How To Maximize the Capital One Venture Welcome Offer

The Capital One Venture Rewards Credit Card is an excellent travel credit card, whether you’re new to points and miles or an expert at redeeming rewards. And now the Venture Card is even sweeter with the launch of an elevated welcome offer.

For a limited time, you can earn $250 to use on Capital One Travel in your first cardholder year. Plus, you can earn 75,000 bonus miles after spending $4,000 on purchases in the first three months of account opening.

Let’s look at how the Capital One Venture welcome offer works and the best ways to maximize your rewards.

400+ Credit Cards

Analyzed independently across 50+ data points in 30+ product categories

Reviewed

By a team of credit card experts with an average of 9+ years of experience

Trusted by

More than one million monthly readers seeking unbiased credit card guidance

CardCritics™ editorial team is dedicated to providing unbiased credit card reviews, advice and comprehensive comparisons. Our team of credit card experts uses rigorous data-driven methodologies to evaluate every card feature, fee structure and rewards program. In most instances, our experts are longtime members or holders of the very programs and cards they review, so they have firsthand experience maximizing them. We maintain complete editorial independence — our ratings and recommendations are never influenced by advertiser relationships or affiliate partnerships. You can learn more about our editorial standards, transparent review process and how we make money to understand how we help you make informed financial decisions.

What Is the Capital One Venture Welcome Offer?

The Capital One Venture Card offers a welcome offer to new cardholders who spend a certain amount within a specific time period. Here’s how it breaks down.

Welcome offer Structure

The Venture Card offer is awarded in two parts:

- After account opening, you’ll receive a $250 credit to use toward flights, hotels, car rentals and vacation rentals booked through Capital One Travel

- After spending $4,000 on purchases in the first three months of account opening, you’ll earn 75,000 bonus miles

This welcome offer is unique in that there’s no minimum spending requirement to earn the Capital One Travel credit. However, to unlock the bonus miles, you’ll need to spend an average of $1,333 a month in the first three months ($4,000 in total).

Why the Capital One Venture Welcome offer Is So Valuable

The Capital One Travel credit is a new, limited-time addition to this offer, while the miles component is the same as the previous offer.

How Much Are Capital One Miles Worth?

The value of Capital One miles varies depending on how you redeem them. You’ll get the best return when you redeem Capital One miles for travel, but there are other (less valuable) options as well:

| Redemption | Value | Description |

| Capital One Travel | 1 cent per mile | Book flights, hotels, rental cars and vacation rentals through Capital One Travel |

| Purchase Eraser | 1 cent per mile | Use miles to “erase” eligible travel purchases made in the past 90 days from your statement |

| Transfer Miles to Partners | Varies | Transfer miles to Capital One’s airline and hotel partners to book award travel |

| Gift Cards | 0.8 to 1 cent per mile | Purchase gift cards with miles through Capital One |

| Pay With Miles | 0.8 cents per mile | Redeem miles with PayPal or at Amazon checkout |

| Cash Back | 0.5 cents per mile | Use miles for a statement credit or check |

| Capital One Entertainment | Varies | Redeem miles through Capital One Entertainment for tickets to exclusive events, concerts, theater productions and sports games |

If you redeem miles through Capital One Travel, or erase recent eligible travel purchases from your statement (1 cent per mile), the 75,000 miles from the welcome offer are worth $1,000. That’s not even counting the $250 Capital One Travel credit.

However, if you transfer miles to Capital One’s airline and hotel partners, you could get an even higher value from your rewards.

Best Ways To Redeem Miles From the Welcome Offer

The best way to redeem your Capital One Venture Card welcome offer is by transferring your miles to partners. Check out the full list:

