Best Balance Transfer Credit Cards for March 2026

When you’re carrying a significant balance on your credit card, you may be shocked to discover how much money you’re racking up on interest charges alone. If you’re looking for a way to pay down your credit card debt efficiently, a balance transfer is a smart financial tool to consider.

Many balance transfer cards offer 0% intro APR for over a year and a half, giving you the breather you need to pay down your balance.

Below are the best balance transfer credit cards on the market for consumers with good to excellent credit.

400+ Credit Cards

Analyzed independently across 50+ data points in 30+ product categories

Reviewed

By a team of credit card experts with an average of 9+ years of experience

Trusted by

More than one million monthly readers seeking unbiased credit card guidance

CardCritics™ editorial team is dedicated to providing unbiased credit card reviews, advice and comprehensive comparisons. Our team of credit card experts uses rigorous data-driven methodologies to evaluate every card feature, fee structure and rewards program. In most instances, our experts are longtime members or holders of the very programs and cards they review, so they have firsthand experience maximizing them. We maintain complete editorial independence — our ratings and recommendations are never influenced by advertiser relationships or affiliate partnerships. You can learn more about our editorial standards, transparent review process and how we make money to understand how we help you make informed financial decisions.

Quick Overview: Best Balance Transfer Credit Cards

| Our Choice For | Credit Range | Annual Fee | Highlights | |

|---|---|---|---|---|

| Intro APR |

Excellent/Good

670 – 850*

|

$0 |

Pay no interest for nearly 2 years 0% intro APR for 21 months from account opening on purchases and on qualifying balance transfers, then a 17.49%, 23.99%, or 28.24% Variable APR

Apply Now

More Details

|

|

| Ultra-Long Intro APR |

Excellent/Good

670 – 850*

|

$0 |

Incredible intro APR on purchases and balance transfers0% intro APR on purchases and balance transfers for 24 billing cycles. After that the APR is variable, currently 17.24%-28.24%.

Full Review

More Details

|

|

| Balance Transfers |

Excellent/Good

670 – 850*

|

$0 |

No Late Fees & an incredibly long intro APR on balance transfers 0% Intro APR on purchases for 12 months and 0% Intro APR on balance transfers for 21 months, then 17.49% – 28.24% (Variable)

Apply Now

More Details

|

|

| Balance Transfers |

Excellent/Good

670 – 850*

|

$0 |

Citi Entertainment® Perks & an incredibly long intro APR on balance transfers 0% intro APR for 12 months on Purchases and 21 months on Balance Transfers then 16.49% – 27.24% (Variable)

Apply Now

More Details

|

|

| Intro APR |

Good – Excellent

670 – 850*

|

$0 |

Long intro APR on purchases and balance transfers 0% Intro APR on Purchases and Balance Transfers for 21 Months, then 18.24% – 28.24% Variable

Apply Now

More Details

|

|

| 2% Cash Back |

Excellent/Good

670 – 850*

|

$0 |

Extra long intro APR on balance transfers, generous welcome bonus, and 2% cash back Earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases. To earn cash back, pay at least the minimum due on time. Plus, earn 5% total cash back on hotel, car rentals and attractions booked with Citi Travel.

Apply Now

More Details

|

|

| Balance Transfers |

Excellent/Good

670 – 850*

|

$0 |

0% Intro APR for purchases and balance transfers0% Intro APR for 18 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the intro APR offer ends a 14.49% to 24.49% Variable APR on purchases and balance transfers will apply.

Full Review

More Details

|

|

| Balance Transfers |

Excellent/Good

670 – 850*

|

$0 |

Incredibly long intro APR on balance transfers 0% Intro APR on purchases for 6 months and 0% Intro APR on balance transfers for 18 months, followed by 17.49% – 26.49% Variable APR

Apply Now

More Details

|

|

| Balance Transfer Intro APR |

Good – Excellent

670 – 850*

|

$0 |

Long intro APR on balance transfers 0% introductory APR for the first 18 billing cycles on balance transfers made within the first 90 days of account opening. After that, 17.49% – 27.49% variable APR based on your creditworthiness. A 17.49%, 19.49%, 22.49%, 25.49% or 27.49% variable APR based on your creditworthiness applies to purchases.

Apply Now

More Details

|

|

| Cash Back |

Good – Excellent

670 – 850*

|

$0 |

Earn an intro offer worth $200 Earn a $200 Bonus after you spend $500 on purchases in your first 3 months from account opening

Apply Now

More Details

|

|

| Rotating Bonus Categories |

Good – Excellent

670 – 850*

|

$0 |

Up to 5% cash back on certain categories each quarter 5% cash back on up to $1,500 in combined purchases in bonus categories each quarter you activate. Enjoy new 5% categories each quarter!

5% cash back on travel purchased through Chase Travel℠, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more. 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1% cash back on all other purchases.

Full Review

More Details

|

|

| Cash Back Card |

Good – Excellent

|

$0 |

Earn a welcome offer and 1% – 3% cash back Earn 3% cash back at U.S. supermarkets on up to $6,000 per year in purchases, then 1%.

Earn 3% cash back on U.S. online retail purchases, on up to $6,000 per year, then 1%. Earn 3% cash back at U.S. gas stations, on up to $6,000 per year in purchases, then 1%. Cash back is received in the form of Reward Dollars that can be redeemed as a statement credit and at Amazon.com checkout.

Apply Now

More Details

|

|

| Cash Back |

Excellent/Good

670 – 850*

|

$0 |

Welcome bonus opportunity, generous intro APR, and choose your 6% cash back category 6% cash back for the first year in the category of your choice and 2% cash back at grocery stores and wholesale clubs for the first $2,500 in combined choice category / grocery store / wholesale club quarterly purchases.

