroll and Capital One Lounges, and a slew of travel and purchase protections, I get a value that far exceeds the annual fee every year.

Again, once you meet the $10,000 spending requirement, you’ll actually earn at least 120,000 miles (100,000 miles from the welcome offer, and at least 20,000 miles from spending $10,000). Keep in mind that while the card earns 2 miles per dollar on most purchases, it actually earns more on Capital One Travel bookings: 10x miles on hotels and car rentals, and 5x miles on flights and vacation rentals booked through the platform. So you could actually end up with more than 120,000 miles if some of your minimum spending is met with Capital One Travel purchases.

Let’s assume you’ve unlocked the welcome offer and are sitting on an even 120,000 miles in your account. Here are some of the best (and a few not-so-great) ways to use your Capital One miles for maximum value.

Book Travel Through Capital One Travel (1 Cent per Mile)

The simplest way to redeem Venture X miles is through Capital One Travel, the issuer’s built-in booking portal powered by Hopper. It’s similar to other third-party online travel agencies like Expedia and Orbitz, and through the platform, you can book over 200 airlines, 2 million hotel properties and nearly 200 rental car agencies.

Why Use Capital One Travel?

When you book through Capital One Travel, your miles have a fixed value of 1 cent apiece — so 120,000 miles is equal to $1,200 in travel. You won’t have to worry about blackout dates or learning about transfer partners and award charts, making this a straightforward way to use your rewards.

It’s also handy if you don’t have enough miles to fully cover a booking, because you can combine miles with cash in whatever amounts you choose. Plus, the Capital One Venture X comes with an annual $300 Capital One Travel credit, so you can stack your miles with this benefit and get up to $1,500 in total value (120,000 miles worth $1,200, plus $300 travel credit).

Capital One Travel includes additional features such as a price match guarantee, price drop protection, and price prediction and alerts. Venture X cardholders can also book stays at Capital One’s Premier Collection of luxury hotels, which come with a $100 experience credit, daily breakfast for two and other elite-like goodies.

That said, Capital One Travel has a few downsides to consider:

- You won’t earn Capital One miles when you redeem rewards for your bookings, so it makes more sense to pay with your card, then “erase” the purchase with miles after the fact (more on that in a bit).

- While you can earn airline miles by linking your frequent flyer number to flight reservations booked through the platform, the same is not true for accommodations. Because Capital One Travel is a third-party service, you won’t earn hotel points or elite night credits, and your hotel loyalty program elite status (if you have it) may not be recognized during your stay.

- Whenever you book through a third-party online travel agency like this, versus with an airline or hotel directly, you’re introducing a middleman. Should you need to change or cancel your trip, you’ll typically have to deal with Capital One instead of making those changes directly with the travel provider.

I once had issues with a straightforward hotel booking through the platform. When we arrived at the hotel, they could see the reservation, but despite having “paid” with my annual $300 Capital One Travel credit, it showed the full cash balance due at check-in. The hotel couldn’t assist directly, even as my kids and I sat in the lobby for over an hour while I tried to get the problem ironed out on the phone with Capital One Travel. That’s one reason I prefer redeeming miles by transferring them to partners or by using the issuer’s purchase eraser tool to cover recent travel purchases.

‘Erase’ Travel Purchases from Your Statement (1 Cent per Mile)

If you prefer to book directly with airlines or hotels as I do, Capital One’s purchase eraser feature lets you use miles to “erase” eligible travel transactions from your statement within 90 days of purchase — also at 1 cent per mile. So again, in this case, 120,000 miles are worth $1,200 in travel.

How Capital One Purchase Eraser Works

The process for redeeming miles for recent travel transactions takes slightly more effort, but the upside is worth it. You’ll earn Capital One miles for your purchase, and hotel bookings are eligible to earn points/elite night credits with the chain.

The list of eligible travel purchases you can cover this way is broad, and includes:

- Airlines

- Hotels

- Rail lines

- Car rental agencies

- Limousine services

- Bus lines

- Cruise lines

- Taxi cabs

- Travel agents

- Time shares

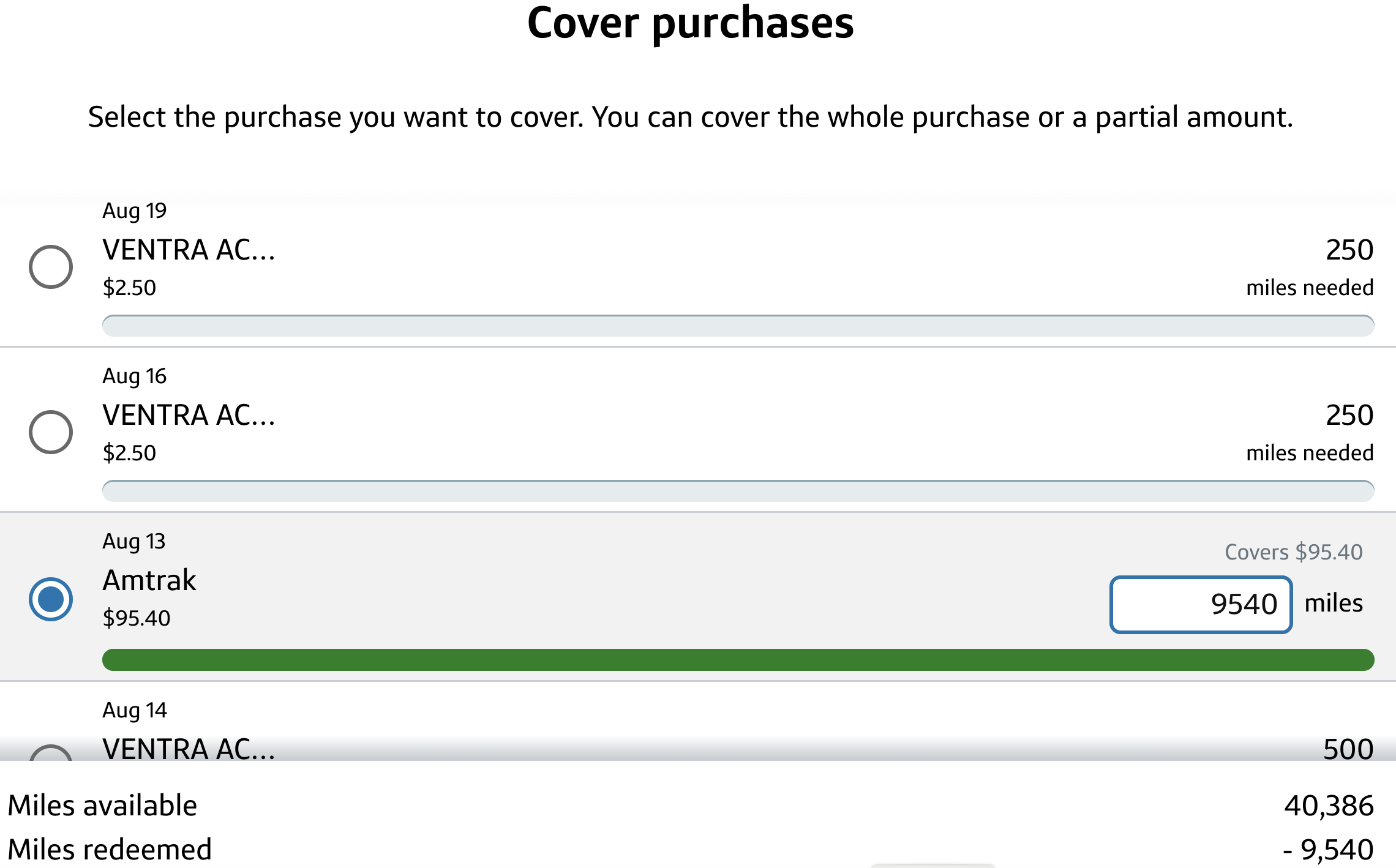

Here are the steps to follow to redeem Capital One miles with the purchase eraser:

- Use your Venture X Card to pay for travel directly with the provider — for example, you could book a United Airlines flight, a Hyatt hotel stay or an Avis car rental with your card

- Within 90 days, sign in to your Capital One account

- In the “Rewards” tab, navigate to “Cover travel purchases”

- You’ll be presented with a list of eligible transactions made in the last 90 days, along with the miles required to “erase” the purchase

- Apply miles to cover that charge

In the screenshot above, I have Ventra (Chicago public transit) and Amtrak purchases that are eligible for redemption. For example, I could cash in 9,540 miles to cover an Amtrak ticket that cost me $95.40.

This is a valuable and flexible way to redeem Capital One miles, especially since it works for just about any travel purchase. I typically use purchase eraser to cover travel expenses that aren’t as easy to redeem rewards for, such as boutique hotels, award ticket fees and cruise charges. But whenever possible, I transfer miles to partners for award travel and get outsized value.