| Loyalty Program | Transfer Ratio | Minimum Transfer Amount |

| Accor Live Limitless | 2:1 | 1,000 miles |

| Aeromexico Rewards | 1:1 | 1,000 miles |

| Air Canada Aeroplan | 1:1 | 1,000 miles |

| Avianca LifeMiles | 1:1 | 1,000 miles |

| Cathay Pacific Asia Miles | 1:1 | 1,000 miles |

| Choice Privileges | 1:1 | 1,000 miles |

| Emirates Skywards | 2:1.5 | 1,000 miles |

| Etihad Guest | 1:1 | 1,000 miles |

| EVA Air Infinity MileageLands | 2:1.5 | 1,000 miles |

| Finnair Plus | 1:1 | 1,000 miles |

| Flying Blue (Air France-KLM) | 1:1 | 1,000 miles |

| I Prefer Hotel Rewards | 1:2 | 1,000 miles |

| Japan Airlines Mileage Bank | 2:1.5 | 1,000 miles |

| JetBlue TrueBlue | 5:3 | 1,000 miles |

| Qantas Frequent Flyer | 1:1 | 1,000 miles |

| Qatar Airways Privilege Club | 1:1 | 1,000 miles |

| Singapore Airlines KrisFlyer | 1:1 | 1,000 miles |

| TAP Miles&Go | 1:1 | 1,000 miles |

| The British Airways Club | 1:1 | 1,000 miles |

| Turkish Airlines Miles&Smiles | 1:1 | 1,000 miles |

| Virgin Red | 1:1 | 1,000 miles |

| Wyndham Rewards | 1:1 | 1,000 miles |

Let’s look at a couple of examples of how to get the most value from the Venture Card welcome offer by transferring to partners.