After the first year from account opening, you’ll earn 3% cash back on purchases in your choice category and 2% cash back at grocery stores and wholesale clubs, up to the quarterly maximum. 1% cash back on all other purchases.

Apply Now

More Details

|

|

| Cash Back |

Excellent/Good

670 – 850*

|

$0 |

Unlimited 2% cash back for the first year on all purchases, generous intro APR, $200 bonus opportunity $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening

Apply Now

More Details

|

|

| Flexible Cash Back |

Excellent/Good

670 – 850*

|

$0 |

Earn a welcome bonus and 1% – 5% cash back Earn 5% cash back on purchases in your top eligible spend category each billing cycle, up to the first $500 spent, 1% cash back thereafter. Also, earn unlimited 1% cash back on all other purchases. Plus, earn an additional 4% cash back on hotels, car rentals, and attractions booked with Citi Travel®.

Full Review

More Details

|

|

| Customizable Rewards With No Annual Fee |

Excellent/Good

670 – 850*

|

$0 |

Earn a welcome bonus and up to 5x Citi ThankYou® points in useful categories Earn 3 ThankYou® Points for each $1 spent in an eligible Self-Select Category of your choice (Fitness Clubs, Select Streaming Services, Live Entertainment, Cosmetic Stores/Barber Shops/Hair Salons, or Pet Supply Stores). Choose your eligible Self-Select Category on Citi Online or by calling customer service. The default Self-Select Category is Select Streaming Services. Earn 5 ThankYou® Points for each $1 spent on Hotels, Car Rentals and Attractions booked on Citi Travel® via cititravel.com; earn 3 ThankYou Points for each $1 spent at Supermarkets, on Select Transit purchases, and at Gas & EV Charging Stations. Earn 2 ThankYou® Points for each $1 spent at Restaurants; earn 1 ThankYou® Point for each $1 spent on All Other Purchases.

Apply Now

More Details

|

|

| Balance Transfers for Military Members |

Good – Excellent

600 – 850

|

$0 |

Pay no interest for 15 months on balance transfers. Get a 0% intro APR for 15 months on balance transfers and convenience checks that post within 90 days of account opening. After this time, the 11.15% to 25.15% variable regular APR will apply to introductory balances. A 11.15% to 25.15% variable regular APR will apply for purchases.

Full Review

More Details

|

|

| Cash Back |

Excellent/Good

670 – 850*

|

$0 |

Earn 2% Cash Rewards plus a $200 bonus Earn a $200 cash rewards bonus after spending $500 in purchases in the first 3 months.

Apply Now

More Details

|

|

| Cash Back on Groceries |

Good – Excellent

|

$0 intro annual fee for the first year, then $95. |

Earn a welcome offer and 1% – 6% cash back Earn 6% cash back at U.S. supermarkets on up to $6,000 per year in purchases (then 1%).

Earn 6% cash back on select U.S. streaming subscriptions. Earn 3% cash back at U.S. gas stations and on transit (including taxis/rideshare, parking, tolls, trains, buses and more). Earn 1% cash back on other purchases. Cash back is received in the form of Reward Dollars that can be redeemed as a statement credit and at Amazon.com checkout.

Apply Now

More Details

|

Detailed Overview: Best Balance Transfer Credit Cards

Top Feature

Low deductible cell phone protection

Purchase & Balance Transfer APR

0% intro APR for 21 months from account opening on purchases and on qualifying balance transfers, then a 17.49%, 23.99%, or 28.24% Variable APR

CardCritics™ Opinion

Recommended Credit Score

Annual Fee

Cash Rewards

Card Details From Issuer

- Apply Now to take advantage of this offer and learn more about product features, terms and conditions.

- 0% intro APR for 21 months from account opening on purchases and qualifying balance transfers. 17.49%, 23.99%, or 28.24% variable APR thereafter; balance transfers made within 120 days qualify for the intro rate, BT fee of 5%, min: $5.

- $0 annual fee.

- Up to $600 of cell phone protection against damage or theft. Subject to a $25 deductible.

- Through My Wells Fargo Deals, you can get access to personalized deals from a variety of merchants. It’s an easy way to earn cash back as an account credit when you shop, dine, or enjoy an experience simply by using an eligible Wells Fargo credit card.

Top Feature

Low deductible cell phone protection

Purchase & Balance Transfer APR

0% intro APR on purchases and balance transfers for 24 billing cycles. After that the APR is variable, currently 17.24%-28.24%.

CardCritics™ Opinion

Recommended Credit Score

Annual Fee

Cash Rewards

Card Details From Issuer

- 0% intro APR on purchases and balance transfers for 24 billing cycles. After that, the APR is variable, currently 17.24%-28.24%.

- 4% cash back on prepaid air, hotel and car reservations booked directly directly in the Travel Center when you use your card.

- Earn a $20 annual statement credit for 11 consecutive months of purchases.

- No annual fee.

- Cell Phone Protection: Get up to $600 reimbursed if your cell phone is stolen or damaged when you pay your monthly cellular bill with your card.

- Terms and conditions apply.

Top Feature

No Late Fees, No Penalty Rate, and No Annual Fee

Purchase & Balance Transfer APR

0% Intro APR on purchases for 12 months and 0% Intro APR on balance transfers for 21 months, then 17.49% – 28.24% (Variable)

CardCritics™ Opinion

Recommended Credit Score

Annual Fee

Cash Back

Card Details From Issuer

- No Late Fees, No Penalty Rate, and No Annual Fee… Ever

- 0% Intro APR on balance transfers for 21 months and on purchases for 12 months from date of account opening. After that the variable APR will be 17.49% – 28.24%, based on your creditworthiness. Balance transfers must be completed within 4 months of account opening.