Transfer Miles to Airline and Hotel Partners (Often Better Value)

To squeeze the most value from your Capital One Venture X welcome offer, consider transferring miles to Capital One’s airline and hotel partners. Most transfers are at a 1:1 ratio, and many are instant. Here’s the full list:

Loyalty Program | Transfer Ratio | Minimum Transfer Amount |

| Accor Live Limitless | 2:1 | 1,000 miles |

| Aeromexico Rewards | 1:1 | 1,000 miles |

| Air Canada Aeroplan | 1:1 | 1,000 miles |

| Avianca Lifemiles | 1:1 | 1,000 miles |

| Cathay Pacific | 1:1 | 1,000 miles |

| Choice Privileges | 1:1 | 1,000 miles |

| Emirates Skywards | 2:1.5 | 1,000 miles |

| Etihad Guest | 1:1 | 1,000 miles |

| EVA Air Infinity MileageLands | 2:1.5 | 1,000 miles |

| Finnair Plus | 1:1 | 1,000 miles |

| Flying Blue (Air France-KLM) | 1:1 | 1,000 miles |

| I Prefer Hotel Rewards | 1:2 | 1,000 miles |

| Japan Airlines Mileage Bank | 2:1.5 | 1,000 miles |

| JetBlue TrueBlue | 5:3 | 1,000 miles |

| Qantas Frequent Flyer | 1:1 | 1,000 miles |

| Qatar Airways Privilege Club | 1:1 | 1,000 miles |

| Singapore Airlines KrisFlyer | 1:1 | 1,000 miles |

| TAP Miles&Go | 1:1 | 1,000 miles |

| The British Airways Club | 1:1 | 1,000 miles |

| Turkish Airlines Miles&Smiles | 1:1 | 1,000 miles |

| Virgin Red | 1:1 | 1,000 miles |

| Wyndham Rewards | 1:1 | 1,000 miles |

This method takes more planning and research, but the payoff can be huge — in some cases, you can get a value of 2 cents per mile or more, especially when you book business-class flights or international hotel stays. Let’s look at some of the best ways to turn your 120,000 miles into travel worth thousands of dollars.

Air Canada Aeroplan: Business Class to Europe

Air Canada’s Aeroplan loyalty program might not be on your radar if you never fly the airline. However, since Air Canada is part of Star Alliance, you can redeem Aeroplan points for award flights on other alliance partners, including United, Lufthansa, EVA Air and SWISS.

Aeroplan award flights are priced partly by zone and partly by distance, which makes relatively short hops more affordable. For example, partner business-class flights between the US East Coast and Europe under 4,000 miles cost just 60,000 Aeroplan points each way, plus taxes and fees. That means you could get a round-trip business-class itinerary to Europe by transferring your 120,000 Capital One miles to Aeroplan.

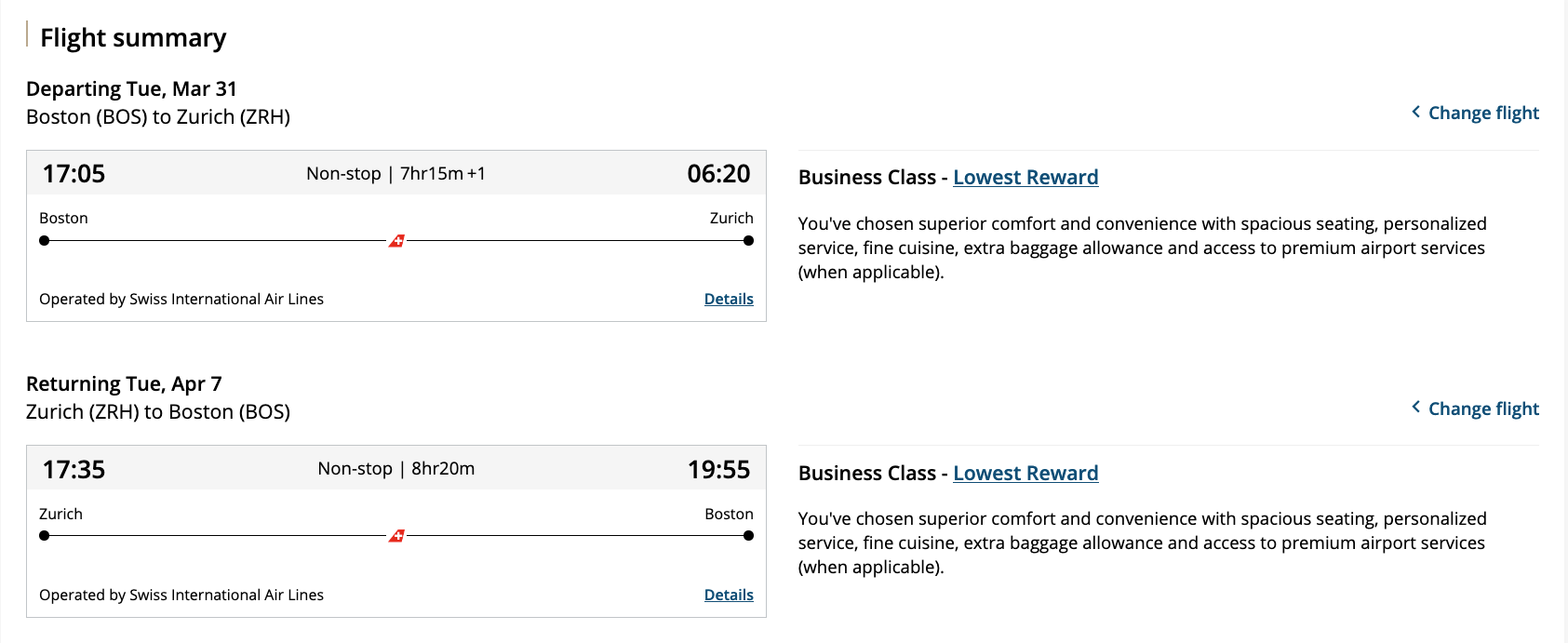

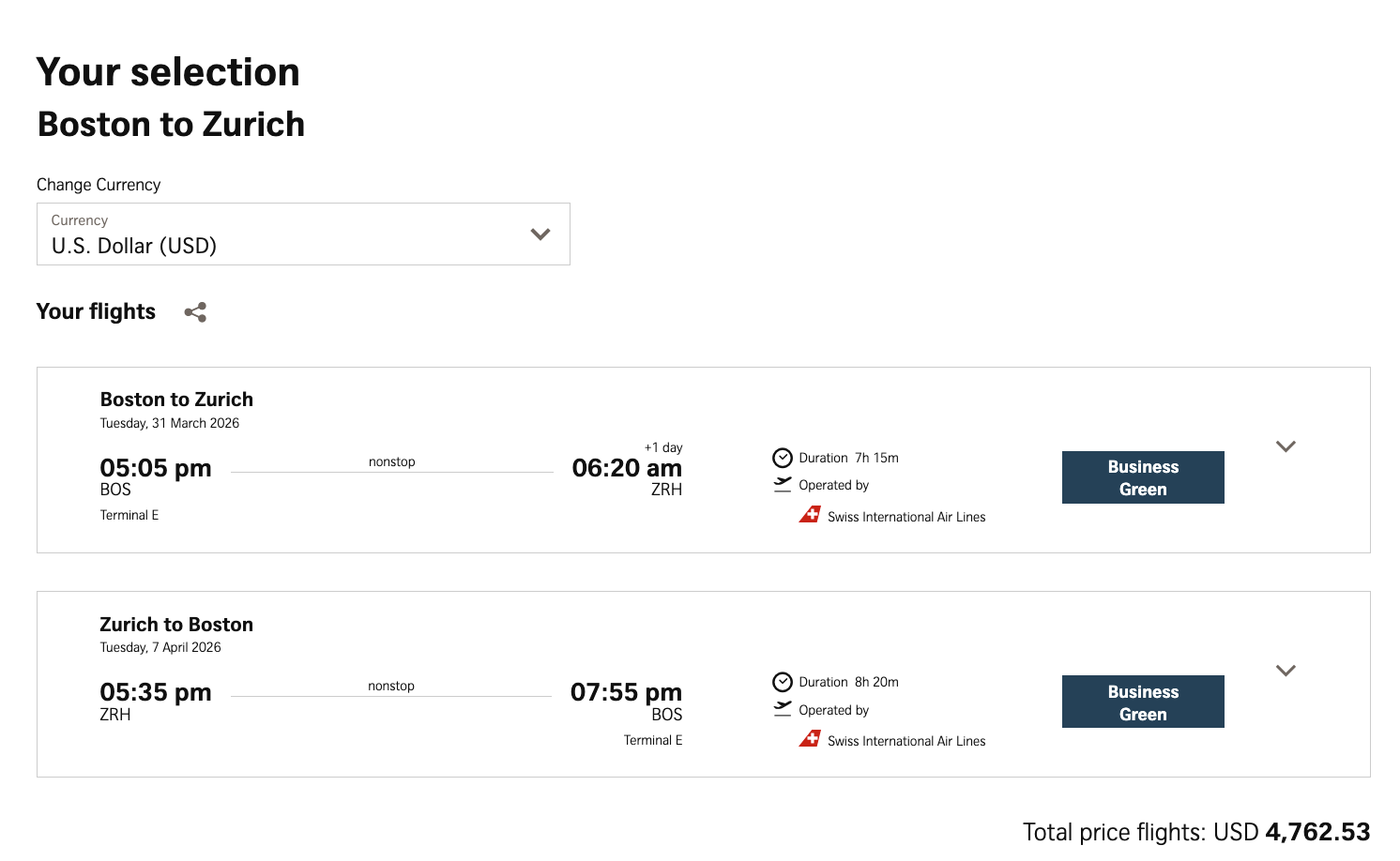

Consider the round-trip itinerary below between Boston (BOS) and Zurich (ZRH) in SWISS’s award-winning business class. You can book it for 120,000 Aeroplan points plus 198 Canadian dollars (about $142).