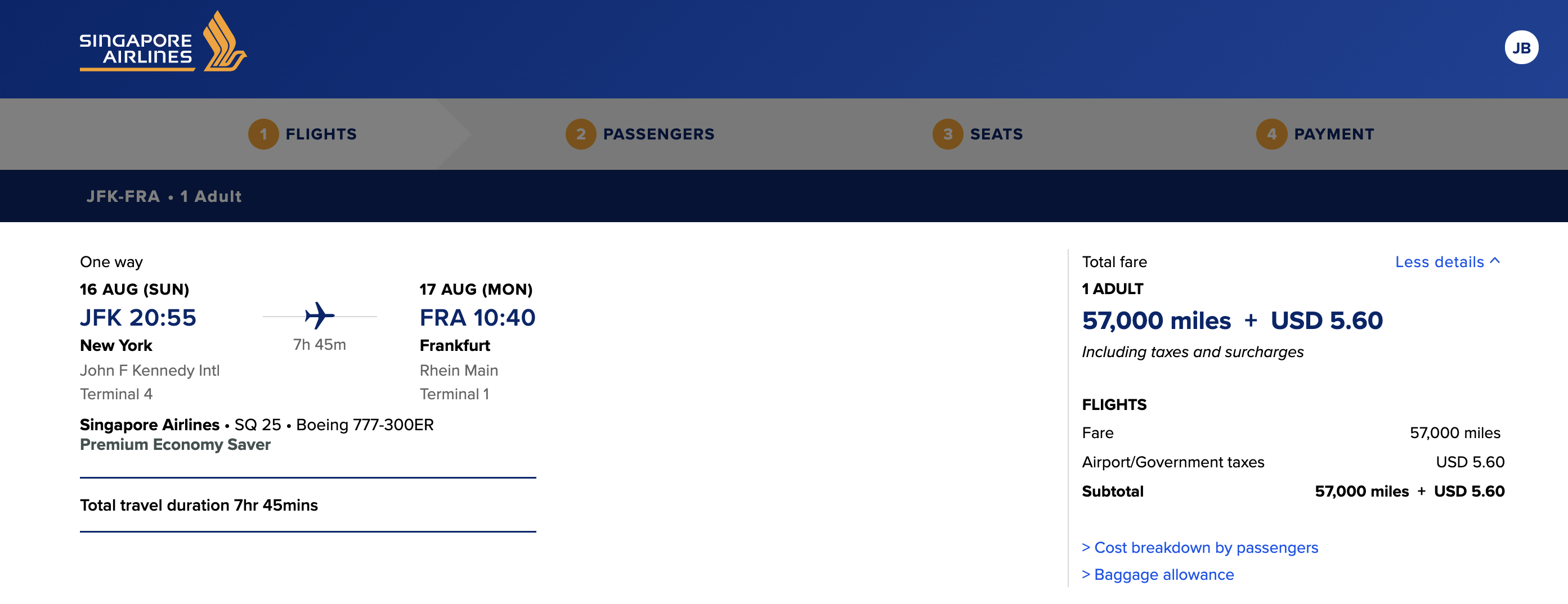

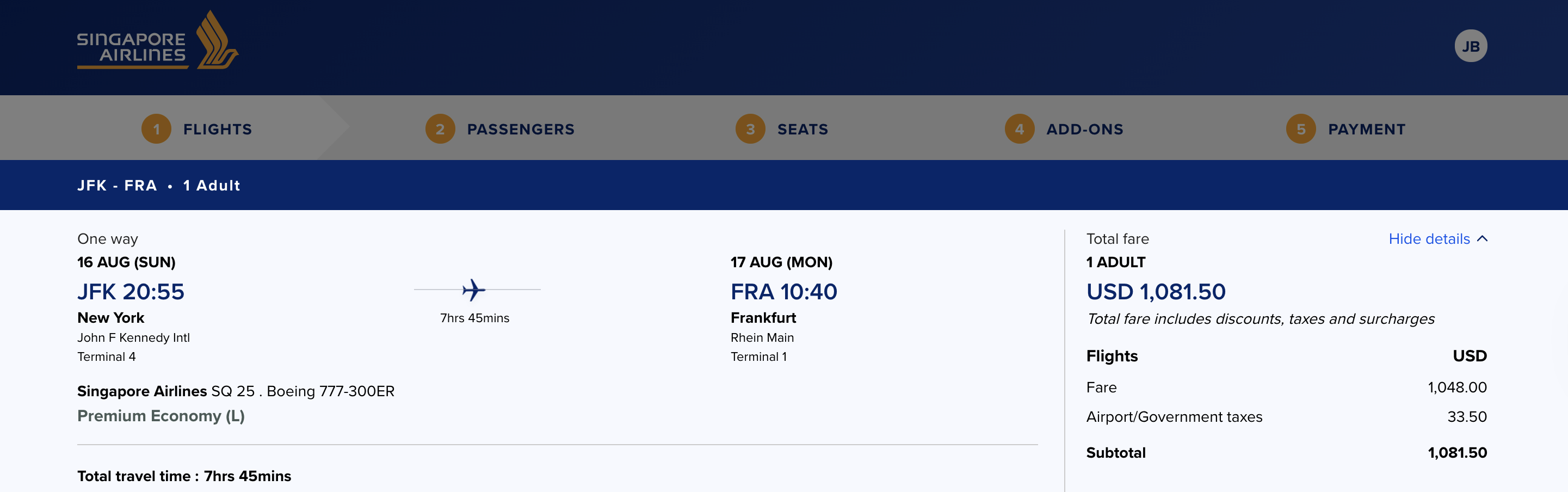

Singapore Airlines From New York to Frankfurt

Singapore Airlines operates an unusual route between New York-JFK and Frankfurt (FRA), with a continuation onward to Singapore (SIN). You can book a premium economy seat on this flight for just 57,000 Singapore Airlines miles and $5.60 in taxes and fees.

If you paid for the same flight in cash, it would cost $1,081.50.

By transferring 57,000 Capital One miles to Singapore Airlines, you can book this trip — and get a value of around 1.9 cents per mile ($1,081.50 minus $5.60 in taxes, divided by 57,000 miles). That’s nearly double the value you’d receive if you booked this flight through Capital One Travel or redeemed miles with purchase eraser to offset the charge.