- There is an intro balance transfer fee of 3% of each transfer (minimum $5) completed within the first 4 months of account opening. After that, your fee will be 5% of each transfer (minimum $5).

- Stay protected with Citi® Quick Lock

Top Feature

Special access to tickets and events with Citi Entertainment

Purchase & Balance Transfer APR

0% intro APR for 12 months on Purchases and 21 months on Balance Transfers then 16.49% – 27.24% (Variable)

CardCritics™ Opinion

Recommended Credit Score

Annual Fee

Cash Back

Card Details From Issuer

- 0% Intro APR on balance transfers for 21 months and on purchases for 12 months from date of account opening. After that the variable APR will be 16.49% – 27.24%, based on your creditworthiness. Balance transfers must be completed within 4 months of account opening.

- There is a balance transfer fee of either $5 or 5% of the amount of each transfer, whichever is greater

- Get free access to your FICO® Score online.

- With Citi Entertainment®, get special access to purchase tickets to thousands of events, including concerts, sporting events, dining experiences and more.

- No Annual Fee – our low intro rates and all the benefits don’t come with a yearly charge.

CardCritics™ Opinion

Recommended Credit Score

Annual Fee

Rewards

Card Details From Issuer

- 0% Intro Offer- Enjoy 0% Intro APR for 21 months on purchases and balance transfers, then a variable APR of 18.24% – 28.24% thereafter

- No Annual Fee- You won’t have to pay an annual fee for all the great features that come with your Slate Card

- Zero Liability Protection & Fraud Protection – You won’t be held responsible for unauthorized charges made with your card. We help safeguard your credit card purchases using sophisticated fraud monitoring. We monitor for fraud 24/7 and can text, email or call you if there are unusual purchases on your credit card.

- Chase Pay Over Time- Access more options to pay over time for eligible purchases made with your participating Chase credit card. With Pay Over Time, you can break up eligible purchases you’ve already made

- Get more purchasing power: Chase Slate® cardmembers may be eligible for a credit limit increase in as few as six months.

- Stay protected with purchase & travel benefits – Enjoy peace of mind with purchase protection, which safeguards your eligible new items against damage or theft for 120 days from the date of purchase, up to $500 per item. Plus, extended warranty protection adds an extra year to U.S. manufacturer warranties of three years or less, giving you up to four full years of coverage from the date of purchase

- Credit Journey: Access your credit score, receive customized score improvement plans from Experian™, and benefit from identity monitoring—all for free with Chase Credit Journey®

- Member FDIC

Top Feature

Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back.

Purchase & Balance Transfer APR

0% Intro APR on balance transfers for 18 months, then 17.49% – 27.49% (Variable). A 17.49% – 27.49% (Variable) APR will apply for purchases.

CardCritics™ Opinion

Recommended Credit Score

Annual Fee

Cash Back

Card Details From Issuer

- Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back.

- Earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases. To earn cash back, pay at least the minimum due on time. Plus, earn 5% total cash back on hotel, car rentals and attractions booked with Citi Travel.

- Balance Transfer Only Offer: 0% intro APR on Balance Transfers for 18 months. After that, the variable APR will be 17.49% – 27.49%, based on your creditworthiness.

- Balance Transfers do not earn cash back. Intro APR does not apply to purchases.

- If you transfer a balance, interest will be charged on your purchases unless you pay your entire balance (including balance transfers) by the due date each month.

- There is an intro balance transfer fee of 3% of each transfer (minimum $5) completed within the first 4 months of account opening. After that, your fee will be 5% of each transfer (minimum $5).

Top Feature

Access your FICO score for free

Purchase & Balance Transfer APR

0% Intro APR for 18 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the intro APR offer ends a 14.49% to 24.49% Variable APR on purchases and balance transfers will apply.

CardCritics™ Opinion

Recommended Credit Score

Annual Fee

Rewards

Card Details From Issuer

- 0% Intro APR for 18 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 14.49% to 24.49% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%. Balance transfers may not be used to pay any account provided by Bank of America.

- No annual fee.

- No penalty APR. Paying late won’t automatically raise your interest rate (APR). Other account pricing and terms apply.

- Access your FICO® Score for free within Online Banking or your Mobile Banking app.

- Contactless Cards – The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

Top Feature

Discover will match all the cash back you’ve earned at the end of your first year.

Purchase & Balance Transfer APR

0% Intro APR on purchases for 6 months and 0% Intro APR on balance transfers for 18 months, followed by 17.49% – 26.49% Variable APR

CardCritics™ Opinion

Recommended Credit Score

Annual Fee

Cash Back

Earn 1% Unlimited Cash Back On All Other Purchases – Automatically

Card Details From Issuer

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards.

- Earn 2% cash back at Gas Stations and Restaurants on up to $1,000 in combined purchases each quarter, automatically. You’ll still earn unlimited 1% cash back on all other purchases.

- Get a 0% intro APR for 18 months on balance transfers. Then 17.49% to 26.49% Standard Variable APR applies, based on credit worthiness.

- Redeem cash back for any amount

- No annual fee.

- Terms and conditions apply.

Top Feature

Visa benefits and late fee forgiveness

Purchase & Balance Transfer APR

0% introductory APR for the first 18 billing cycles on balance transfers made within the first 90 days of account opening. After that, 17.49% – 27.49% variable APR based on your creditworthiness. A 17.49%, 19.49%, 22.49%, 25.49% or 27.49% variable APR based on your creditworthiness applies to purchases.