The cash price for the same flights is $4,762.53.

If you bought this ticket using your Capital One Venture X and offset the cost with miles via purchase eraser, you’d be on the hook for a whopping 476,253 miles, which is a terrible deal. But with the 120,000-point award ticket, after subtracting the cost of taxes and fees, you’ll get a value of 3.85 cents per Capital One mile ($4,762.53 paid fare minus $142 in taxes and fees, divided by 120,000 miles).

It’s redemptions like these that make Air Canada Aeroplan one of my favorite frequent flyer programs. Even coach tickets can represent a solid value; I recently booked a one-way economy class flight for my mom from Angeles City, Philippines (CRK) to Toronto (YYZ) via Taipei (TPE) on EVA Air with 60,000 Aeroplan points and $58. The same itinerary, paid with cash, would have cost $888 — a value of 1.38 cents per point.

British Airways Club: Short-Haul Oneworld Flights

Here’s another example where knowing how to make the most of airline partnerships and alliances can pay off in a big way. British Airways is part of the Oneworld alliance, which also includes American Airlines, Alaska Airlines, Japan Airlines and Cathay Pacific.

The British Airways Club uses a currency called Avios, and awards are priced based on distance. That makes the program ideal for quick hops that would otherwise be expensive when paid with cash, including short flights within the US or between the US and Canada, Mexico and the Caribbean.

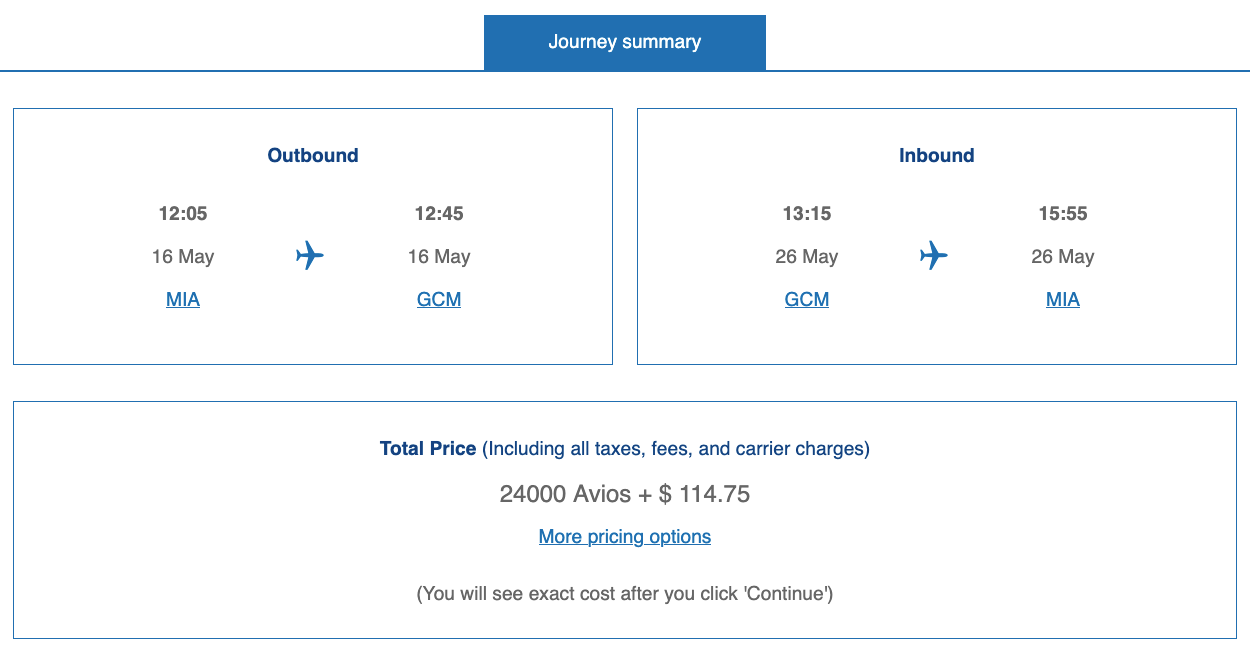

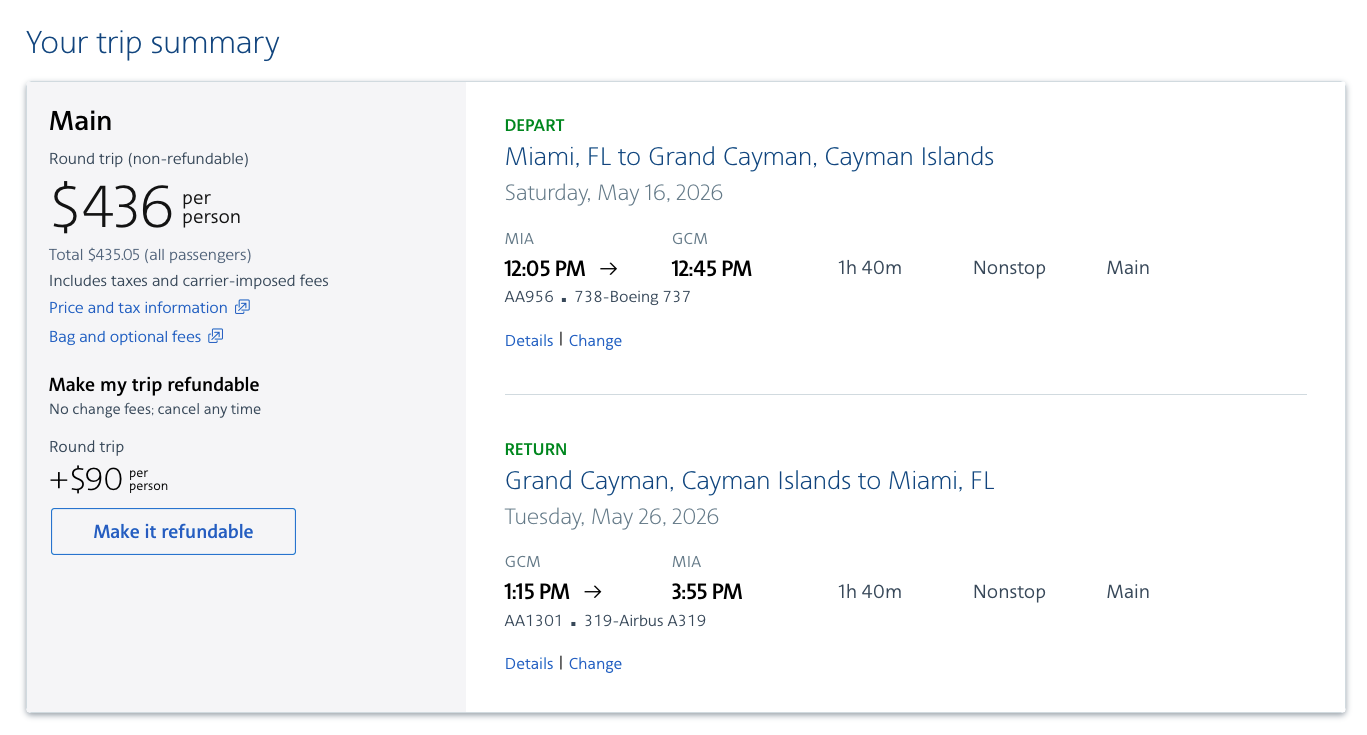

For example, you could book this round-trip economy class itinerary on American Airlines between Miami (MIA) and Grand Cayman (GCM) by transferring 24,000 Capital One miles to British Airways, plus spending $114.75 in taxes and fees.