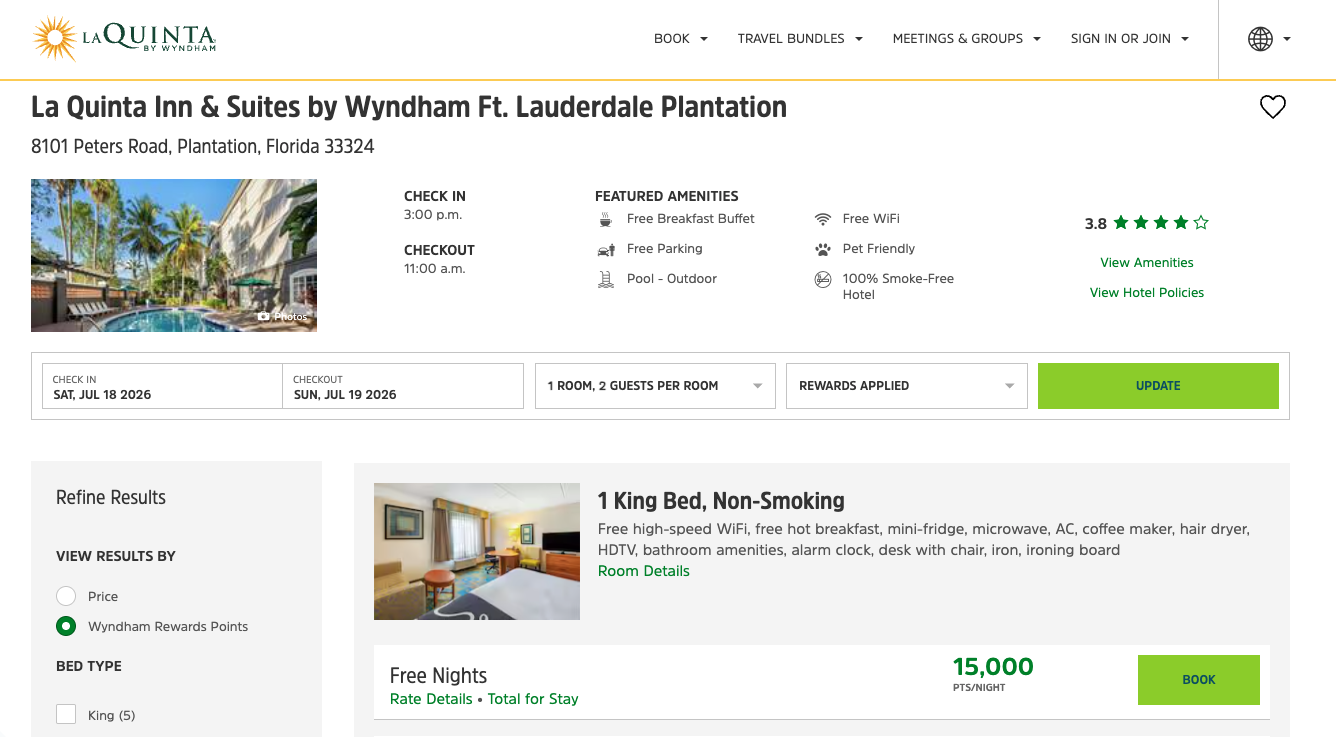

Expensive Wyndham or Choice Hotel Stays

Wyndham Rewards and Choice Privileges aren’t the most aspirational hotel loyalty programs, since most of their brands are geared to budget travelers. However, they can be immensely valuable for booking stays that would otherwise cost an arm and a leg — particularly during peak season or when demand is high.

Consider the much-anticipated FIFA World Cup 2026. The bronze medal match will be held on July 18, 2026, at Hard Rock Stadium in Miami Gardens, Florida. Have a look at the cash price of a stay at the La Quinta Inn & Suites Fort Lauderdale Plantation, located about 14 miles from the stadium. It’s not a fancy hotel, but for that night, you’d pay $705.03, including taxes.

Instead, you could transfer 15,000 Capital One miles to Wyndham Rewards to book the exact same room.

Crunching the numbers, you’d get an impressive value of 4.7 cents per mile in this case ($705.03 divided by 15,000).