CardCritics™ Opinion

Recommended Credit Score

Annual Fee

Cash Back

Card Details From Issuer

- Our best balance transfer offer: Get a 0% introductory APR* on balance transfers for the first 18 billing cycles, for balance transfers made within the first 90 days of account opening. After that, 17.49% – 27.49% variable APR based on your creditworthiness.

- No annual fee

- Get built-in flexibility with the TD FlexPay Credit Card

- Our best balance transfer offer

- Get Visa benefits like cell phone protection when you pay your monthly mobile bill with your card

- Must be a resident of CT, DC, DE, FL, MA, MD, ME, NC, NH, NJ, NY, PA, RI, SC, VA or VT.

Top Feature

Earn a $200 Bonus after you spend $500 on purchases in your first 3 months from account opening

Purchase & Balance Transfer APR

0% Intro APR on Purchases and Balance Transfers for 15 months, then 18.24% – 27.74% Variable

CardCritics™ Opinion

Recommended Credit Score

Annual Fee

Cash Back

Card Details From Issuer

- Earn a $200 Bonus after you spend $500 on purchases in your first 3 months from account opening

- Enjoy 5% cash back on travel purchased through Chase Travel℠, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 1.5% on all other purchases.

- No minimum to redeem for cash back. You can use points to redeem for cash through an account statement credit or an electronic deposit into an eligible Chase account located in the United States!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 18.24% – 27.74%.

- No annual fee – You won’t have to pay an annual fee for all the great features that come with your Freedom Unlimited® card

- Keep tabs on your credit health, Chase Credit Journey helps you monitor your credit with free access to your latest score, alerts, and more.

- Member FDIC

Top Feature

Earn a $200 Bonus after you spend $500 on purchases in your first 3 months from account opening!

Purchase & Balance Transfer APR

0% Intro APR on Purchases and Balance Transfers for 15 months, then 18.24% – 27.74% Variable

CardCritics™ Opinion

Recommended Credit Score

Annual Fee

Cash Back

5% cash back on travel purchased through Chase Travel℠, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more.

3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1% cash back on all other purchases.

Card Details From Issuer

- Earn a $200 Bonus after you spend $500 on purchases in your first 3 months from account opening

- 5% cash back on up to $1,500 in combined purchases in bonus categories each quarter you activate. Enjoy new 5% categories each quarter!

- 5% cash back on travel purchased through Chase Travel℠, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more

- 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1% cash back on all other purchases.

- No minimum to redeem for cash back. You can use points to redeem for cash through an account statement credit or an electronic deposit into an eligible Chase account located in the United States.

- 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 18.24% – 27.74%.

- No annual fee – You won’t have to pay an annual fee for all the great features that come with your Freedom Flex® card

- Keep tabs on your credit health – Chase Credit Journey helps you monitor your credit with free access to your latest score, real-time alerts, and more.

- Member FDIC

Top Feature

You may be eligible for as high as $200 cash back after spending $2,000 in purchases on your new Card in the first 6 months. Welcome offers vary and you may not be eligible for an offer. Cash back is received as Reward Dollars, redeemable for statement credit or at Amazon.com checkout. Terms Apply.

Purchase & Balance Transfer APR

0% intro APR on purchases and on balance transfers for 15 months from the date of account opening, then 19.49%-28.49% Variable APR

CardCritics™ Opinion

Recommended Credit Score

Annual Fee

Cash Back

Earn 3% cash back on U.S. online retail purchases, on up to $6,000 per year, then 1%.

Earn 3% cash back at U.S. gas stations, on up to $6,000 per year in purchases, then 1%.

Cash back is received in the form of Reward Dollars that can be redeemed as a statement credit and at Amazon.com checkout.

Card Details From Issuer

- Apply and find out your welcome offer. As High As $200 cash back* after you spend $2,000 in purchases on your new Card within the first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply, and if approved: 1. Find out your offer amount 2. Accept the Card with your offer 3. Spend $2,000 in 6 months 4. Receive the cash back. *Cash back is received in the form of Reward Dollars that can be redeemed for a statement credit or at Amazon.com checkout.

- No Annual Fee.

- Enjoy 0% intro APR on purchases and balance transfers for 15 months from the date of account opening. After that, your APR will be a variable APR of 19.49%-28.49%.

- Plan It®: Buy now, pay later with Plan It. Split purchases of $100 or more into equal monthly installments with a fixed fee so you don’t have the pressure of paying all at once. Simply select the purchase in your online account or the American Express® App to see your plan options. Plus, you’ll still earn rewards on purchases the way you usually do.

- Earn 3% cash back at U.S. supermarkets, 3% cash back on U.S. online retail purchases, 3% cash back at U.S. gas stations, on eligible purchases for each category on up to $6,000 per year in purchases (then 1%). Cash back is received in the form of Reward Dollars that can be redeemed as a statement credit and at Amazon.com checkout.

- Get up to a $7 monthly statement credit after using your enrolled Blue Cash Everyday® Card for a subscription purchase, including a bundle subscription purchase, at DisneyPlus.com, Hulu.com, or Stream.ESPN.com U.S. websites. Subject to auto-renewal.

- Terms Apply.

Welcome Bonus

$200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening

Purchase & Balance Transfer APR

0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the intro APR offer ends a 17.49% – 27.49% Variable APR will apply.