If you paid cash with AA, these flights would cost $435.05.

In this case, you’ll get a value of 1.33 cents per mile ($435.05 paid fare minus $114.75 in taxes and fees, divided by 24,000 miles). That’s not an off-the-charts value, but it’s better than using miles to offset this fare directly. And with 120,000 Capital One miles, you’d have enough to fly a family of five to the Caribbean and back, with a total value (after subtracting taxes) of $1,600.

Air France-KLM Flying Blue: Monthly Promo Rewards

Flying Blue is the loyalty program of Air France and KLM, and it’s well known for its Promo Rewards that offer discounted award prices on certain routes, including North America to Europe. Eligible destinations and discounts change from month to month, but if you’re flexible, you can snag some very good deals.

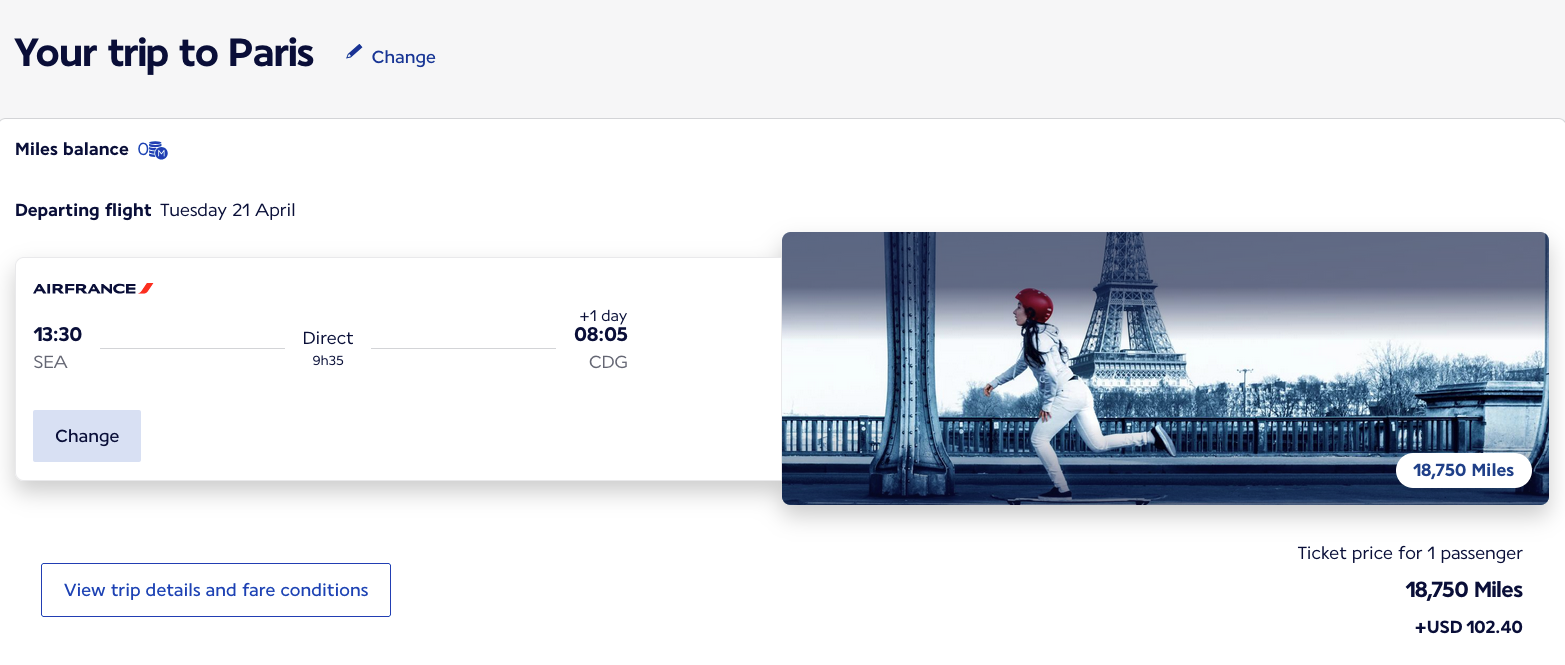

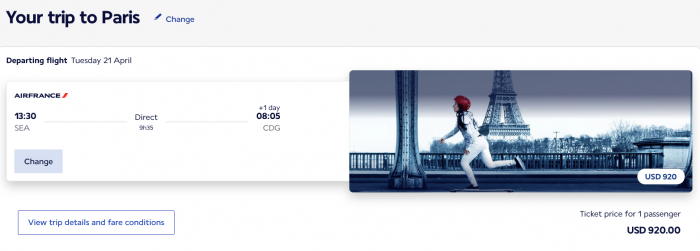

In November 2025, Flying Blue Promo Rewards include a 25% discount on economy class flights between several US cities and Europe. For example, you could transfer 18,750 Capital One miles to Flying Blue to book an Air France flight from Seattle (SEA) to Paris (CDG), plus pay $102.40 in taxes and fees.

The same flight costs $920 in cash. After subtracting taxes and fees, you’ll get a value of 4.36 cents per mile ($920 paid fare minus $102.40 in taxes and fees, divided by 18,750 miles). That’s an excellent deal.

This would be a great way to use the Capital One Venture X welcome offer to book two round-trip tickets to Paris for a couple’s getaway and get potentially thousands of dollars in value — plus, you’d still have lots of miles left over for another trip.

Singapore Airlines KrisFlyer: Premium Cabins to Asia and Beyond

Singapore Airlines is among the most aspirational transfer partners in Capital One’s lineup, and a great option for maximizing your Capital One miles. While you can redeem Singapore KrisFlyer miles for flights on Star Alliance and other partners, you’ll typically get the best value when you book premium award flights on Singapore Airlines itself.

If you’re craving an unforgettable luxury travel experience, here are a couple of bucket-list flights you can book by transferring Capital One miles to Singapore Airlines KrisFlyer.