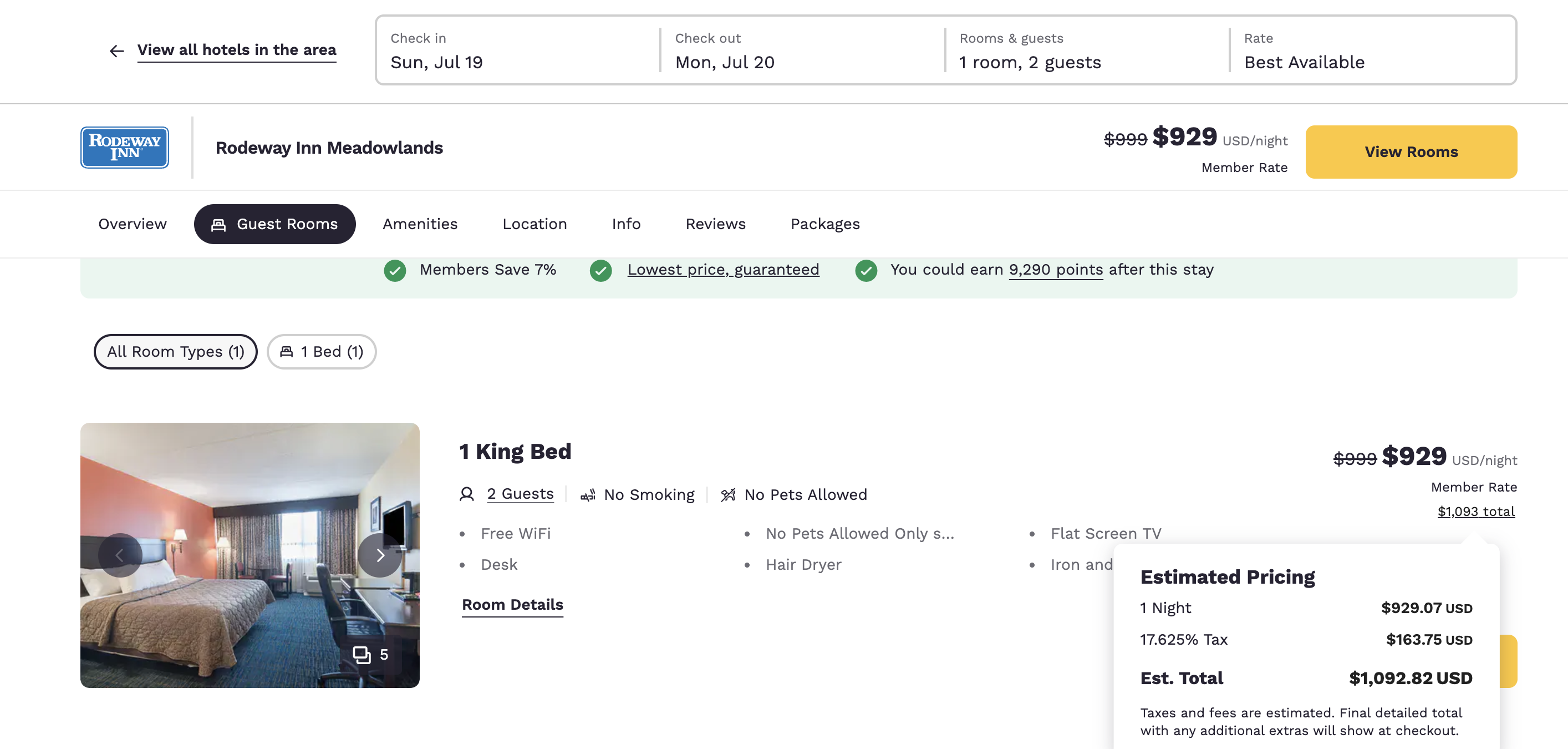

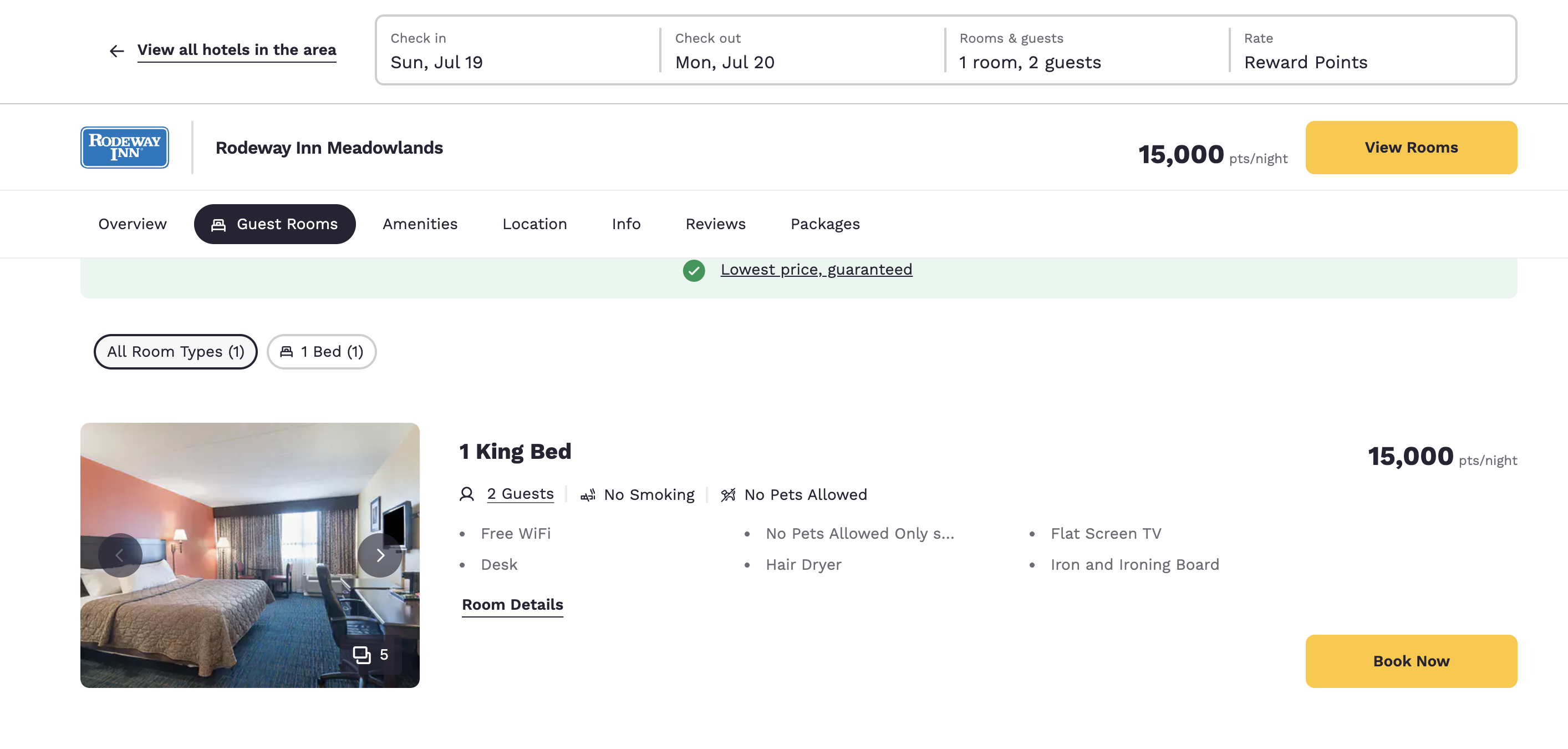

But what about the FIFA World Cup final match, to be held on July 19, 2026, at MetLife Stadium in East Rutherford, New Jersey? The decidedly not luxurious Rodeway Inn Meadowlands, just 2 miles from the stadium, costs a whopping $1,092.82 that night, including taxes.

Alternatively, you could transfer 15,000 Capital One miles to Choice Privileges and book the same room, yielding a stunning value of nearly 7.3 cents per mile ($1,092.82 divided by 15,000).

Keep in mind, these are extreme examples, but it’s not uncommon to see jacked-up rates like this for big-name concerts, sporting events and conventions. That’s where credit card rewards can come in clutch, particularly transferable rewards like Capital One miles.

For more booking examples using Capital One miles, read our guide to maximizing the Capital One Venture X Rewards Credit Card welcome offer. The Venture X is the Venture Card’s premium sibling, and also earns miles that you can redeem in the same ways.

How To Earn the Capital One Venture Welcome Offer Faster

It might feel like a challenge to meet the Venture Card’s minimum spending requirement of $4,000 in purchases within three months of account opening. However, you can speed your progress toward that goal by being savvy about your spending.

Smart Spending Strategies To Meet the Minimum Requirement

To reach the minimum spend requirement faster, be sure to put every possible expense you can on your new card — even small ones like your morning drive-thru coffee or pack of gum at the gas station — as well as gas, groceries, dining and other household purchases. Every little bit counts.