CardCritics™ Opinion

Recommended Credit Score

Annual Fee

Cash Back

After the first year from account opening, you’ll earn 3% cash back on purchases in your choice category and 2% cash back at grocery stores and wholesale clubs, up to the quarterly maximum.

1% cash back on all other purchases.

Card Details From Issuer

- $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

- Earn 6% cash back for the first year in the category of your choice. You’ll automatically earn 2% cash back at grocery stores and wholesale clubs, and unlimited 1% cash back on all other purchases. After the first year from account opening, you’ll earn 3% cash back on purchases in your choice category.

- Earn 6% and 2% cash back on the first $2,500 in combined purchases each quarter in the choice category, and at grocery stores and wholesale clubs, then earn unlimited 1% thereafter. After the 3% first-year bonus offer ends, you will earn 3% and 2% cash back on these purchases up to the quarterly maximum.

- No annual fee and cash rewards don’t expire as long as your account remains open.

- Select your card design option when you apply – the Customized Cash Rewards design, or the limited-time FIFA World Cup 2026™ design.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 17.49% – 27.49% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 5%. Balance transfers may not be used to pay any account provided by Bank of America.

- This offer may not be available elsewhere if you leave this page. You can take advantage of this offer when you apply now.

Welcome Bonus

$200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening

Purchase & Balance Transfer APR

0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the intro APR offer ends a 17.49% – 27.49% Variable APR will apply.

CardCritics™ Opinion

Recommended Credit Score

Annual Fee

Cash Back

1.5% cash back on all purchases after the first year from account opening.

Card Details From Issuer

- $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

- Earn 2% cash back on purchases for the first year from account opening, with no limit to the amount of cash back you can earn.

- Thereafter, you’ll earn unlimited 1.5% cash back on all purchases, with no expiration on rewards as long as your account remains open.

- No annual fee.

- Select your card design option when you apply – the Unlimited Cash Rewards design, or the limited-time FIFA World Cup 2026™ design.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 17.49% – 27.49% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 5%. Balance transfers may not be used to pay any account provided by Bank of America.

- This offer may not be available elsewhere if you leave this page. You can take advantage of this offer when you apply now.

** Information for the following card was not reviewed by Citi or provided by Citi.

Top Feature

Earn $200 in cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back.

Purchase & Balance Transfer APR

0% intro APR for 18 months on Balance Transfers, then 17.49% – 27.49% (Variable). A 17.49% – 27.49% (Variable) APR will apply for purchases.

CardCritics™ Opinion

Recommended Credit Score

Annual Fee

Cash Back

Card Details From Issuer

- Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back.

- 0% Intro APR for 18 months on balance transfers from date of account opening; after that, the variable APR will be 17.49% – 27.49%, based on your creditworthiness.

- Earn 5% cash back on purchases in your top eligible spend category each billing cycle, up to the first $500 spent, 1% cash back thereafter. Also, earn unlimited 1% cash back on all other purchases. Plus: Earn an additional 4% cash back on hotels, car rentals, and attractions booked on Citi Travel℠ portal.

- No rotating bonus categories to sign up for – as your spending changes each billing cycle, your earn adjusts automatically when you spend in any of the eligible categories.

- No Annual Fee

- Citi will only issue one Citi Custom Cash® Card account per person.

Top Feature

Earn 20,000 bonus Points after spending $1,000 in the first 3 months of account opening.

Purchase & Balance Transfer APR

0% intro APR for 15 months on Purchases and Balance Transfers, then 18.49% – 28.49% (Variable)

CardCritics™ Opinion

Recommended Credit Score

Annual Fee

Rewards

Card Details From Issuer

- Earn 20,000 bonus Points after spending $1,000 in the first 3 months of account opening.

- 0% Intro APR on balance transfers and purchases for 15 months; after that, the variable APR will be 18.49% – 28.49%, based on your creditworthiness. There is an intro balance transfer fee of 3% of each transfer (minimum $5) completed within the first 4 months of account opening. After that, your fee will be 5% of each transfer (minimum $5).

- Earn 3 ThankYou® Points for each $1 spent in an eligible Self-Select Category of your choice (Fitness Clubs, Select Streaming Services, Live Entertainment, Cosmetic Stores/Barber Shops/Hair Salons, or Pet Supply Stores). Choose your eligible Self-Select Category on Citi Online or by calling customer service. The default Self-Select Category is Select Streaming Services.

- Earn 5 ThankYou® Points for each $1 spent on Hotels, Car Rentals and Attractions booked on Citi Travel® via cititravel.com; earn 3 ThankYou Points for each $1 spent at Supermarkets, on Select Transit purchases, and at Gas & EV Charging Stations.

- Earn 2 ThankYou® Points for each $1 spent at Restaurants; earn 1 ThankYou® Point for each $1 spent on All Other Purchases.

- No Annual Fee

Top Feature

USAA proudly offers membership to current and former military, as well as their spouses and dependents.

Purchase & Balance Transfer APR

Get a 0% intro APR for 15 months on balance transfers and convenience checks that post within 90 days of account opening. After this time, the 11.15% to 25.15% variable regular APR will apply to introductory balances. A 11.15% to 25.15% variable regular APR will apply for purchases.

CardCritics™ Opinion

Recommended Credit Score

Annual Fee

Cash Back

Card Details From Issuer

- Must be a USAA® member, or become a member, to apply. USAA proudly offers membership to current and former military, as well as their spouses and dependents.

- Intro Offer: Get a 0% intro APR for 15 months on balance transfers and convenience checks that post within 90 days of account opening. After this time, the variable regular APR of 11.15% to 25.15% will apply to introductory balances.