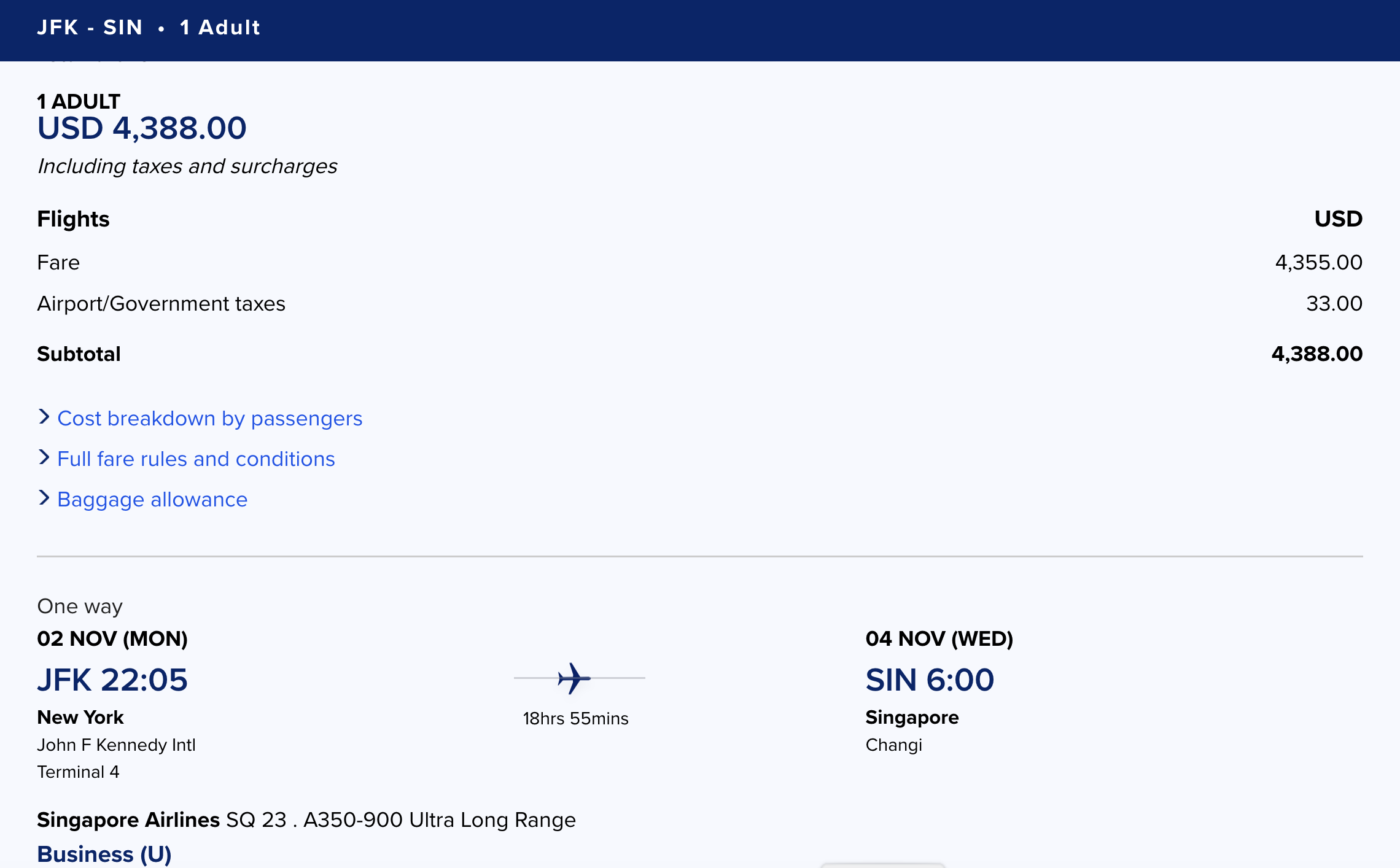

Business Class on One of the World’s Longest Flights

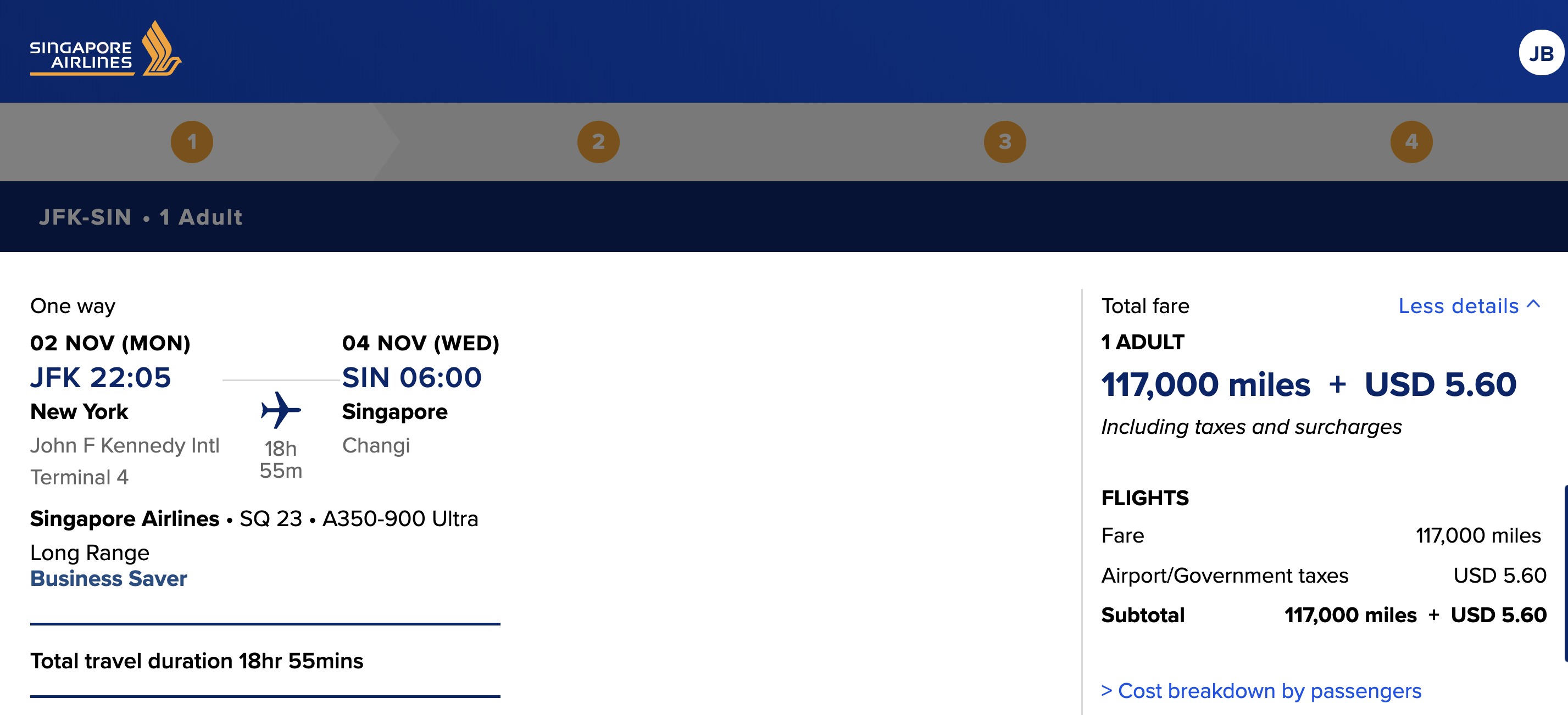

Let me geek out as an aviation nerd for a second: Singapore’s non-stop flight from New York (JFK) to Singapore (SIN) clocks in as the third-longest commercial flight in the world, at 9,537 miles and nearly 19 hours of flight time. The flight is so long that they don’t even sell economy class tickets on the Airbus A350-900ULR (Ultra Long Range) that flies this route; the plane has only premium economy and business class seats.

You can book this unforgettable flight in business class by transferring 117,000 Capital One miles to Singapore KrisFlyer and paying an additional $5.60 in taxes and fees.

Singapore’s business class was ranked No. 2 in the 2025 SKYTRAX World Airline Awards (it’s No. 1 for first class; we’ll come to that in a bit). So it’s not surprising that this ticket costs a pretty penny otherwise. You’d pay $4,388 for the same seat.

That works out to 3.75 cents per mile ($4,388 paid fare minus $5.60 in taxes and fees, divided by 117,000). That’s a fantastic way to make the most of the Capital One Venture X welcome offer, and for many, a memory to cherish for a lifetime.

Remember, I mentioned my mom earlier? I used Singapore miles to book her on this route, in business class, with a connection to Manila (MNL). She’s stoked about flying in a luxurious lie-flat seat on one of the world’s best airlines, and I’m thrilled that she’ll get to experience a journey she couldn’t have otherwise imagined.

If getting the most cents per mile gives you a dopamine rush, you might do even better with another Singapore route.