Beyond that, you can be strategic by:

- Timing large purchases after opening the card: If you have a home-improvement project coming up, consider buying supplies early. Or, if you’re planning a vacation for later in the year, booking hotels, flights and tours now could go a long way toward hitting your spending goal.

- Prepaying routine expenses: You may be able to pay for routine expenses in advance — think utilities, cell phone bills, insurance payments and the like. Just be sure you can pay your credit card statement in full and on time to avoid interest charges.

- Adding an authorized user: When you add an additional cardholder (make sure it’s someone you trust!), their purchases will count toward your minimum spending requirement, too. This could be a parent, child, sibling or partner.

What Counts (and Doesn’t Count) Toward Earning the Welcome offer

You’ll also want to be mindful of what counts toward meeting the minimum spending required to trigger the Venture Card welcome offer. The key thing to remember is you’ll need to make $4,000 in purchases (less any returns/refunds). I always try to exceed the minimum spending by a couple of hundred bucks in case I have to return an item later, for example.

Also, the following types of purchases and transactions typically do not count toward meeting the minimum spending requirement (on any card):

- Fees, including the annual fee, interest, late fees and other bank charges

- Balance transfers

- Cash advances

- Cash-like transactions, such as money orders, wire transfers, P2P payments, casino gambling chips and lottery tickets

Stacking Value After You Earn the Welcome Offer

Beyond the miles you’ll earn from the welcome offer, the Capital One Venture Card comes with benefits that offer even more value.

Using the Capital One Travel Credit

The $250 Capital One Travel credit that comes with the Venture Card welcome offer is valid through your first year of card membership, so there’s no rush to use it right away.

When you’re ready to book, you can combine the credit with miles from your account (or pay any amount over $250 with your card). Keep in mind the card earns unlimited 5x miles on hotels, rental cars and vacation rentals booked through Capital One Travel, so for a pricey booking, you could stand to earn a significant amount of miles.

Capital One Travel comes with other perks, including:

- Flight price prediction and alerts

- Free price drop protection for flights

- Price match guarantee

- Cancel flights for any reason (fee applies)

- Access to the luxury Premier Collection and Lifestyle Collection of hotels, which include elite-like benefits

- Flight status alerts (upon enrollment)

However, Capital One Travel has drawbacks. Because you’re booking through a third party, you won’t be able to change or cancel your bookings directly with the airline or hotel. And, you typically won’t earn hotel points or elite status credits on hotel bookings, and may not have your elite status recognized when you don’t book directly.

Making the Most of Other Card Benefits

Although the Venture Card charges a $95 annual fee, you can easily justify it if you take advantage of the card’s rewards and additional benefits. These include:

- A generous 2x miles earning rate on most purchases (except hotels, car rentals and vacation rentals booked through Capital One Travel, which earn 5x miles)

- Up to $120 in statement credits toward the application fee for Global Entry or TSA PreCheck every four years

- Hertz Five Star status* (enrollment required), which comes with perks such as complimentary upgrades, a wider selection of cars and a 25% bonus on Hertz rentals

- Decent travel insurance and purchase protections, including secondary car rental insurance, travel accident insurance, travel and emergency assistance services, and extended warranty coverage

I’m particularly fond of the TSA PreCheck/Global Entry credit, especially since you can use your card to pay for someone else’s application fee and get reimbursed. Joining one of these Trusted Traveler Programs can save you loads of time waiting in airport lines — I always suggest getting Global Entry, because it includes TSA PreCheck benefits.

Common Mistakes That Can Cost You the Welcome Offer

You’ve applied for the Venture Card, gotten approved and have your card in hand. Make sure you don’t fumble and miss out on your welcome offer.

Missing the Spending Deadline

To earn the welcome offer, you’ll need to spend $4,000 on purchases in the first three months of account opening. The clock starts the day you’re approved for the card — not when you receive it in the mail or make your first purchase.

It can take a couple of weeks for your card to arrive, so be sure to time your spending correctly. I keep a spreadsheet of card opening dates and deadlines (and set calendar reminders) to ensure I meet the minimum spending requirement in the required timeframe.