- A fee of 5% of the amount of each balance transfer, cash advance and convenience check applies. If you transfer a balance or write a convenience check to take advantage of the introductory rate offer, you will immediately incur interest on purchases until you pay your balance in full, including any transferred balances.

- No annual fee.

- No foreign transaction fees.

- 11.15% to 25.15% variable regular APR.

- See Rates and Fees for details.

Top Feature

Earn a $200 cash rewards bonus after spending $500 in purchases in the first 3 months.

Purchase & Balance Transfer APR

0% intro APR for 12 months from account opening on purchases and on qualifying balance transfers, then a 18.49%, 24.49%, or 28.49% Variable APR

CardCritics™ Opinion

Recommended Credit Score

Annual Fee

Cash Rewards

Card Details From Issuer

- Apply Now to take advantage of this offer and learn more about product features, terms and conditions.

- Earn a $200 cash rewards bonus after spending $500 in purchases in the first 3 months.

- Earn unlimited 2% cash rewards on purchases.

- 0% intro APR for 12 months from account opening on purchases and qualifying balance transfers. 18.49%, 24.49%, or 28.49% variable APR thereafter; balance transfers made within 120 days qualify for the intro rate and fee of 3% then a BT fee of up to 5%, min: $5.

- $0 annual fee.

- No categories to track or remember and cash rewards don’t expire as long as your account remains open.

- Find tickets to top sports and entertainment events, book travel, make dinner reservations and more with your complimentary 24/7 Visa Signature® Concierge.

- Up to $600 of cell phone protection against damage or theft. Subject to a $25 deductible.

Top Feature

You may be eligible for as high as $300 cash back after spending $3,000 in purchases on your new Card in the first 6 months. Welcome offers vary and you may not be eligible for an offer. Cash back is received as Reward Dollars, redeemable for statement credit or at Amazon.com checkout. Terms Apply.

Purchase & Balance Transfer APR

0% intro APR on purchases and on balance transfers for 12 months from the date of account opening, then 19.49%-28.49% Variable APR

CardCritics™ Opinion

Recommended Credit Score

Annual Fee

Cash Back

Earn 6% cash back on select U.S. streaming subscriptions.

Earn 3% cash back at U.S. gas stations and on transit (including taxis/rideshare, parking, tolls, trains, buses and more).

Earn 1% cash back on other purchases.

Cash back is received in the form of Reward Dollars that can be redeemed as a statement credit and at Amazon.com checkout.

Card Details From Issuer

- Apply and find out your welcome offer. As High As $300 cash back* after you spend $3,000 in purchases on your new Card within the first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply, and if approved: 1. Find out your offer amount 2. Accept the Card with your offer 3. Spend $3,000 in 6 months 4. Receive the cash back. *Cash back is received in the form of Reward Dollars that can be redeemed for a statement credit or at Amazon.com checkout.

- $0 intro annual fee for the first year, then $95.

- Enjoy 0% intro APR on purchases and balance transfers for 12 months from the date of account opening. After that, your APR will be a variable APR of 19.49%-28.49%.

- Plan It®: Buy now, pay later with Plan It. Split purchases of $100 or more into equal monthly installments with a fixed fee so you don’t have the pressure of paying all at once. Simply select the purchase in your online account or the American Express® App to see your plan options. Plus, you’ll still earn rewards on purchases the way you usually do.

- Earn 6% cash back at U.S. supermarkets on up to $6,000 per year in eligible purchases (then 1%), 6% cash back on select U.S. streaming subscriptions, 3% cash back at eligible U.S. gas stations and on transit (including taxis/rideshare, parking, tolls, trains, buses and more) purchases and 1% cash back on other purchases. Cash Back is received in the form of Reward Dollars that can be redeemed as a statement credit and at Amazon.com checkout.

- Get up to a $10 monthly statement credit after using your enrolled Blue Cash Preferred® Card for a subscription purchase, including a bundle subscription purchase, at DisneyPlus.com, Hulu.com, or Stream.ESPN.com U.S. websites. Subject to auto-renewal.

- Terms Apply.

What Is a Balance Transfer Card?

Many credit cards allow you to transfer balances from another card. A balance transfer card typically offers a low introductory APR on balance transfers for a limited time after account opening.

For example, several credit cards offer a 0% intro APR on balance transfers for 18 to 24 months. They serve the purpose of helping you to escape high-interest payments on your other credit cards.

In general, these credit cards don’t tout impressive earning rates or ongoing benefits; their primary purpose is to (temporarily) shelter you from interest fees.

How Much Can I Save With a Balance Transfer Credit Card?

Your potential savings with a balance transfer credit card depend on the amount you’re currently paying in interest. If you’ve got considerable debt, you could save many hundreds of dollars per month.