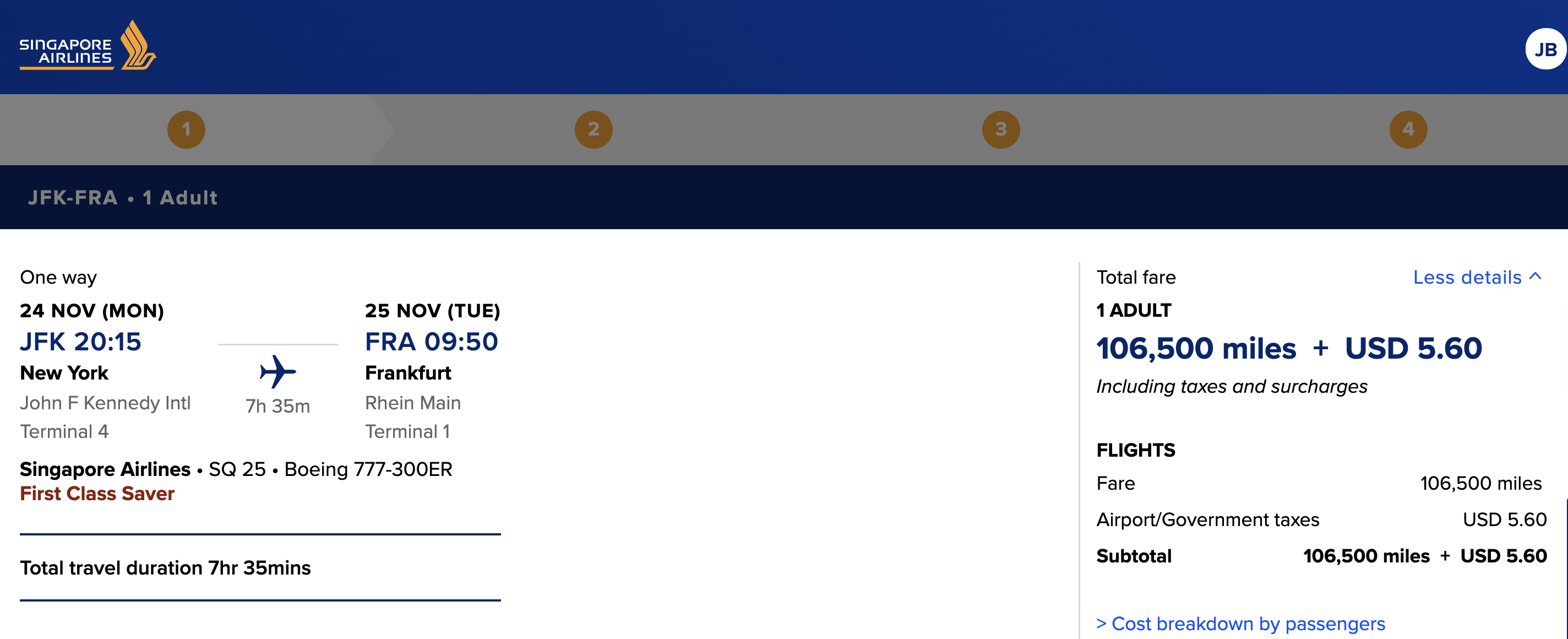

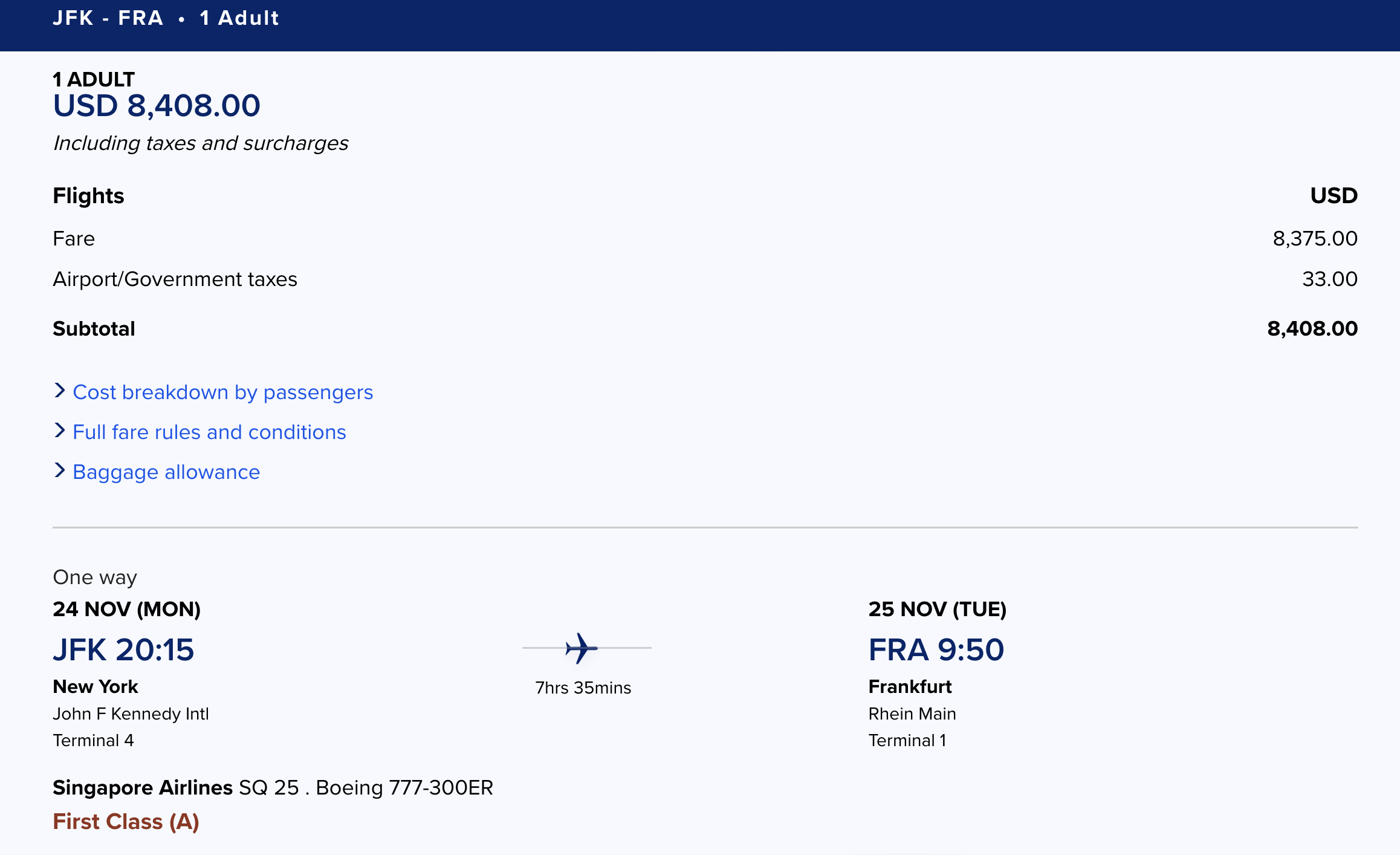

First Class to Europe

Singapore Airlines operates an unusual “fifth-freedom” route from New York (JFK) to Frankfurt (FRA), then onward to Singapore. You can book the airline’s renowned first class from New York to Frankfurt by transferring 106,500 Capital One miles to Singapore KrisFlyer and paying $5.60 in taxes and fees.

If you paid cash for this ticket, you’d be out a jaw-dropping $8,408. But by booking it as an award flight, you’d get a return of 7.89 cents per mile ($8,408 paid fare minus $5.60 in taxes and fees, divided by 106,500 miles). That’s nearly 8x the value you’d get from redeeming miles through Capital One Travel or purchase eraser.

Be sure to manage your expectations if you try to book these flights. As you might imagine, they’re immensely popular, so you’ll have the best luck finding saver award seats if you book well in advance or at the very last minute.

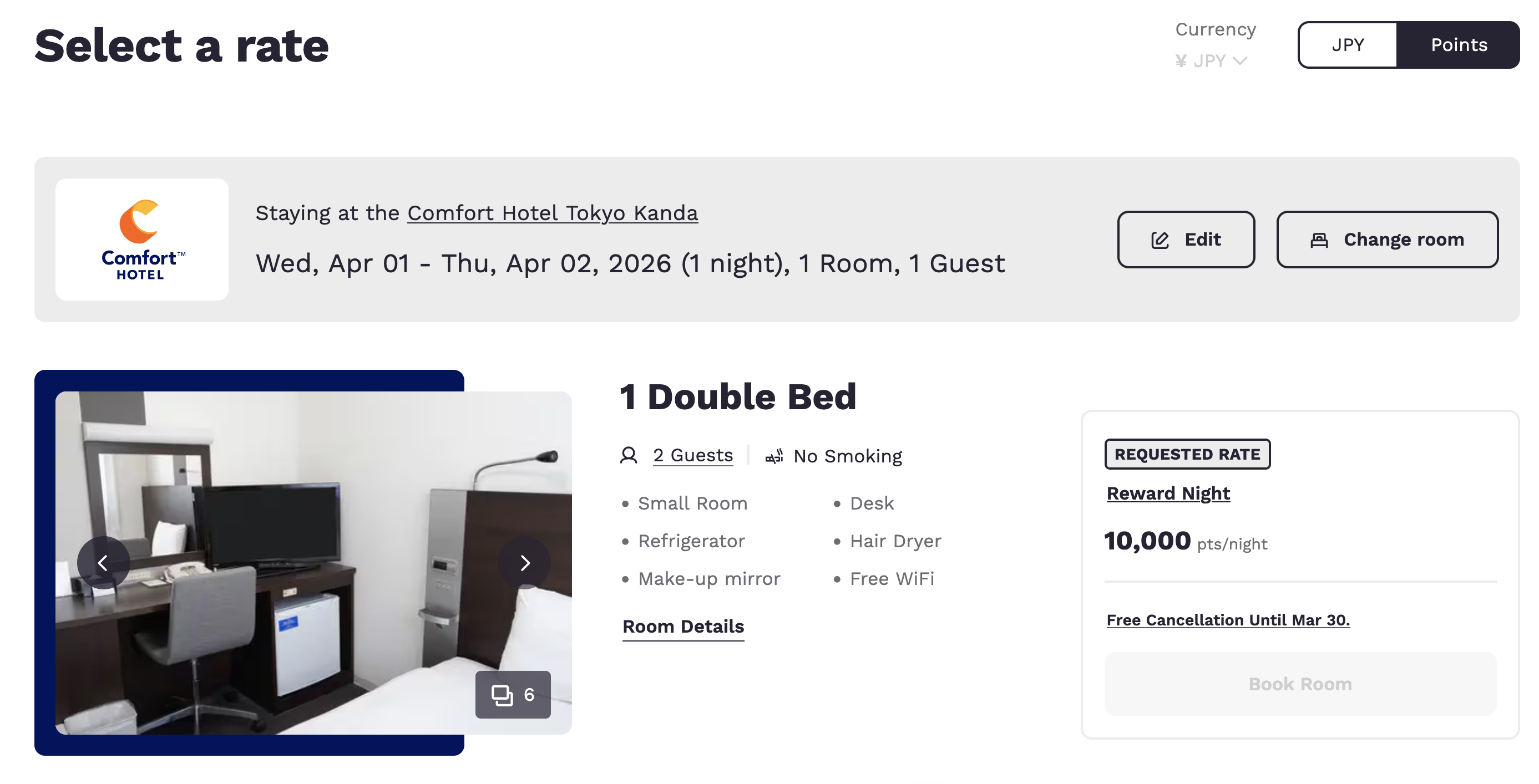

Choice Privileges: Affordable International Award Stays

Choice Privileges is the loyalty program for Choice Hotels, which includes budget-friendly favorites such as Quality Inn, Comfort, Rodeway Inn and Clarion. But it also covers more upscale brands like Ascend Collection, Cambria and Radisson Blu.