Don’t leave spending until the last minute, either. Some purchases can take a while to post to your account, such as online purchases that don’t get charged until the item ships. Be sure to factor in any returns you make, as well; those will be subtracted from your spending requirement, so if you think you might need to take something back to the merchant, give yourself some wiggle room.

And, again, balance transfers, cash advances, P2P payments and other cash-like transactions won’t count toward the spending requirement. The $95 annual fee doesn’t count, either.

Applying When You’re Not Eligible

You won’t be approved for the Venture Card if you’ve earned a new cardmember welcome offer for the Venture Card or the Capital One Venture X card in the past 48 months.

To be eligible to apply, you’ll also likely need at least a good credit score (670 or higher on FICO’s scale). Capital One will consider other factors when evaluating your application, so a good credit score isn’t a guarantee of approval.

Is the Capital One Venture Welcome Offer Worth It?

The limited-time Capital One Venture Card welcome offer is a terrific opportunity for many, but it’s not perfect for everyone.

Best for These Types of Cardholders

The Venture Card is worth it if:

- You travel frequently and appreciate the ease and value of Capital One miles

- Capital One’s transfer partners are appealing to you

- You can make the most of benefits such as travel insurance, access to Capital One Travel and a TSA PreCheck/Global Entry fee credit

- You don’t mind paying a $95 annual fee upfront

- Extras like airport lounge access or hotel elite status aren’t important to you

- You aren’t looking for a card with an introductory 0% APR offer

If you’re already invested in Capital One’s rewards program, the Venture Card can be a great complement to other cards you have. Pro tip: When you have the Venture Card or other Capital One miles-earning card, and also have a Capital One credit card that earns cash back, you can convert your cash-back rewards to Capital One miles at a rate of 1 cent = 1 mile.

When Another Card Might Be Better

For those who don’t travel often and prefer earning flexible rewards, a cash-back credit card may be a better choice. While you can redeem Venture miles for cash back, the rate is 0.5 cents per mile — essentially halving your value.

And, if the annual fee is a dealbreaker for you, you still have options — check out our guide to the best no-annual-fee travel credit cards to find the perfect fit for you. For example, the Capital One VentureOne Rewards Credit Card also earns Capital One miles with similar redemption options, and it doesn’t charge an annual fee.

For Capital One products listed on this page, some of the benefits may be provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

**Upon enrollment, accessible through the Capital One website or mobile app, eligible cardholders will remain at that status level through the duration of the offer. Please note, enrolling through the normal Hertz Gold Plus Rewards enrollment process (e.g. at Hertz.com) will not automatically detect a cardholder as being eligible for the program and cardholders will not be automatically upgraded to the applicable status tier. Additional terms apply.

Frequently Asked Questions About the Capital One Venture Welcome offer

How long will the Capital One Venture Card limited-time welcome offer last?

Capital One hasn’t shared an end date for the Venture Card’s limited-time welcome offer. From past experience, elevated offers like this typically last for a month or two, so if you’re interested in applying, you should do so quickly.

How much is the Capital One Venture Card welcome offer worth?

The 75,000 miles from the Venture Card welcome offer are worth $1,000 when you redeem them for Capital One Travel bookings or to erase recent eligible travel purchases from your statement. You could get an even higher value if you transfer your miles to Capital One’s partners to book award flights and stays.

Tack on the $250 Capital One Travel credit, and you’re looking at a minimum of $1,000 in value from a single card welcome offer. That’s an excellent offer.

Does the Capital One Venture Card offer airport lounge access?

No, the Venture Card doesn’t come with airport lounge access. However, the card’s premium sibling, the Capital One Venture X, offers Priority Pass at participating lounges and Capital One Lounge access.

Which is better, the Capital One Venture Card or Venture X?

In terms of perks, Venture X benefits far outshine those of the Venture Card. But you’ll have to weigh those against the Venture X’s hefty $395 annual fee. That said, the Capital One Venture X is worth it if you can maximize benefits such as airport lounge access, a $300 annual Capital One Travel credit, a 10,000-mile bonus each account anniversary, and superior travel insurance coverage.