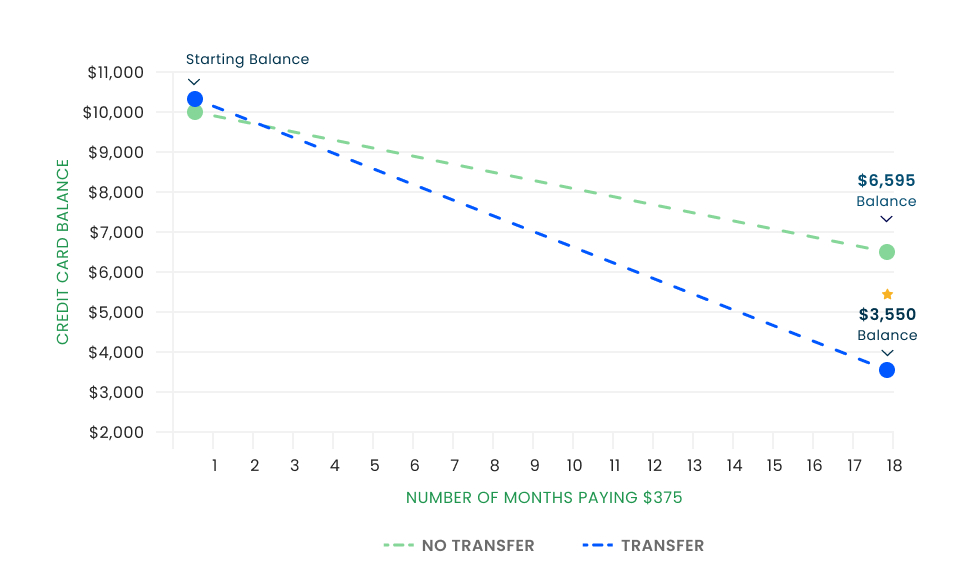

For example, let’s say:

- You’ve got a $10,000 balance on a credit card that charges 22.12% APR

- You’re only making the $375 minimum payment each month

- You open a balance transfer credit card that offers 0% intro APR for 18 months with a 3% balance transfer fee (then 22.12% APR, just like your first card)

Without changing your monthly $375 payment, even with the balance transfer fee, your balance will go down $3,045 more than without the transfer! Again, both examples make the same payments. The second one simply takes advantage of the card issuers’ introductory offers to drastically cut credit card debt. The ongoing APR does kick in after your 0% intro APR, so the more you can pay down your debt within that intro period, the better. A monthly payment of $573 for 18 months would pay off this balance in full (balance transfer fee included).

Is a Balance Transfer Right for Me?

Balance transfer credit cards are a useful tool to help you pay down debt faster, but they’re not for everyone. A balance transfer may be right for you if:

- You’re carrying high-interest debt: If you’re carrying balances on credit cards with a high APR and you can’t pay them off in the near future, a balance transfer could save you a significant amount of money (even with a balance transfer fee).

- You have a good credit score: The best balance transfer cards require at least a good credit score (a FICO score of 670 or higher) to be eligible to apply.

- You have a plan to pay off your debt: Balance transfer credit cards give you breathing room from interest, but you’ll still have to pay off your debt before the introductory period expires.

- You’ll make on-time payments: Even with an intro 0% APR, you’ll still need to make at least the minimum payment on your card each month. Late or missed payments can result in the issuer removing your intro APR.

- You want to consolidate debt: Moving balances from multiple accounts to a single balance transfer card can help you streamline your finances and consolidate your debt into a single payment.

Before committing to a balance transfer, calculate the interest payments on your current cards and compare them to the balance transfer fee you’d pay. Be sure to break down how much you’ll need to pay each month to ensure you’ve paid off your balance before the intro period expires. And be honest with yourself: Do you have the financial discipline to pay on time and avoid spending on the card, which could lead to more debt?

How Do I Qualify for a Balance Transfer?

Not everyone is eligible for a balance transfer credit card. To qualify for a balance transfer, you should:

- Have a good credit score (670+ FICO score) or better

- Meet other issuer creditworthiness requirements (such as having a solid income, credit history, relationship with the bank and manageable debt)

- Be able to complete the balance transfer in a specified time frame (some issuers will only allow balance transfers at a promotional APR within the first months of opening the card)

- Open a balance transfer card from a different issuer than the card you want to transfer the balance from

How To Complete a Balance Transfer

Completing a balance transfer is simple — and there are a few ways to go about it.

You can often request a balance transfer during the application process. You’ll be asked to enter the account numbers of the loans you’d like to transfer to your card, as well as the amount to be transferred.

If your account is already open, you can call the issuer or potentially request one through your card’s online account. You may even receive balance-transfer checks that can be used to transfer money from one credit card to another.

When initiating a balance transfer, there are a couple of things to keep in mind.

First, you can only transfer up to your credit limit. If you open a balance transfer credit card and are approved for a $5,000 credit line, you’ll only be allowed to transfer up to $5,000 to the card (minus the balance transfer fee, which will also be charged to your card).

Additionally, you typically cannot transfer a balance between credit cards issued by the same bank. For example, you can’t transfer a balance from one Citi credit card to another. You should instead apply for a balance transfer credit card issued by Wells Fargo, American Express, Chase or other banks.

Pros and Cons of Balance Transfers

Pros

The purpose of a balance transfer is to pay down your debt faster and reduce your interest charges. It can do this in a few ways.

As covered above, a balance transfer can lower your interest charges. Whether the card you’re transferring to offers a promotional interest-free period or simply a lower regular APR than your current card, a balance transfer can keep you from hemorrhaging money in fees.

You can also transfer multiple balances to a single card to consolidate debt. This will result in one single monthly payment instead of multiple payments. It’ll almost certainly lower your monthly minimum payment overall, meaning you’ll have more money to throw toward your debt.

Cons

There’s really only one “gotcha” when it comes to a balance transfer: The fee you’ll pay for the privilege of initiating the transfer. Not all credit cards charge a fee, but you’ll commonly be charged either $10 or 3% to 5% of the transferred amount — whichever is higher. Depending on the amount you’re transferring, this could result in hundreds of dollars in fees.

What Is a Balance Transfer Fee?

A balance transfer fee is a processing fee charged by many credit cards that allow balance transfers. To be clear, this fee is charged by the card assuming the balance, not the card being relieved of its balance.

Is a Balance Transfer Fee Always Worth It?