Within North America, it’s challenging to get outsized value from Choice points, but if you look further afield, there are compelling deals to be had — particularly in Asia and Europe.

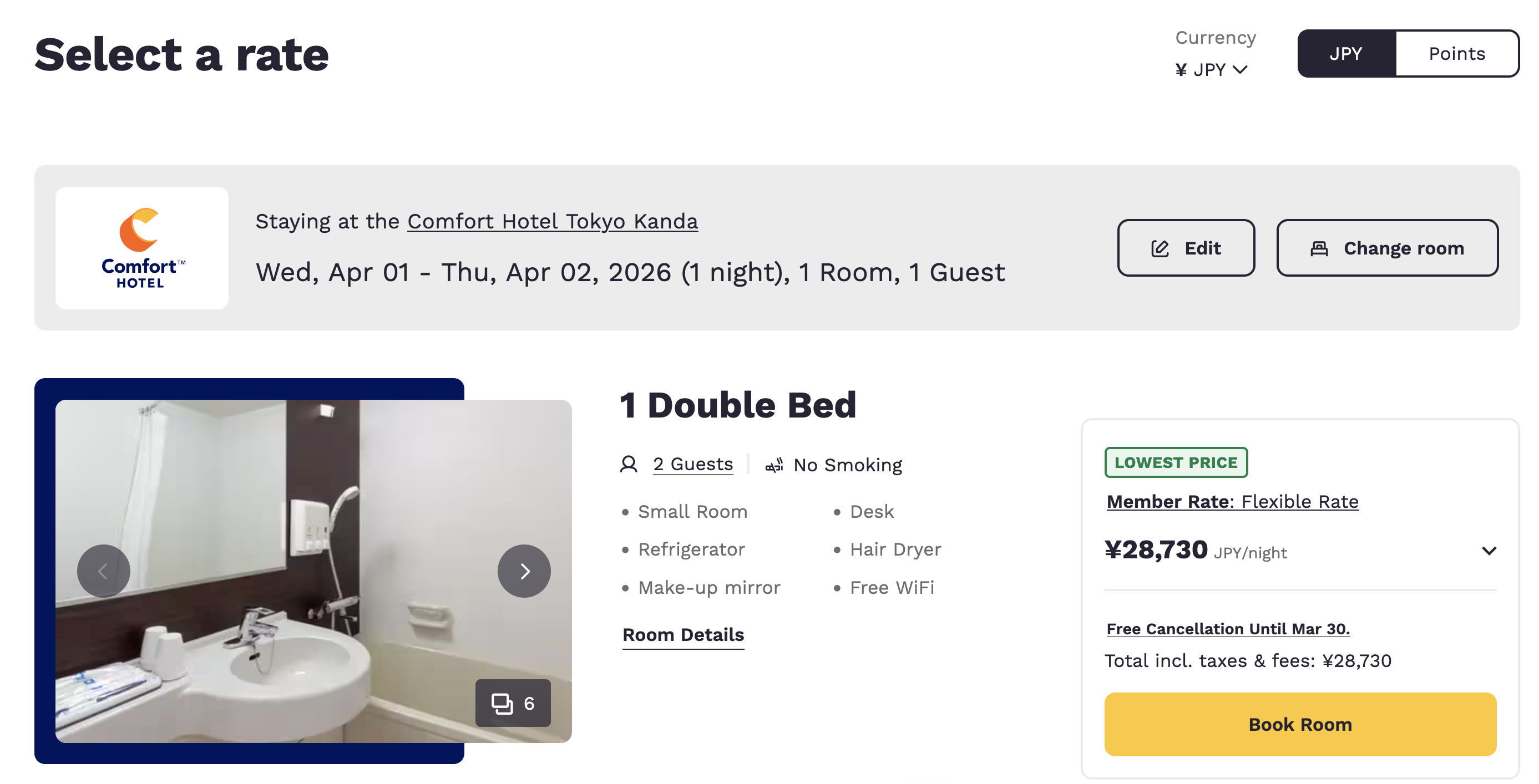

Here’s an example of a Comfort Inn in Tokyo that you could book during cherry blossom season for just 10,000 Capital One miles, transferred to Choice Privileges.

The cash price of this room is 28,730 Japanese yen, or about $186, yielding a respectable return of 1.86 cents per mile ($186 cash price divided by 10,000 miles).

You could spend 120,000 miles from the Venture X welcome offer on 12 nights here, and get a value approaching $1,900.