To decide if a balance transfer fee is worth it, you should ask yourself one thing: Will the money I save in interest more than offset the money I’ll spend in balance transfer fees?

To answer this question, you should know:

- The amount you’re currently spending on interest payments

- The amount you will spend on interest payments after your balance is transferred to the new card

- The amount of money you’ll lose in fees when moving your debt to your balance transfer card

If you know these three details, simple math will reveal your answer.

How To Compare Balance Transfer Credit Cards

Choose One With the Lowest APR

When choosing a balance transfer credit card, no detail is more important than opening a card with an APR lower than the one on your current card. There’s little sense in transferring a balance if you’re not going to save money on interest (though it may still be potentially worthwhile simply to consolidate your debt for fewer monthly payments).

Your best bet is to go with a card that offers 0% intro APR for an extended period.

Rate Shop To Preview Your Credit Limit

You’ll generally only know the exact card terms, including regular APR and credit limit, after you’ve been approved. But some issuers offer “preapproval.” This doesn’t guarantee that you’ll be approved for a card. However, it does come with a peek at the credit line and interest rates you’ll be offered if you decide to apply for the card.

Consider Value After the Intro APR Offer

Balance transfer credit cards are largely a one-trick pony. Those that offer the lengthiest intro APR windows often don’t have any valuable benefits. Some don’t even offer returns on your everyday spending in the form of rewards.

If you don’t need 21 interest-free months, choose a card that offers a slightly less generous intro APR that earns cash back or travel rewards on your spending. That way, you’re not left with a dry husk of a credit card after the promotional APR offer ends.

Methodology

CardCritics™ experts have thoroughly examined all balance transfer credit cards from major issuers and distilled the overwhelming number of options down to the best cards for consumers with good to excellent credit.

- 0% intro APR windows

- Annual fees

- Rewards programs

- Ongoing benefits

- Applicant standards

The information related to USAA Rate Advantage Credit Card, Citi Custom Cash® Card , U.S. Bank Shield™ Visa® Card, Chase Freedom Flex® and BankAmericard® credit card was collected by CardCritics™ and has not been reviewed or provided by the issuer of this product/card. Product details may vary. Please see issuer website for current information. CardCritics™ does not receive a commission for these products.

Frequently Asked Questions About the Best Balance Transfer Credit Cards

Do balance transfers hurt your credit score?

Balance transfers themselves don’t generally affect your credit score. However, opening a balance transfer credit card can potentially improve your credit score in the long run. Although your credit score is slightly (and temporarily) dinged for opening a new credit card, access to more available credit will lower your credit utilization.

Is it a good idea to do a balance transfer on a credit card?

It’s a good idea to transfer a balance to a different credit card if the destination card has a lower APR than the card currently carrying the balance — or if you know that your monthly minimum payment will be reduced by consolidating debts.

Which is the best bank for a balance transfer?

Most major banks offer balance transfer credit cards. For example, Citi offers several credit cards with solid balance transfer options, including some with a 0% intro APR for up to 21 months. And some of its cash-back credit cards offer interest-free periods of up to 18 months.

What is a disadvantage to a balance transfer?

The main disadvantage of a balance transfer is the fee typically charged to initiate it. A select few credit cards don’t charge a fee, but most incur between 3% and 5% of the transferred amount.

When should I not do a balance transfer?

You shouldn’t do a balance transfer if the transfer fees will be greater than the interest you’ll be saving. If you think you can pay off your bill relatively soon — say, within a month or two — you probably shouldn’t go through the hassle of a balance transfer.

Is there a catch to balance transfer cards?

Aside from the balance transfer fee, there’s an insidious mental catch to balance transfers. If you’re carrying a balance on a high APR credit card and open a low-interest credit card to transfer that balance, you may find yourself carrying a balance on your original credit card again. A balance transfer credit card won’t solve your unhealthy spending habits — and can in fact exacerbate them.

Why have credit cards stopped offering balance transfers?

Many credit cards still offer balance transfers. However, if you’ve stopped receiving targeted balance transfer promotions through the mail, it could be because issuers don’t feel that you’re currently a good balance transfer candidate. Take a look at your credit profile to ensure that there aren’t any red flags on your credit report or that your credit score hasn’t decreased.

What will the fees be to transfer a $1,000 balance?

Balance transfer fees typically range between 3% and 5% of the transferred amount. In other words, you can expect to pay between $30 and $50 when transferring a $1,000 balance.

What happens to an old credit card after a balance transfer?

Nothing happens to an old credit card after a balance transfer. Its balance is simply lowered. You can keep or cancel the card. Make sure you understand how your credit score may be affected before you cancel any credit card.

Is it hard to get approved for a balance transfer?

It’s not hard to get approved for a balance transfer. Your transfer will likely be approved as long as your transfer request isn’t higher than the credit limit on the card you’re transferring to. You also generally aren’t allowed to transfer a balance between cards issued by the same bank.

How big a balance transfer can I do?

Again, you can transfer as large a balance as your credit line allows. For example, if you’ve got a $5,000 credit limit, you can transfer a maximum of $5,000 to the card. Just note that the card’s balance transfer fee will also count toward that $5,000 limit, as the fee will be charged to your card.

How Do Our Critics Evaluate the Cards?

All of the credit cards featured on CardCritics™ are assessed using the same criteria. Our critics evaluate fees, interest rates, balance transfer options, introductory bonuses, rewards, additional benefits and the average credit score required for approval.

Editorial Note: Any opinions, analyses, reviews or recommendations expressed are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer.

*CardCritics™ references a FICO® 8 score, which is one of many different types of credit scores. A financial institution may use a different score when evaluating your application.