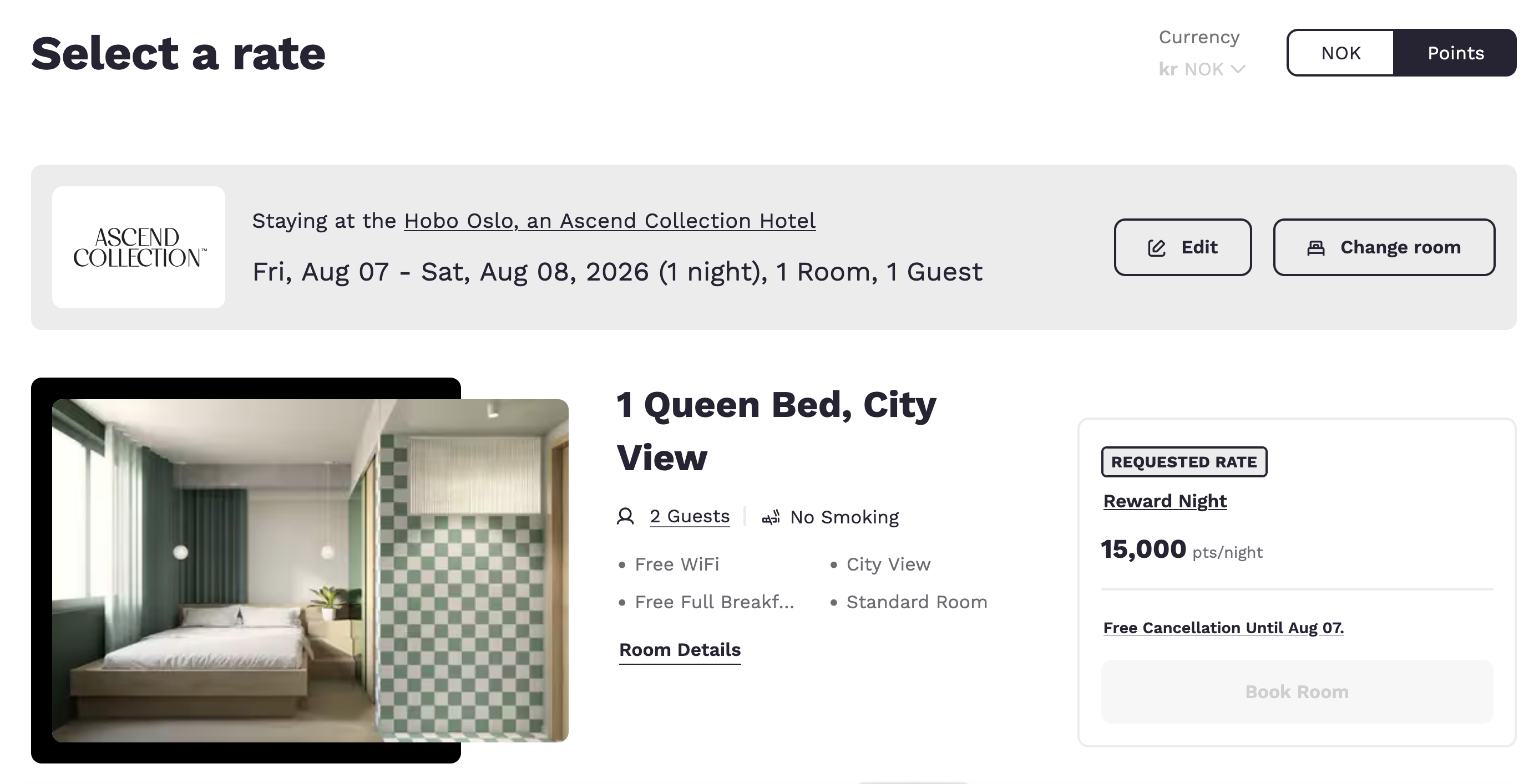

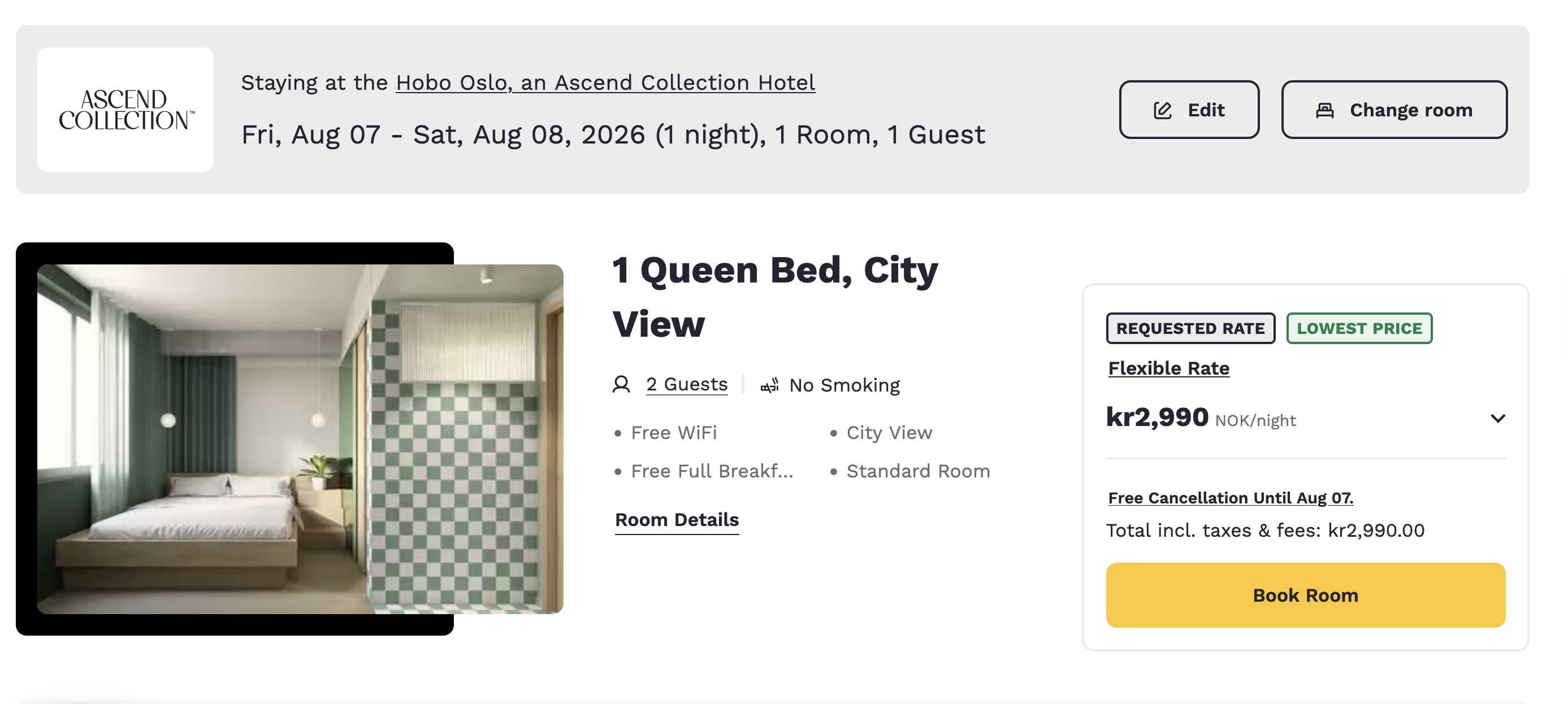

Similarly, if you have your eye on Norway, consider the Hobo Oslo, an Ascend Collection Hotel. You could book award nights there this summer for 15,000 Capital One miles transferred to Choice Privileges.

If you paid cash, it would cost 2,990 Norwegian kroner per night, or about $297 — a value of 1.98 cents per mile ($297 cash price divided by 15,000 points). You could stretch 120,000 Capital One miles to get eight nights here worth around $2,376.

Choice Hotels in the US tend to be quite inexpensive, so if you want to use Capital One miles to book Choice properties, compare the cash and award prices to see if erasing the purchase with miles is a better deal than booking an award stay.

How Not to Use Your Venture X Miles

Not every Capital One miles redemption delivers great value. Avoid these options if you want to preserve the full potential of your miles:

- Cash back: While it’s possible to redeem miles for cash back, you’ll get a poor return rate of just 0.5 cents per mile — so 120,000 miles is worth a paltry $600.

- Pay With Points: You can link your Capital One and Amazon or PayPal accounts and redeem miles at 0.8 cents each at checkout, making 120,000 miles worth just $960 in purchases.

- Gift cards: You’ll typically get a value of 0.8 to 1 cent per mile when you cash them in for gift cards; here, again, you’re looking at a value of $960 to $1,200 for 120,000 miles.

- Capital One Entertainment: This platform allows you to use miles for hard-to-get event tickets, VIP packages and other exclusive experiences. The value varies, but typically won’t be as good as redeeming miles for travel.

Other Strategies To Stretch Your Capital One Miles Further

Making the most of the Venture X’s intro offer is just part of the equation if you want to maximize your miles. Combining your Capital One Venture X benefits with your welcome offer haul can get you more travel (or fancier trips) if you’re strategic.

Stack Card Benefits

You’ll get an even better value from your Capital One Venture X when you utilize these perks:

- $300 annual travel credit: You’ll receive a $300 Capital One Travel credit at account opening, and again every year on your card anniversary. This credit is as good as cash toward Capital One Travel bookings, and you can combine it with miles to make your rewards go further.

- 10,000 anniversary miles: Each year on your account anniversary, you’ll receive 10,000 miles (worth at least $100 in travel) . This can boost your account balance to help you reach a redemption goal.

- Airport lounge access: The Venture X gets you access to Priority Pass when you enroll and Capital One Lounges, so keep an eye out for locations where you can use this benefit to upgrade your travel experience. Pro tip: The Capital One Landing at Washington National (DCA) has incredible tapas — I’ve never had a meal like that in any airport.

- Speed up your airport experience: The Venture X provides a statement credit of up to $120 every four years to cover the cost of TSA PreCheck or Global Entry. Enrolling in one of these Trusted Traveler programs can shave time off waiting in long airport security lines (and get you to the lounge sooner).

- Travel insurance: As one of the best credit cards for travel insurance, using the Venture X to pay for your travel (or taxes and fees on award tickets) can unlock protections like primary rental car insurance, trip cancellation/interruption insurance, trip delay reimbursement and lost luggage reimbursement.

Combine Miles

You can pool your Venture X miles with rewards earned from other Capital One cards to reach your goals faster. You can also transfer miles to another cardholder for free, which is ideal for couples or families working toward earning enough rewards for a trip.

Mix Redemptions

There’s no harm in splitting up your redemptions — you don’t have to commit all of your miles to one use. I sometimes use miles to offset travel purchases, and at other times, transfer them to partners for award travel.

Bottom Line

The new Capital One Venture X limited-time offer of 100,000 miles after spending $10,000 on purchases in the first six months of account opening is a rare opportunity. Once you meet the minimum spending requirement, you’ll have at least 120,000 miles in your account, and that’s where the fun begins.

If you prefer simplicity, it’s an easy win to redeem those miles for $1,200 in flights, accommodations or car rentals booked through Capital One, or to erase eligible travel purchases from your statement. However, for those who enjoy scrutinizing transfer partners and award charts, the challenge of maximizing value from those miles — in some cases, thousands of dollars’ worth in return — can be extra gratifying.

But whatever you do, avoid redeeming miles for cash back, because your value is shaved in half (or more) when you use rewards this way. If cash back is your preference, consider one of the best cash-back credit cards instead.

For Capital One products listed on this page, some of the benefits may be provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

Frequently Asked Questions About the Capital One Venture X 100K Offer

How long will the 100K Venture X offer last?

Capital One hasn’t confirmed an exact end date for the limited-time Venture X offer, but has confirmed the offer is ending soon, so it’s your last chance to apply.

How much are Capital One miles worth?

Capital One miles are worth 1 cent each toward statement credits for eligible travel purchases or for Capital One Travel bookings. You can get an even higher value by transferring miles to partners and redeeming rewards strategically, but you’ll get a relatively poor value of 0.5 to 0.8 per mile for most non-travel redemptions.

Do Capital One miles expire?

No, Capital One miles don’t expire as long as your account is open and in good standing.

Can I share or transfer Capital One miles with someone else?

Yes, you can transfer miles instantly at no cost to another Capital One cardholder.

What credit score do I need for Venture X?

Based on what we’ve seen, you’ll typically need excellent credit (a score of 720 or better) for the best shot at getting approved for the Capital One Venture X. Keep in mind that the issuer will look at additional factors, including other Capital One cards you have open or received a welcome offer for, when deciding on your application.